Ignore The Herd's Fear Of The Fed And Of Recession. Focus On The Fund-Flows

In this piece we remind readers that it is not rates or the Federal Reserve Bank that drives markets, but rather net fund-transfers from the Treasury that fee bull markets.

Politics are not separate from the investment universe; market economies exist because legislators create spending-laws (sovereign currency-creation) and taxation-laws (currency-cancellation). It, therefore, is important that Congress ends its self-harming clown-show and gets back to its most important duty--to deposit money in private bank accounts by passing spending laws. The new House Speaker holds seriously anti-Democratic ideas, but he at least seems to want the US Government to work well enough to fund both Israel and Ukraine.

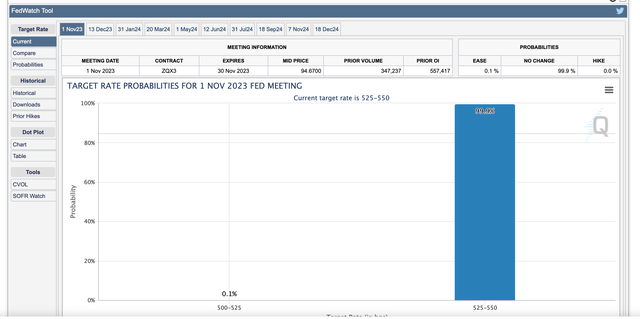

The herd continues to be fixated on the monetary policy of the Federal Reserve, but at this point it is a distraction; the important factor is the fiscal (spending) policy. The market is saying that the Fed has paused the rate hikes.

(Click on image to enlarge)

Rate Future (CME Group)

Powell always does what the market tells him to do. Rates will stay where they are, for now.

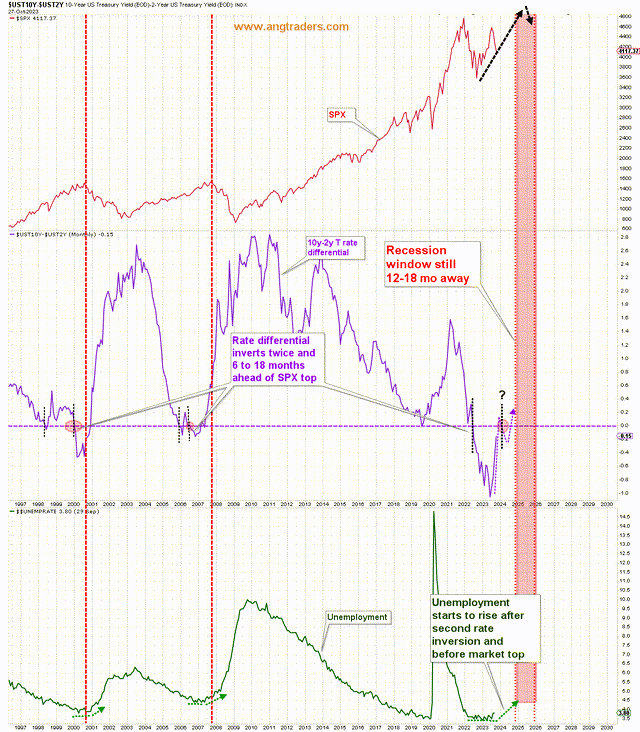

The fear of recession has started to stir the herd again after having faded over the summer. As the chart below demonstrates, recessions tend to occur 6-18 months after the second 10-2 inversion (on the monthly scale) and with unemployment unambiguously rising. According to this correlation, the latter half of 2024 is the earliest we could expect increased recession probabilities.

(Click on image to enlarge)

10y-2y (ANG Traders, stockcharts.com)

In addition, this is a presidential election-year (which rarely see austerity) and once Congress gets over its tantrum, the two wars will require increased spending, and the elevated rates will continue to deliver interest-income. The current weakness is temporary.

