An Extended Market

Image Source: Pexels

SPX Monitoring purposes; Long SPX on 10/31/25 at 6840.20.

Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

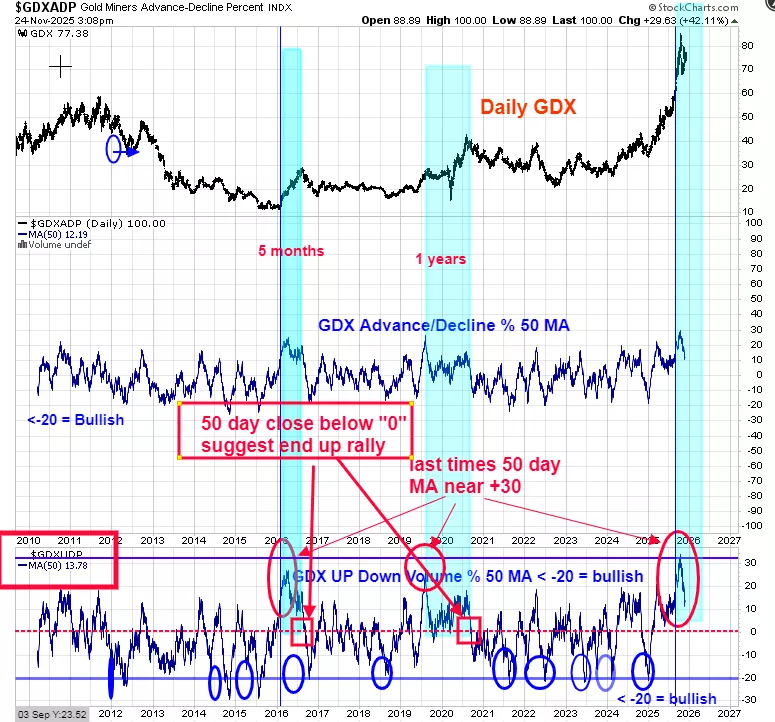

Monitoring purposes GOLD:Long GDX at 75.76; 9/29/25

(Click on image to enlarge)

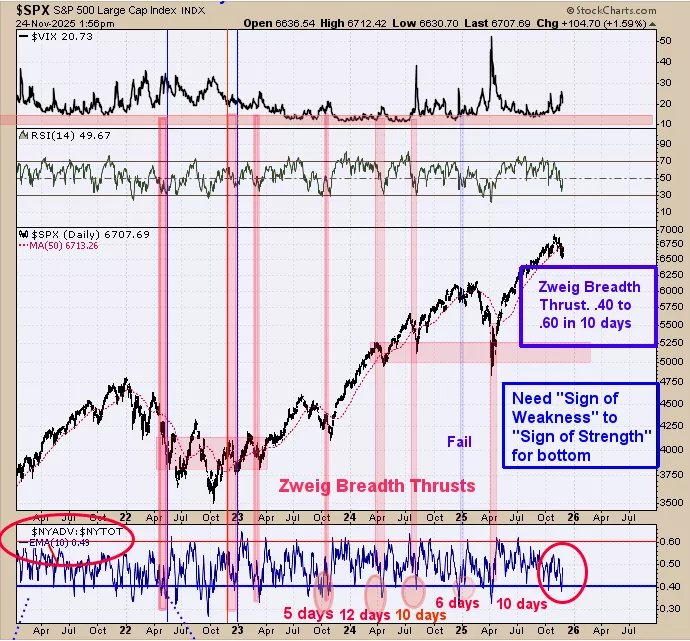

Last Thursday the SPY closed below its lower Bollinger bands which shows an extended market (noted with blue squares). Last Thursday the TRIN closed at 1.28 and the ticks at -337 which is a bullish combination and adds the bullish picture. There was also a “Selling Climax” on Thursday showing exhaustion to the downside.Current rally is important and may extend into December if not longer. Testing the October high near 690 SPY is possible. Ideally we would like to see a ZBT triggered (see page two).

We are monitoring the “Zweig Breadth Thrust” (ZBT) for a possible setup. To trigger a ZBT is for the 10 day average of the NYSE advancing/NYSE Total that reaches .40 or lower and than rallies to .60 or higher in ten days or less. ZBT are bullish signs for the market. We shaded in pink the previous times ZBT has been triggered and notice that all came near lows.If the bull market is going to continue than a ZBT ideally would be triggered on the current rally. Last Thursday the ZBT closed at .38 and Friday closed at .45 triggering the start of the ZBT countdown. The ZBT has until December 5 (10 days) to reach .60; and it if does than this condition suggests another bull run is in the making.

(Click on image to enlarge)

The bottom window is the 50 day average of the up down volume for GDX which is a trend following indicator.We have shaded in light green the times when this indicator reached near +30.A +30 range suggest an “Initiation of an uptrend” which can last from 5 months to one year.The uptrend comes to an end when this indicator falls below “0” (noted with red squares). Also long as the 50 day average stays above “0” the general uptrend in GDX should continue; current reading is +17.78. Long GDX on 9/29/25 at 75.76.

More By This Author:

Year-End Signals Hint At A Bullish SPX Setup While Gold Miners Enter A Critical Cycle

SPY Eyes New Highs, GDX Signals Possible Consolidation

SPY Trend Strong; GDX Remains Internally Bullish

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more