Fear And Loathing Of The Deficit

Because the US Congress is stuck in a ludicrous political 'mosh-pit', and because their central policy is one of deficit-reduction and austerity, I am re-posting something I wrote in April 2021 which continues to be relevant.

Is mathematics discovered, or invented? Is science discovered, or invented? What about art?

Science, is clearly discovered. If Einstein had not realized that E=mc^2, then eventually someone else would have.

Art, on-the-other-hand, is clearly invented. If Da Vinci had not created the Mona Lisa, no one else would have, and the Mona Lisa would not exist (some other painting might have been created using the same model, but it could never be the Mona Lisa).

When it comes to mathematics, however, the question is not so easily answered, and in fact, it is still an active question in academia. Science uses the language of mathematics to describe its discoveries, and this argues for math being a discovery, but there is so much more mathematics that, although internally consistent, has no foundation in the physical world and, therefore, makes it look like an invention. The arguing continues.

At this point, you might be wondering where I'm going with this, and what it has to do with our investments? The more we understand about what an economy is, and more broadly, what the society that maintains the economy itself is, the better we are able to understand the market and how to invest.

Societies and economies are inventions, not discoveries; both are created by the rules (laws) that humans agree to cooperate around, not discovered like scientific knowledge is. Whether we are comparing communism to capitalism, or dictatorships to democracies, the common fundamental reality is that they are all human constructs, not a naturally-occurring inevitability.

According to Margaret Thatcher:

...there is no such thing as society. There are individual men and women and there are families. And no governments can do anything except through people, and people must look to themselves first.

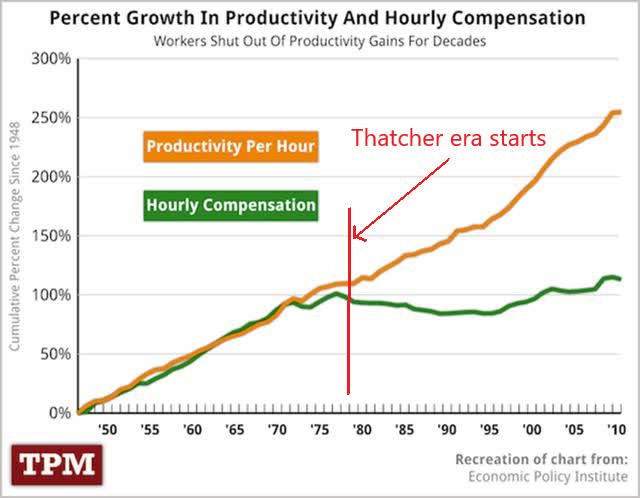

To me, that statement is as ridiculous as saying there is no such thing as a car, just individuals and groups of people travelling down a road. Yet, that flawed thinking led to 40-years of "trickle-down" economic theory where the idea that only what is good for an individual is of any value--with the 'family' thrown in there as a kind of hedge--has resulted in the growth of the wealth gap within the UK and the US (Reagan enthusiastically picked up the idea).

(Click on image to enlarge)

Humanity has progressed as much through cooperation as through competition. Society is simply the manifestation of our cooperative activities, and should be viewed as an extension of the cooperation within a healthy family unit. In a functional family, there is no meritocracy involved when it comes to accessing the available resources; there is no, "...people must look to themselves first" ideology at work. The analogy of a bundle of sticks being stronger than a collection of individual sticks, is apropos both to families and societies.

This 'trickle-down, every man for himself' ideology, in combination with the complete misunderstanding of how a fiat money system functions, has resulted in 40-years of chronic under-spending on the infrastructure that helps the economy grow and create wealth: education and training, healthcare, basic research, internet connectivity, as well as the traditional transportation/electrification/water and sewage treatment infrastructures. China has 2,800 pairs of bullet trains (217 mph) connecting 33 of its 34 provinces, while the US has none.

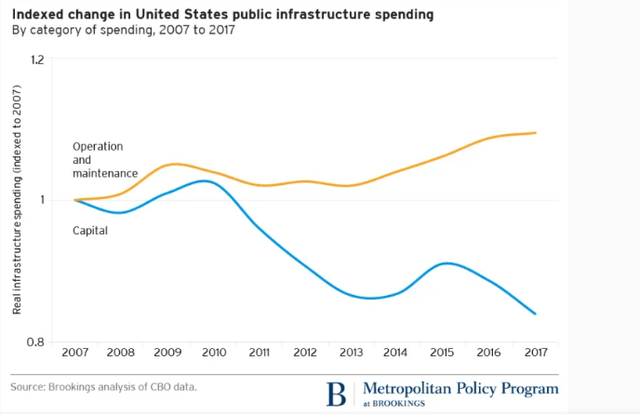

(Click on image to enlarge)

The chart above shows that spending on repairs and maintenance has gone up while investment (capital) has gone down. Like old cars, there is a point when it makes more sense to buy a new one.

Unlike the response to the GFC, this time around the pandemic-induced deficit-spending has been delivered to the base of the economic pyramid where the bulk of the consumers reside instead of to the top of the pyramid where it tends to get sequestered and rendered economically useless. Even though the money always 'trickles up' to the top (not down), at least the base of the pyramid gets to use it and put it to work in the real economy unlike during the response to the GFC when the money went straight to the top (QE), bi-passing the real economy.

This paradigm shift of providing fiscal support to individuals (high propensity to spend) and small businesses, and the funding of infrastructure will produce economic growth the likes of which we have not seen since the post WWII era. Recall that the free education provided by the GI Bill resulted in technological advances--such as landing a man on the Moon--that we are still reaping the benefits of today, five decades later.

Ignore all the fear and loathing concerning the deficit and inflation. Economies are human constructs, not naturally-occurring phenomena; economies can be organized to benefit the majority. Everyone can be richer if we simply invest in building a bigger pyramid instead of shifting the resources from the base up to the top...a top-heavy pyramid is inherently unstable.

Breaking out of the 40-year-old, wrong-headed ideology of Thatcher/Reagan, once and for all, will allow the start of a massive growth phase that will see the stock market reach unimaginable heights.

The gridlock in Congress, and the widespread fear and loathing of the deficit, is delaying the biggest bull market any of us have ever experienced, but I am confident it is only a delay, not a cancellation.

More By This Author:

Similar To 2018

The Government Funds The Economy, Not The Other Way Around

Investor Sentiment And Stock Market Timing