A Lot Of Panic

SPX Monitoring purposes; Long SPX on 2/6/23 at 4110.98

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Neutral

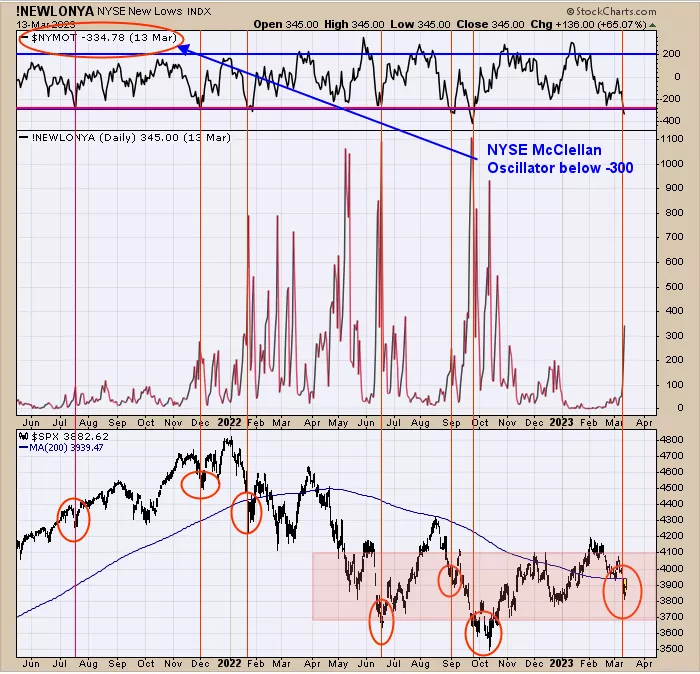

The top window is the NYSE McClellan Oscillator which dates back to March 2021. We marked the times when the NYSE McClellan Oscillator closed below -300 (yesterday's close came in at -335). In all cases with a -300 or less Oscillator reading markets a least a short-term low and most marked lows that last several weeks or longer. SPY appears to be building a base noted in a pink shaded area where Oscillator reached -300 or lower, Page two shows where panic has formed using the trin and both methods have similar appearances.

Yesterday we said, “The bottom window is the 5-day TRIN, the next higher window is the 3-day TRIN and the top window is the 10-day TRIN. When all three-time frames line up with bullish readings the market is near an important low. We circle in blue at the June and October lows where the market pushed lower to a new low before reversing. Currently, SPY is not far from the December low and may (or may not) test that level before reversing higher. There is a lot of panic TRIN closes going back to May of last year which we noted with a pink box. Panic comes at lows in the market and panic trin readings dating back to May, suggest are large support area is forming. The SVB failure last week didn’t help our long position but did produce panic closes in the trin and tick.” Page one shows where the McClellan Oscillator produced -300 which is noted with a pink shaded area and rhymes with the TRIN shaded area. The market appears to be building a base that has a measured target to the 470 SPY range which is January 2021 high. May see some back and forth before the breakout of the shaded area occurs.

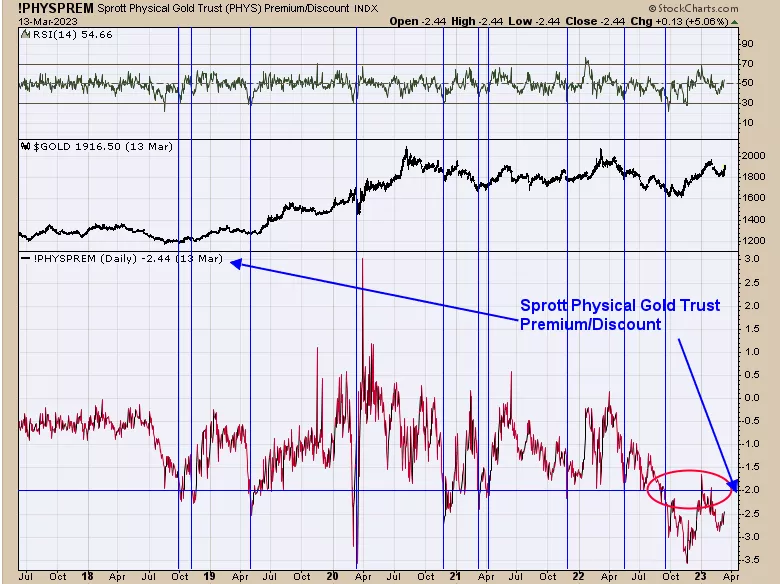

Above is the Sprott Physical Gold Trust Premium/discount index. This index shows what you can buy this physical gold above or below the real price of gold. We have this chart going back to 2010. Before 2018 the Sprott Physical Gold Trust Premium/Discount was never below -2% discounts. This Sprott Trust is a sentiment indicator. When investors lean bearish they can buy this trust below the real price. We marked the times when blue lines were the times when Sprott trust was below a 2% discount. As it turns out, Every time the discount was below 2% discount, Gold was near at least a short-term low and some marked intermediate-term lows. The largest <2% discount going back to 2010 started back in September of last year and is still ongoing with a 2.44% closing discount yesterday. This long discount below 2% is a bullish intermediate sentiment indicator. The current discount below 2% suggests gold is still a good buy at current prices.

More By This Author:

Weekly XAU/Gold Ratio

Nasdaq McClellan Oscillator

Panic Is Present - Tuesday, Jan. 24

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more