Bigger Picture Remains Bullish

SPX Monitoring purposes; Long SPX 4/12/24 at 5123.41.

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

What we said on last Thursday’s report still applies, “We listed in blue on the chart above the TRIN closes above 1.20 (TRIN >1.20 show panic and panic only form near lows). We shaded in light pink where the panic TRIN levels occurred and in turn suggests these levels on the SPY are support. The week after option expiration week (this week is option expiration week) can see softness in the market. There is usually a summer rally that starts around the July 4 timeframe that can be strong.” Added to above, The SPY was up 7 days in a row going into last Wednesday; predict market will be higher (5-7 days) 91% of the time and keeps the short term trend bullish. Staying long the SPX.

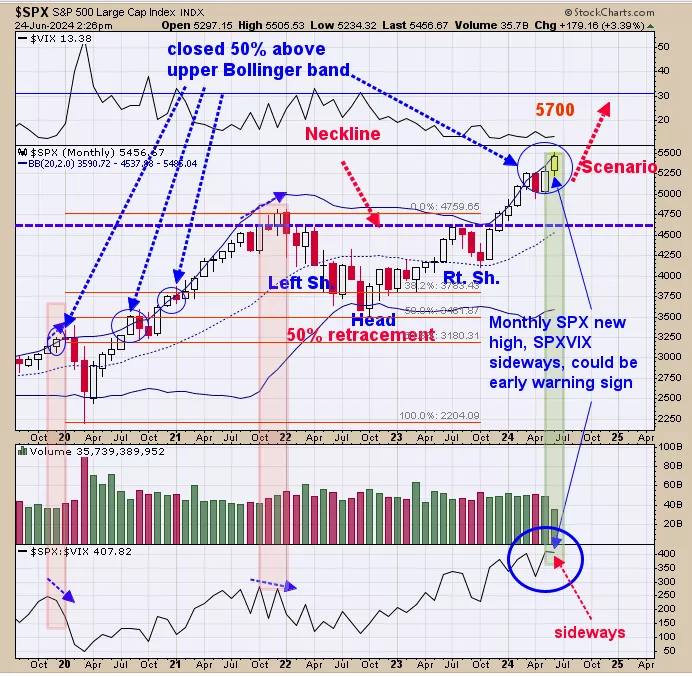

The bottom window is the monthly SPX/VIX ratio and middle window is the monthly SPX. Monthly SPX is setting at a new high and the monthly SPX/VIX ratio is down a touch from the May high which is a minor bearish divergence; however the month of June is not over (Friday’s ends the month of June) and SPX/VIX ratio may still close higher by Friday and end the bearish divergence. If however, SPX/VIX ratio does not close at a new high (along with SPX) than a warning sign is present. Seasonality wise, there is a rally (some times strong) that starts around the July 4 timeframe and runs to mid July and we will be watching for that. Staying long the SPX for now.

The top window is the weekly GDX and next window down is the weekly cumulative advance/decline and next lower window is the weekly cumulative up down volume (both for GDX). The very right window (big red square) show the close up view. The top window is the weekly GDX which has pull back since mid May; notice that both weekly up down volume and weekly advance/decline hit new highs. These two indicators are showing that GDX is getting stronger on the weekly timeframe and at some point suggests that GDX will also be hitting new higher highs. Bigger picture remains bullish.

More By This Author:

Bigger Trend Remains Bullish

Short Term Divergence

Uptrend Remains On Track

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more