Elliott Wave Technical Analysis: Bitcoin/U.S. Dollar

Image Source: Pexels

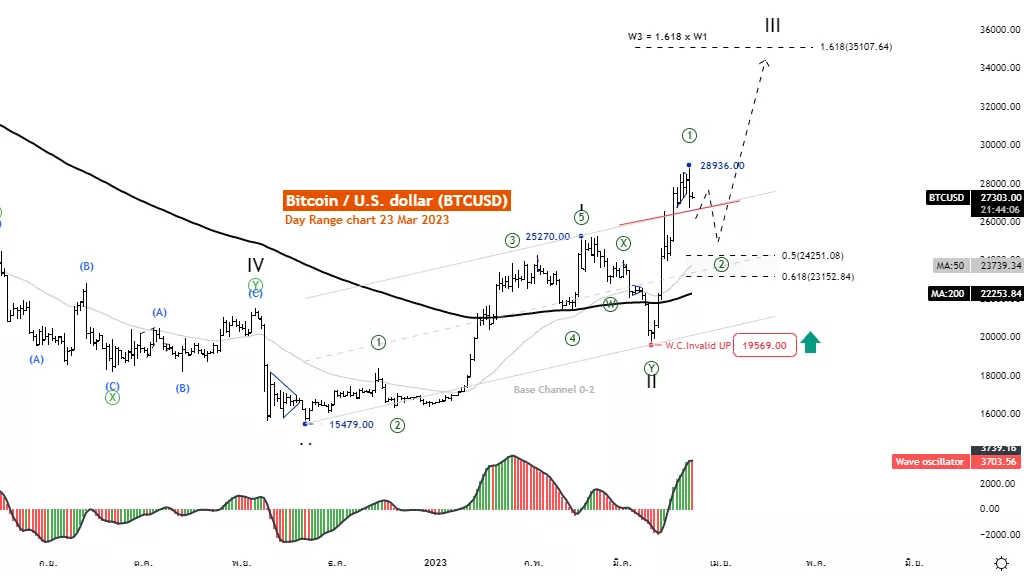

Elliott Wave Analysis TradingLounge Daily Chart, 23 March 2023.

Bitcoin/U.S. Dollar (BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave III

Direction Next higher Degrees: wave (I) of Motive

Details: Wave 3 is equal to 1.618 multiplied Length of wave 1 at 35366

Wave Cancel invalid level: 15479

Bitcoin/U.S. Dollar (BTCUSD) Trading Strategy: Bitcoin is developing in wave III and is trending towards 1.618 times wave I at 35107 as the price recovers from support at MA200 and breaks the upper channel. Help support this idea. So the overall picture is still a steady increase in the uptrend.

Bitcoin /U.S. Dollar (BTCUSD) Technical Indicators: The price is above the MA200 indicating an uptrend. The wave oscillators above Zero-Line momentum are bullish.

Analyst: Kittiampon Somboonsod, CEWA

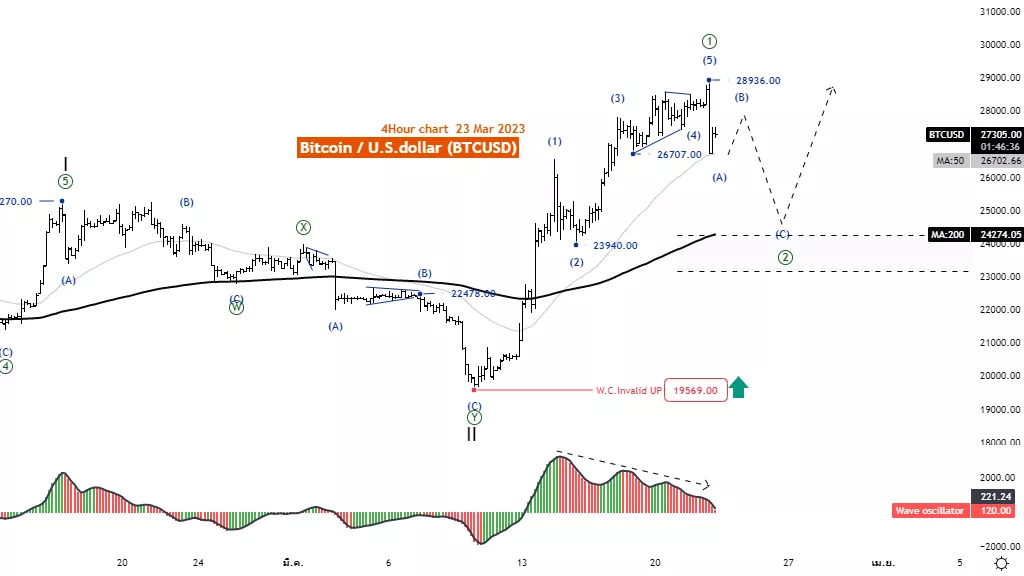

Elliott Wave Analysis TradingLounge 4H Chart, 23 March 2023.

Bitcoin/U.S. Dollar (BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Zigzag

Position: Wave A

Direction Next higher Degrees: wave ((2)) of Motive

Details: Wave ((2)) usually retraces 50-61.8% of wave ((1)).

Wave Cancel invalid level: 19569

Bitcoin/U.S. Dollar (BTCUSD) Trading Strategy: Wave ((1)) seems to end at the level 28936. As the price structure completes five waves and the Wave Oscillator slows down, it is possible that a reversal in wave ((2)) is ongoing and it is likely to end at the level of 28936. will go to the level of 50 - 61.8% of the wave ((1)) before rising again in the wave ((3)).

Bitcoin/U.S. Dollar (BTCUSD) Technical Indicators: The price is above the MA200 indicating an uptrend. The wave oscillators above Zero-Line momentum are bullish.

More By This Author:

Elliott Wave Technical Analysis: Fortinet Inc. - Wednesday, March 22

Elliott Wave Technical Analysis: AAVE Token/U.S. Dollar

U.S. Indices - Elliott Wave Trading Strategies

Disclaimer: