Bull Or Bear? Anticipate The Next Big Move With Price Volume Analysis

Image Source: Unsplash

Watch the video extracted from the live session on 25 Jul 2023 below to find out the following:

- How to use Wyckoff's efforts vs results to predict the next move.

- The groups that could benefit from the potential market rotation from Nasdaq 100

- Identify the key levels using the axis line concept

- How to judge the "supply level" to determine if the pullback is healthy

- And a lot more

Video Length: 00:09:42

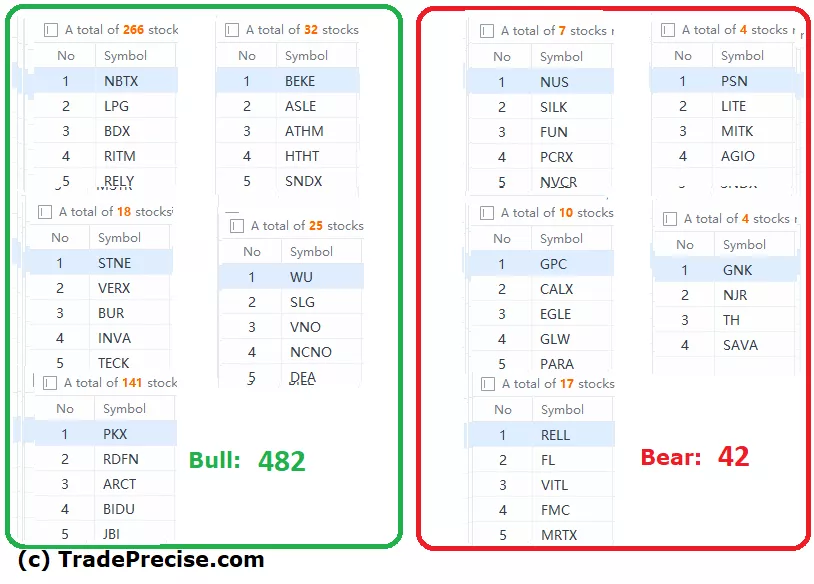

The bullish vs. bearish setup is 482 to 42 from the screenshot of my stock screener below pointing to a positive market environment.

Both the long-term and the short-term market breadth are pointing to a sustainable rally (e.g. buy on dip is back).

12 “low hanging fruits” (YPF, PETQ, etc…) trade entries setup + 20 others (FTNT, TER, etc…) plus 17 “wait and hold” candidates are discussed in the video (51:49) accessed by subscribing members below.

(Click on image to enlarge)

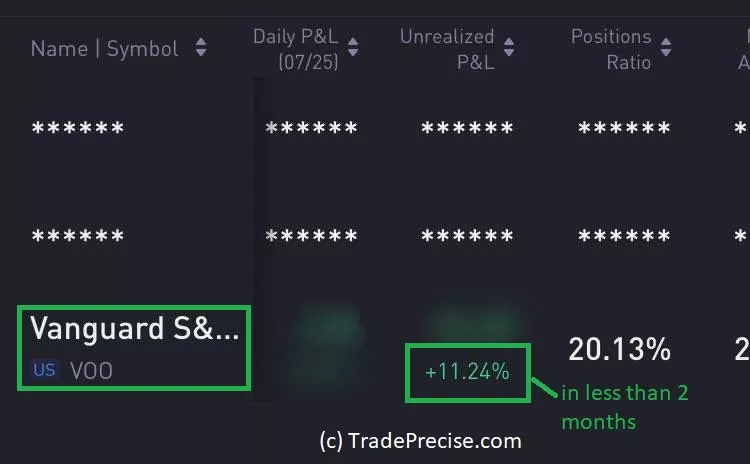

11% in 2 Months

Here is a recent win from a WLGC member in one of her portfolios.

Apart from swing trading the trade setups as discussed during the live session, she is also building a simple retirement portfolio by position trading (i.e. active investing with a technical approach) in S&P 500.

So, position trade for the long term makes a lot of sense as she can take advantage of the compounding effect while avoiding averaging down or catching the falling knife during the bear market.

In less than 2 months, the return of VOO is 11.24%. This is the simplest form of trading or investing, just by following the weekly analysis of the market.

Note: VOO is S&P 500 ETF by Vanguard. In case you are wondering, This ETF has a lower expense ratio compared to SPY, which is great for keeping for the long term.

More By This Author:

Unmasking The Bear's Footprint - Is There Still Room For Growth?

XRT ETF Unleashes Profits: How To Trade The Cup & Handle Breakout With Leveraged ETF RETL

Market Rotation Into One Juicy Group Could Put A Cap On Nasdaq

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.