Federal Debt To GDP – When Did It Jump?

Regardless of gross or net, at par or market value, as a ratio to GDP or potential GDP, the answer is pretty obvious.

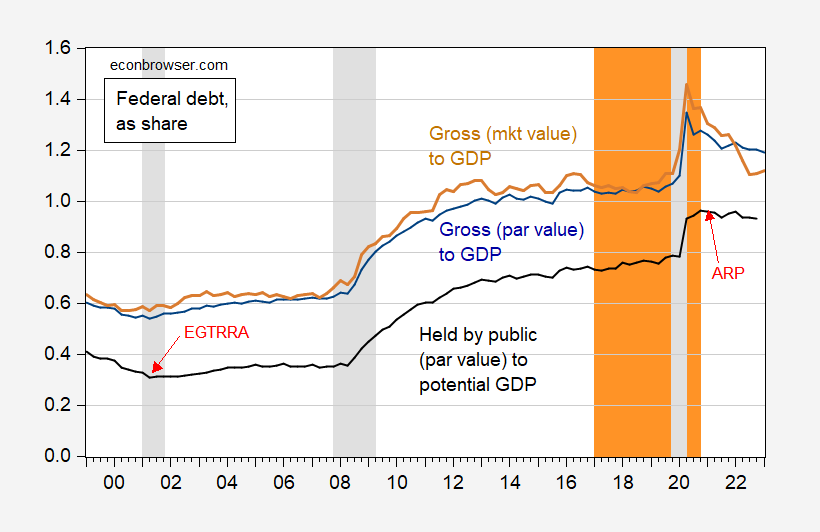

Figure 1: Gross Federal debt at par value as ratio of GDP (blue), at market value as ratio to GDP (tan), Federal debt held by public at par value as ratio to CBO potential GDP (black). NBER defined peak-to-trough recession dates shaded gray. Trump administration shaded orange. Source: Treasury via FRED, Dallas Fed, CBO (February 2023), NBER, and author’s calculations.

Publicly held debt as a share of potential GDP rose by 15 percentage points going from 2020Q1 to 2020Q2. The 25 ppts increase using actual GDP is in some sense misleading because it’s largely by the sharp drop in output in Q2.

The market value of debt has dropped substantially more than the par value, and in some ways the market value is more representative of the burden posed by the outstanding stock of debt (see discussion here).

None of this should detract from the argument that the path of debt is not sustainable. I would say that it is impossible, given the consensus to maintain defense and Social Security, to meaningfully address this problem without raising additional revenue. (Productivity and output-enhancing measures, like increased immigration, wouldn’t hurt either.)

(Side Note: Japan’s net debt to GDP in 2021 was about 170%).

More By This Author:

Business Cycle Indicators At Mid-MayOil, Risk, And Price Pressures Before Putin/Ukraine – Using The Hamilton Filter

Oil, Risk, And Price Pressures Before Putin/Ukraine