Bullish Period

SPX Monitoring purposes; Long SPX 4/12/24 at 5123.41.

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

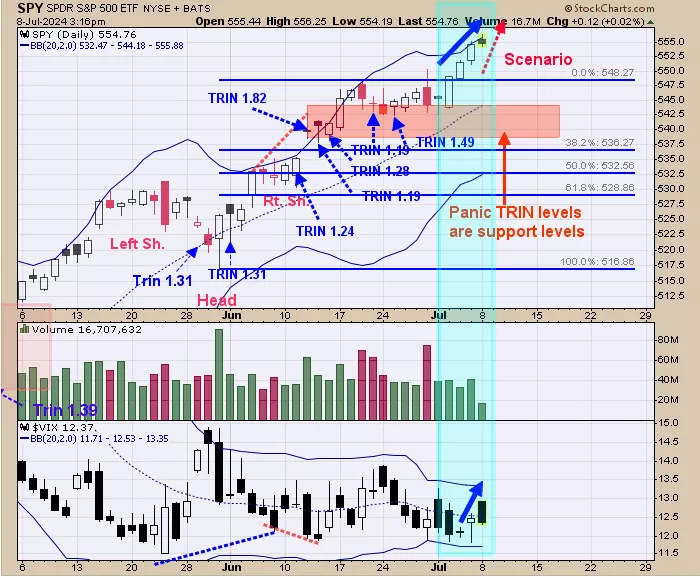

We listed in blue on the chart above the TRIN closes of 1.19 and higher (TRIN >1.20 show panic and panic only form near lows). We shaded in light pink where the panic TRIN levels occurred and in turn suggests support for the SPY which comes in between 540 to 545. There is usually a summer rally that starts around the July 4 time frame and last into mid to late July, so seasonality wise the market entering into a bullish period. The bottom window is the VIX. When the VIX and SPY rally together, it can be a bearish sign for the SPY. Last Thursday and Friday both the SPY and VIX where up producing a negative divergence; negative divergences can last a while before a negative affect takes hold. Watching the VIX closely. Staying long the SPX.

The bottom window is the monthly SPX/VIX ratio and next higher window is the monthly SPX. Intermediate highs can form when the monthly SPX makes higher highs and the monthly SPX/VIX ratio makes lower highs; so far that is not happening here. Currently we have the SPX making higher highs and the SPX/VIX ratio making higher highs giving the “all clear” for now. Another thing to watch for is the 50% of the monthly trading range closing above it’s upper Bollinger band (noted with blue arrows); this condition suggests a pause in the market and can also come near large declines; That’s not happening here either, but the month is not over. Staying long the SPX.

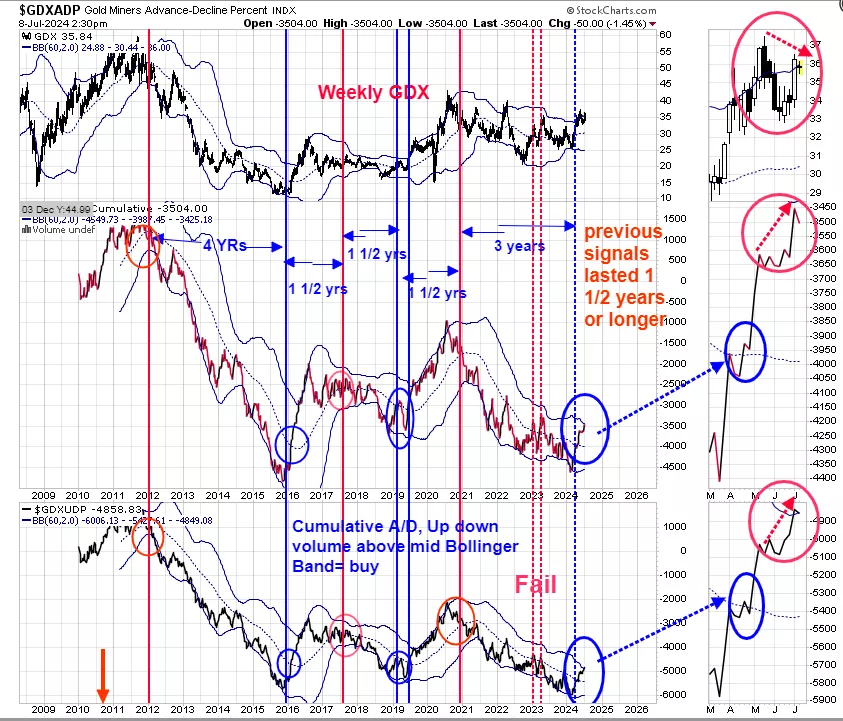

We updated this chart from last Thursday and last Thursday’s commentary still applies, “The bottom window is the weekly GDX cumulative Up down volume and next higher window is the weekly GDX cumulative Advance/Decline. The far right window shows a clear picture what is going on short term for GDX. Both indicators traded above its previous highs of mid May today suggesting at some point GDX will trade above its mid May high which was 37.47. Not saying that GDX will top at 37.47, but rather that the next rally phase has started on GDX and the pull back from the mid May high has ended.”

More By This Author:

SPX Shows Bullish Signals

Bigger Picture Remains Bullish

Bigger Trend Remains Bullish

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more