International Stocks On Track To Trail US Equities In 2023

After world shares ex-US enjoyed a rare if unimpressive win over American shares in 2022 — by losing less — the odds don’t look encouraging for a repeat run of outperformance in 2023, based on a set of ETFs through Thursday’s close (Nov. 9).

In 2022, Vanguard Total International Stocks Fund (VXUS), which excludes US companies, fell 16.1%. A painful loss, but SPDR S&P 500 ETF (SPY), a proxy for US companies, retreated even more via an 18.2% decline last year.

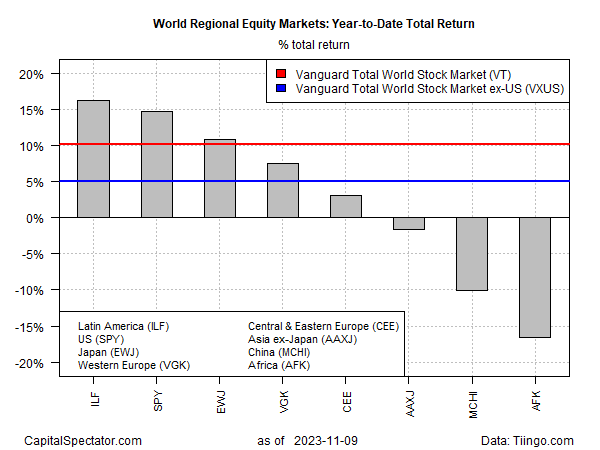

The return spread so far in 2023 has widened but now favors US shares by a hefty degree. SPY is up a strong 14.7% year to date, far above the 5.1% advance for VXUS. Looking at the regional components of global markets shows that only Latin America stocks (ILF) are outperforming the US (SPY) year to date. Otherwise, the rest of the field is trailing, in some cases by a wide degree. Indeed, African stocks (AFK) are in the red by nearly 17% so far this year.

The argument for owning a global portfolio of stocks draws on the view that international diversification will pay off eventually. To be sure, there have been periods when that’s true – but not lately. US shares (SPY) earned more than 11% on an annualized basis over the past decade – more than double the 3.4% performance for VXUS, according to Morningstar.com.

The difference is striking, but some analysts warn against using the rearview mirror to dominate decisions about asset allocation when it comes to the global equities market. Developing estimates for expected return, by contrast, suggests a different profile.

“If you’ve been 100% the US the last 15 years, drink some Champagne, pat yourself on the back, but it’s probably the wrong choice now,” says Meb Faber, chief executive of Cambria Investment Management.

One reason for tilting toward foreign stocks is lower valuations relative to the US. As The Wall Street Journal points out, the US has the highest valuation vs. several key markets elsewhere.

No one knows if the lower valuations in foreign shares will translate to higher performance vs. the US. Meantime, this much is clear: 2023’s horse race is on track to favor American stocks by a wide margin.

More By This Author:

Still Looking For A Clear Risk-Off Signal In MarketsUS Q4 GDP Growth Still Appears Set For Substantial Slowdown

US Economic Slowdown Watch

Disclosure: None.