Getting Exposure To Quality Companies In Developed Markets?

The quality factor has outperformed the broad market this year across the globe, and we expect that to continue through the expansion phase of the economic cycle.

The WisdomTree International Quality Dividend Growth Index (WTIDG) selects companies with strong measures of profitability and earnings growth prospects in the developed markets. The thesis is that these companies will be able to grow their dividends at a faster and more stable pace, translating into strategic outperformance.

Having exposure to these companies when COVID-19 hit was important. WTIDG’s median annual dividend growth over the last three years has been 10.5% compared to 2.8% by the MSCI EAFE Index. During this same period, WTIDG has outperformed MSCI EAFE by more than 400 basis points (bps) while its hedged version, the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH), has outperformed by a wider 600 bps1.

WTIDG and WTIDGH share a common equity basket and are tracked by the WisdomTree International Quality Dividend Growth Fund (IQDG) and the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), respectively. This equity basket underwent its annual reconstitution at the beginning of November.

Rebalance Summary

Fundamentals

Fundamentals after our rebalance show an increase in quality metrics, as well as higher implied growth as measured by the earnings retention times the return on equity (ROE). Return on assets (ROA) improves from 9.94% to 10.87% and implied growth rate from 12.58% to 14.07%.

Within its objectives, WTIDG’s fundamentals show a portfolio with more attractive quality and growth metrics than the MSCI EAFE Index, along with a lower growth-adjusted valuation.

Country and Sector Changes

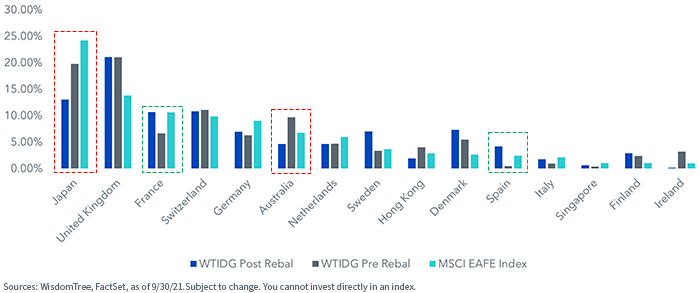

During this latest reconstitution, Japan and Australia saw notable reductions in weights relative to the MSCI EAFE Index. Exposures to France, Sweden and Spain were significantly increased.

The largest change from a country perspective was France, whose weight increased 4.04%. This increase was driven by the addition of Consumer Discretionary conglomerates Kering SA and Michelin. Both companies showed a solid rebound in earnings and dividend growth post COVID-19 slowdown. Increases for Sweden and Spain can be largely attributed to the addition of companies in the Industrials and Consumer Discretionary sectors, respectively.

Country Exposures

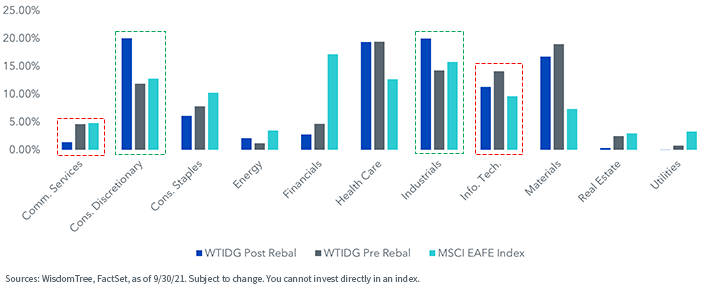

When looking at sector changes, Consumer Discretionary had the biggest percentage weight increase, driven by the previously mentioned French companies along with Spanish Industria de Diseno Textil, S.A. The Industrials sector also saw a significant weight increase driven by Deutsche Post AG, Hapag-Lloyd AS and Sandvik AB.

Noteworthy weight reductions came from the Communication and Information Technology sectors. Companies with large weight reductions were SoftBank Corp. and SAP SE.

Sector Exposures

Possibility of Implementing Currency View

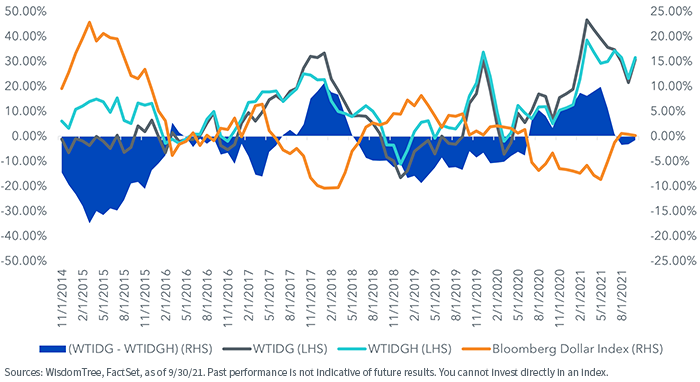

Going back to their common inception in November 2013, we can see how the excess in the rolling 12-month performance between WTIDG and WTIDGH is highly correlated to the performance of the Bloomberg Dollar Spot Index. In periods of U.S. dollar (USD) strength, WTIDGH will seeks to outperform WTIDG, with the opposite happening in periods of USD weakness. The idea behind IQDG and IHDG sharing a stock basket is to allow investors to implement their views on the USD on top of a portfolio of companies with strong profitability and growth outlook metrics.

Trailing 12-Month Return

1 Sources: WisdomTree, FactSet. Data from 9/30/18–9/30/21. Past performance is not indicative of future results. You cannot invest directly in an index.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal.

IHDG: Foreign investing involves special risks, such as risk ...

more