Fund-Flows

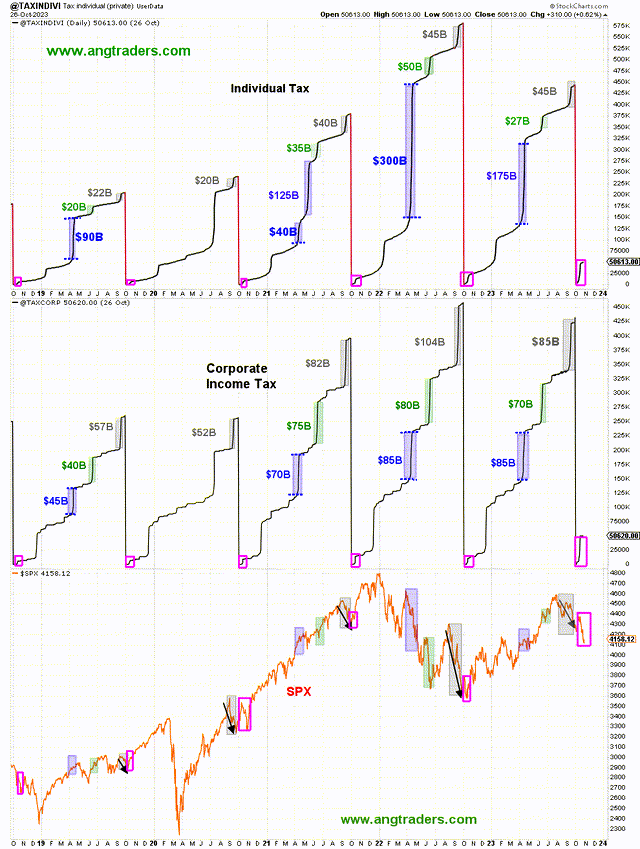

- So far in October, there has been a net-transfer of +$10B, compared to +$55B last year.. This is the result of October's tax-take that removed $80B from private bank accounts, compared to only $30B in October 2022 (pink boxes below). To date, $51B of the $80B tax-take has been returned.

- We are monitoring the rate at which the tax money flows back into the economy; the slower it returns, the slower the recovery in the SPX.

(Click on image to enlarge)

Taxation (ANG Traders, stockcharts.com)

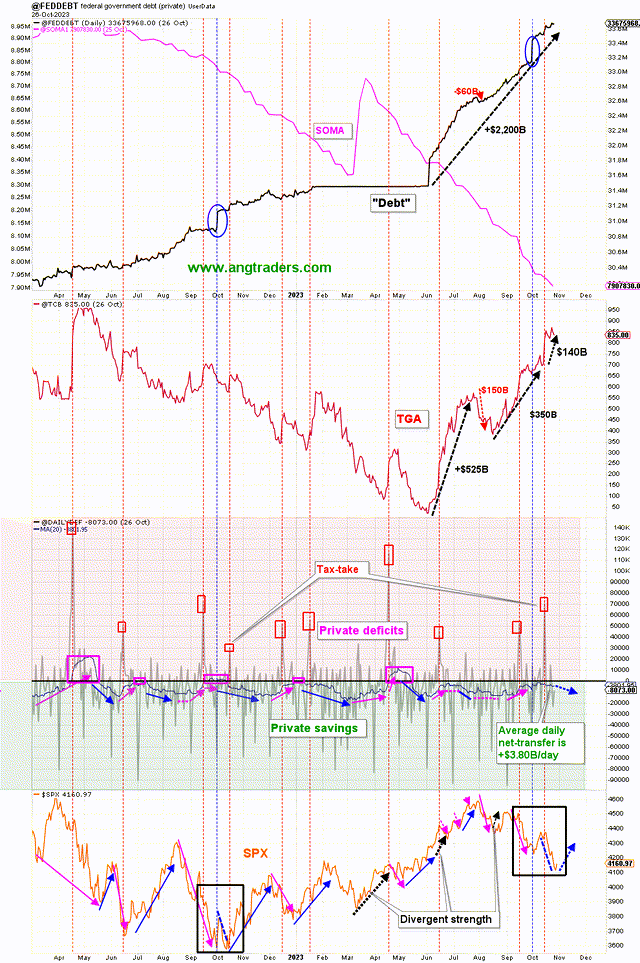

- The 20-day average of daily net-transfers is +$3.80B/day, compared to last year's +$7.10B/day. The spending-flows will eventually close this gap and the SPX will rally again.

- The TGA has $200B more sitting in it than it did last year at this time. That represents $200B more possible spending than last year.

(Click on image to enlarge)

The stock market is driven by the net fund-flows which, in turn, are driven by Congressional spending laws. It looks like Congress will allow the required spending that will drive the market higher in fiscal 2024. Investors would be wise to ignore the "herd's" fear of the Fed and of recession, and buy broad spectrum ETFs such as IWN, and SPY.

More By This Author:

Fear And Loathing Of The Deficit

Similar To 2018

The Government Funds The Economy, Not The Other Way Around