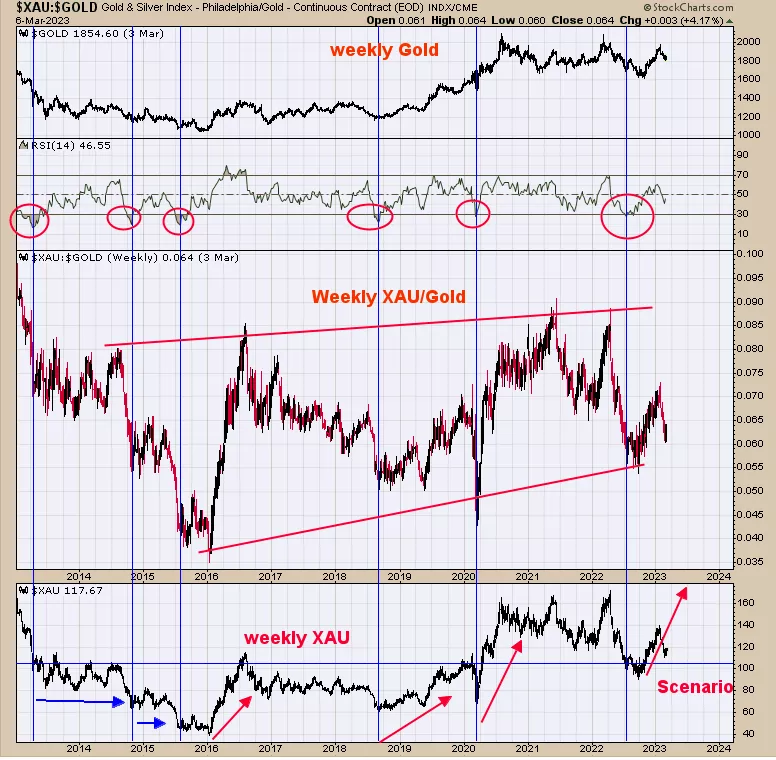

Weekly XAU/Gold Ratio

SPX Monitoring purposes; Long SPX on 2/6/23 at 4110.98

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Neutral

The tan shaded area is where panic in the trin and tick occurred and panic from near lows; so the 395 to 400 range on the SPY is a support area. The blue numbers are trin closes (first number) than tick closes (second number). For very short term, SPY could back and fill near the tan area before heading higher. The short-term statistics are not showing a bullish or bearish sign but the monthly chart leans bullish (page two). At some point probably this month, a “Sign of Strength” may show up near the 405 (close to where the SPY is now) and rally through the monthly Neckline on a wide price spread along with higher volume (Sign of Strength). Noteworthy statistic; since 1950, PreElection years (like this year) are 17-1 for an average annual gain of 16.8%.”

Above is the SPY monthly chart. The pattern that appears to be forming is a “Head and Shoulders Bottom” where the Head is the October low and the Right Shoulder is forming now and the Neckline lies near the 405 level. SPY has tested the 405 level five times over the last five months. The more times a level is tested the more likely that level will be exceeded. There is symmetry in the Head and Shoulders patterns. Notice below the Neckline starting May of last year, the market declined for five months into the October low. Form October low SPY rose for five months, showing symmetry. Currently, SPY is at the Neckline and will need a “Sign of Strength” through this level to confirm the Head and Shoulders pattern. This potential Head and Shoulders pattern has a measured target to the 470 level which is the previous major high.

The middle window is the weekly XAU/Gold ratio and the next higher window is the RSI of this ratio. Intermediate-term lows in the XAU are found when the weekly RSI for the weekly XAU/Gold ratio falls below 30 and then turns up. The chart above goes back to mid-2013. The blue lines show the times when the weekly RSI fell below 30 which triggered the buy signals. Starting in 2015, most buy signals lasted a year on this type of indicator. That would give a target for July of this year on the current signal. The XAU has moved sideways since mid-2020 and is due to do something different. Our view right now (which may change) is a breakout above the 150 range producing an impulse wave higher.

More By This Author:

Nasdaq McClellan Oscillator

Panic Is Present - Tuesday, Jan. 24

A High Degree Of Accumulation

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more