Nasdaq McClellan Oscillator

SPX Monitoring purposes; Long SPX on 2/6/23 at 4110.98

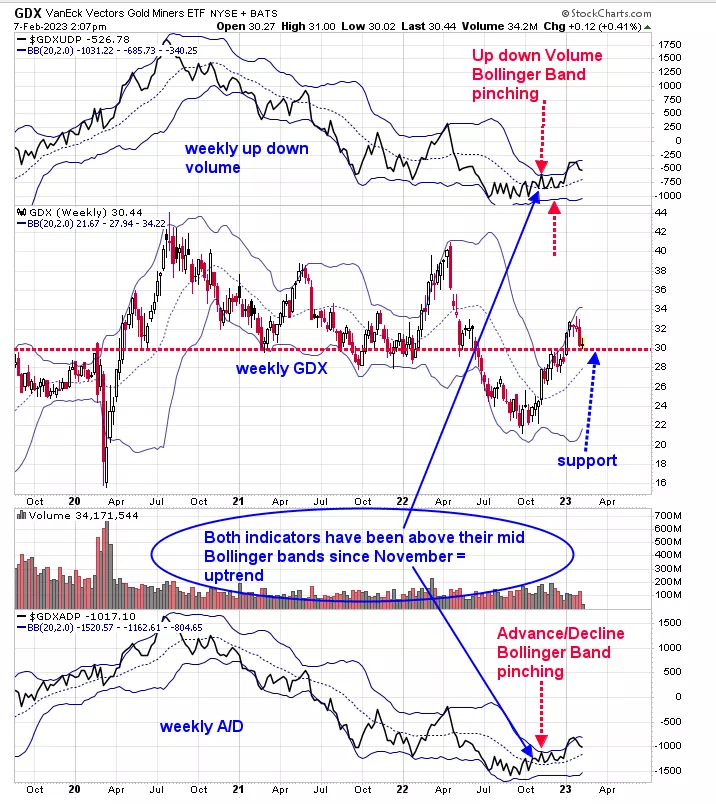

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Neutral

The bottom window is the 10-day average of the TRIN. The 10-day average of the TRIN above 1.20 (shows panic is present in the market and panic form near lows) has been bullish which is noted in light tan. 10-day TRIN near .80 and below have been bearish for the market noted in light blue. There is evidence that SPY may rally to the next resistance to the August high which comes in near 430. If the 430 on SPY is reached and the 10-day TRIN falls to .80 or below; a possible topping area would be suggested. We would need other evidence to prove that point but the 10-day TRIN would be an important factor. However, if the volume is good and the Advance/Decline remains strong; SPY could go to the next higher target of April high near 450. We will remain long the SPX.

Yesterday we said, “Bullish intermediate-term rallies form when the NYSE McClellan Summation index falls below -700 (capitulation) and then rallies to +1000 (Sign of Strength). The summation index reached below -1000 in early October and reached +1000 on February 3, 2023, and confirms an intermediate-term rally.” Some traders are wondering what the prospects look like for the Nasdaq. The middle window above is the Nasdaq Summation index. An intermediate-term sign is triggered for the Nasdaq Summation index to fall below -1000 (triggered in early October) and then rally to +600 (closed yesterday at +593; close enough). Therefore Nasdaq also gave a bullish intermediate-term sign. The bottom window is the Nasdaq McClellan Oscillator. Bullish short-term signs are triggered when the Oscillator falls below -300 (capitulation) and then rallies above +300 (Sign of Strength) within 30 days. We have circled in red when these limits were met. Notice that there were three times last year these limits were met whereas previous years have shown it happens only once a year during the bottom process of 2018 and 2020. Not sure what that means, but it may add to the bullish outcome.

More By This Author:

Panic Is Present - Tuesday, Jan. 24

A High Degree Of Accumulation

Zweig Breadth Thrust

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more