Large Declines Can Occur

Image Source: Pexels

SPX Monitoring purposes; Sold 12/18/24 at 5872.16 = gain .67%; Long SPX on 10-29-24 at 5832.92

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD:Long GDX on 10/9/20 at 40.78.

(Click on image to enlarge)

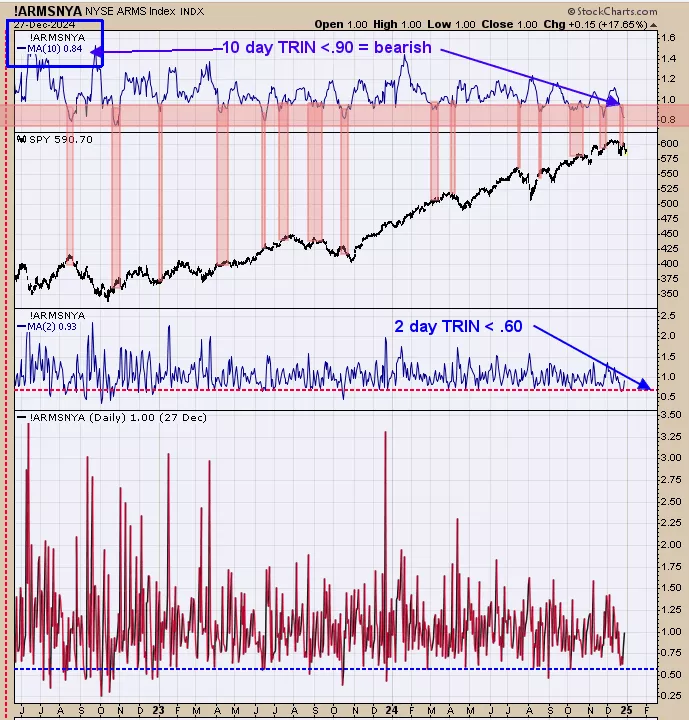

We are up 29.28%; SPX up 24% so far this year. The second window bottom is the 63 day average of the TRIN dating back to mid 2017. We shaded in blue the times when the 63 day TRIN is above 1.10 which are bullish and predict higher prices for the SPY intermediate term. We shaded in pink when the 63 day TRIN is below 1.00 (current reading is .97) and this reading is bearish for the market. This reading happened at the last five tops. Market appears to be entering a period where large declines can occur. Sold long SPX 12/18/24 = gain .67%.

The top window is the 10 day average of the TRIN. We shaded in pink the times when the 10 day TRIN reached below .90 (current reading is .84). Previous times the 10 day TRIN reached below .90 it has been a bearish sign for the market; some it just stalled and other times a pull back materialized. Don’t see a setup where an extended rally is likely here.

(Click on image to enlarge)

Last week we presented the Inflation/deflation ratio with its bullish RSI near 30. The bottom window is the 18 day average of the advance/decline and next higher window is the 18 day average of the up down volume both for GDX. Top window is the GDX. Intermediate term lows are found when both indicators fall below -40 and turn up. This setup occurred when both indicators fall below -40 on November 15 (note on chart). Some times GDX will move sideways to modestly down before rally stats which we noted in shaded green. These times see GDX moving sideways to modestly down as both indicators make higher lows. Bullish setup is alive and higher highs in GDX are still expected.

More By This Author:

Defining The Next Low

VIX Remains Relatively Low

Rally In SPX Should Continue

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more