Why Might Firms Raise Prices Faster Than Input Prices?

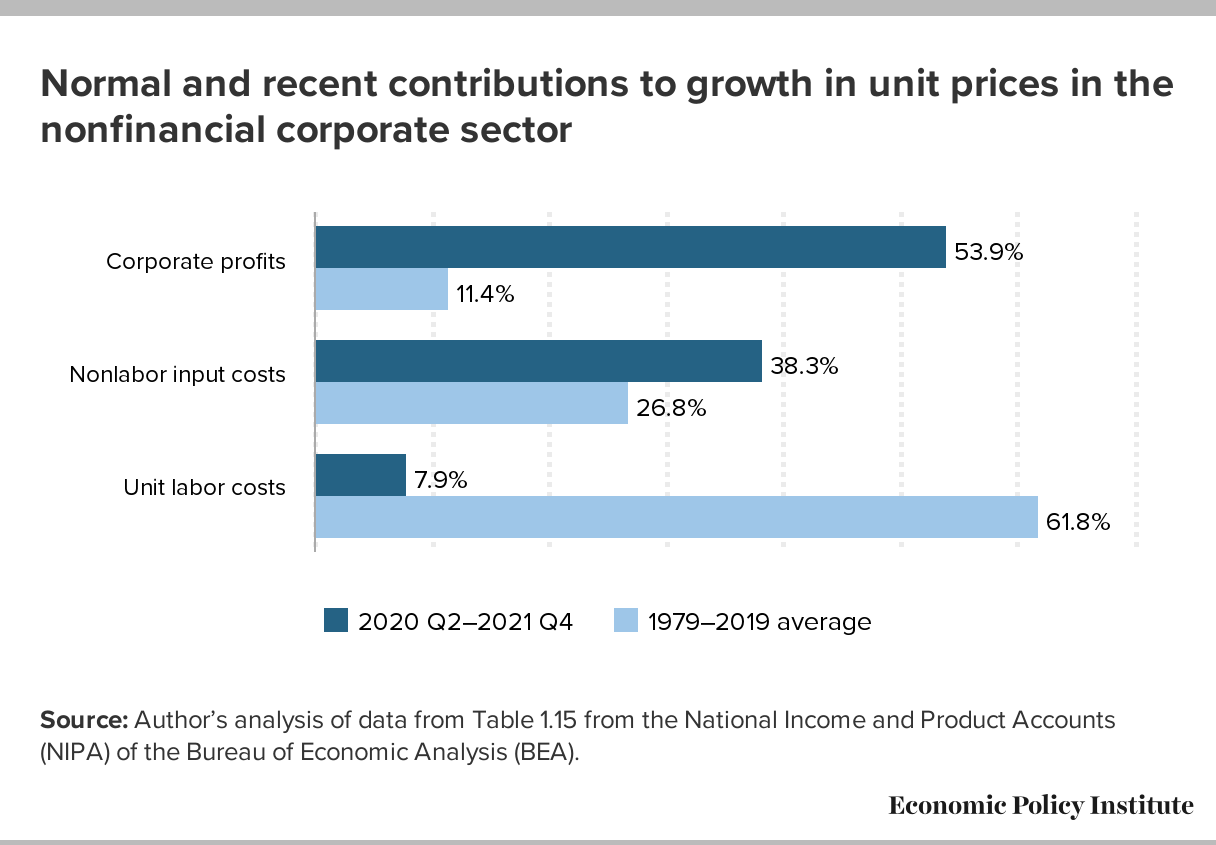

Josh Bivens at EPI has recently presented a decomposition of price changes into those attributable to price-cost margins (i.e., roughly profits), labor and nonlabor input prices, to wit:

Source: EPI, April 2023.

Former Fed Governor Brainard as well as Paul Krugman have commented on this price-price spiral (although I think the latter is a little less definitive on whether he believes this constitutes the majority of the inflationary impulse).

While the decomposition is interesting (it’s a decomposition after all), I’m not sure that the argument that Bivens forwards that it’s not demand pressures (aka overheating). While in very early NK models, the elasticity of demand for the differentiated goods are constant over the business cycle, so the price cost margin is constant, more recent work (e.g., Nakardo and Ramey, JMCB 2020) notes that depending on the type of shock, the profit margin can be procyclical.

It might be useful to think about price changes in the presence of stickiness. When inflation is rapid, then deviations from the optimal price at any given time between price-resets will be larger, inducing larger profit loss. Assuming more rapid expected inflation in the current episode than occurred in previous periods then implies firms re-set prices faster, and by larger increments. From this perspective, I might expect a bigger mechanically-defined contribution from profits, especially if firms over-estimate inflation.

The preceding argument relies on a Calvo pricing view. If price changes are staggered, an alternative interpretation is that the strategic complementary that slows price adjustment during periods of low inflation would be attenuated when firms reach consensus on a faster rate of inflation.

These aren’t rigorous (i.e., general equilibrium) arguments for an elevated profit margin; they’re just ways of saying we’re not sure the elevated profit margins aren’t due to higher aggregate demand.

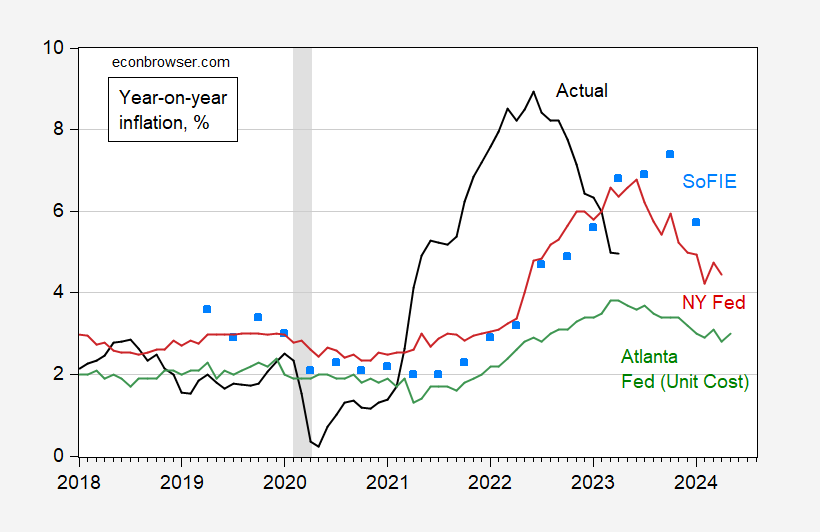

How fast did firm CEOs expect inflation to be? Coibion and Gorodnichenko provide the answer in their Survey of Firm Inflation Expectations.

Figure 2: Actual CPI inflation, y/y (black), NY Fed consumer inflation expectations for year ahead (red), Atlanta Fed unit cost inflation for year ahead (green), and firm expectations for inflation a year ahead (sky blue squares), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NY Fed, Atlanta Fed, Coibion-Gorodnichenko, NBER and author’s calculations.

The last observation we have for firm expectations is the January 2023 forecast for January 2024 year-on-year inflation. Interestingly, in the November and January surveys, firm expected inflation outstripped consumer expectations (which in turn outstripped economists’). In other words, firms expected rapid inflation (although not as rapid as actual outcomes, until April’s number). Note the Atlanta Fed measure of expected unit cost inflation is not from the same sample as that for the firm inflation, so a direct comparison is not possible.

None of the foregoing is to say that the profits currently enjoyed by firms is “good”. Rather, I’d just say it’s not clear that one can infer from profit margins whether demand shocks drove the outcome or not.

More By This Author:

Negative GDP Growth Is Delayed Again

Federal Debt To GDP – When Did It Jump?

Business Cycle Indicators At Mid-May