Trade War; Easier For Chinese Than Americans

If Chinese citizens are asked to be patriotic, they will pay less for local goods because of PPP explained below. If US citizens are asked to be patriotic in order to win the trade war they will have to pay much more to buy American.

Our consumers are already weak even without having to buy American! After discussing these economic principles, the third chart below will show the debacle that Donald Trump is creating with US manufacturing.

So, understanding purchasing power parity (PPP) and how relatively small the US non-financialized economy really is because of high manufacturing costs, is necessary to comprehending serious disadvantages that we have if we think we can win a trade war with China.

Alan Blinder was on CNBC May 20th sharing misinformation about the trade war. His position on trade wars being generally bad is legitimate. But he said that China will lose the trade war because the US only imports 3 percent of GDP from China and they export more than we do.

But that thinking is misguided. PPP and the first chart are explained below

(Click on image to enlarge)

|

Total Retail Receipts in the USA (Click on image to enlarge) |

|

Subdued Private Retail Industry Is Not Contributing As Much to GDP as in 2016/2017 |

Understanding PPP

Understanding PPP and how small the US non-financialized economy really is because of high manufacturing costs is necessary to comprehending serious disadvantages that we have if we think we can win a trade war with China.

As we can see from the first Fred chart above, total retail sales appear to be a lot lower than other estimates. We are at almost 2 trillion dollars annually. Other figures list retail sales at 3.628 trillion dollars. Either way, $500 billion of Chinese imports is a large figure. At over 500 billion dollars, China exports mostly goods to the USA. This does not include imports from other nations. The Chinese do not export oil or gasoline or very many autos to the USA.

It is hard to get the precise numbers, but if the non-financialized US economy is one third to one-fourth of the total US GDP, then China could be exporting well over 10 percent of non-financialized US GDP to America. Replacing this production, perhaps 12 to 15 percent of the non-financialized US GDP, and an even larger percentage of retail minus gasoline and autos, will be difficult on American consumers.

This will devastate low and middle-end shoppers. It will hurt higher-end shoppers who carry heavy debt and are found at dollar stores driving Mercedes and Cadillacs. It will impact the US ability to make what it needs.

It is true that China is not without pain, as the price of fruit is skyrocketing. There are issues with African Swine Fever as well. But overall, there will be far more items going up in the USA if all the tariffs are applied, and PPP means the Chinese will not suffer as greatly.

Trump in a Box

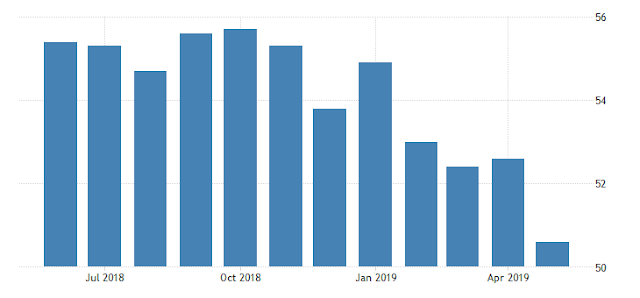

Donald Trump has boxed himself in. He cannot easily bow to China or his base will revolt. But if he doesn't bow to China the farmers could revolt against him. And he is badly hurting the manufacturing economy of the USA which has sunk to a 10 year low:

(Click on image to enlarge)

|

| Source |

The destruction of US manufacturing is the opposite of what Donald Trump wanted. He needs to stop the trade war before he does even more damage to the United States economy. But as Rick Newman of Yahoo Finance said, perhaps Trump is no longer interested in making America Great, not that tariffs could ever do that, but rather in destroying China. His knowledge of economics is really poor.

He cannot force much more tariff injury to China or we will cross over the line to a cold war. So far, he will apparently continue to squeeze China at the margins with sanctions on Hikvision, a security firm. But if he seriously crosses the line there could be terrible trouble for everyone.

His adviser Kudlow spilled the beans saying that the US citizen pays the tariffs Trump has imposed. POTUS has been lying about that at his rallies, saying the costs are born by the Chinese. That simply is not true. Trump tariffs directly impact Americans as they are charged to importers into the USA. The next round will include shoes and toys, hitting American families hard:

Trump: "Tariffs are NOW being paid to the United States by China of 25% on 250 Billion Dollars worth of goods & products. These massive payments go directly to the Treasury of the U.S." — tweet Friday.

The facts: This is not how tariffs work. China is not writing a check to the U.S. Treasury. The tariffs are paid by American companies, which usually pass the cost on to consumers through higher prices.

Why Donald Trump would want to fool the American public about who pays for tariffs is perplexing. It is likely evidence that he knows the taxation issue caused by tariffs could diminish his already waning popularity.

Stocks were down on 5/23, but immediately rose off their lows when Trump talked about including Huawei in any trade deal. The stock market has to stop believing him, and as Jim Cramer has said, bake as much negativity into the market as is possible, in order to get the two biggest economies, and especially Trump, to act towards a trade deal.

Supply Chain Reality

Indirectly, Chinese business can suffer, but often it is the supply chain of American business trying to make finished products with Chinese components that Americans can afford to buy that will suffer.

Steve Bannon is to China what John Bolton is to Iran. He wants a full-blown trade war. Bannon says there is no chance Trump will back down on trade. However, since then Trump has been measured. He knows the stock market will tank if the lines are crossed that should not be crossed. But the longer he waffles on supply chain issues worldwide, the more unreliable the US will be seen by world trading partners.

As it is, the United States is now a nation of companies that can be labeled an unreliable supplier. The world will look at the US as an unreliable partner in business. This assessment has to be going on in Europe and in Japan. Damage could be done to these nations, especially with autos and auto parts. These nations need a plan B if relying on the US, because plan A, is not certain.

Trump has torn down trust in the supply chain. We are the nation that will pay dearly for this lack of trust. Risk management of supply chains is something that is continually assessed in the business world. It is almost like Donald Trump, in his efforts to label China is untrustworthy, is actually the one cutting off supplies to the world! He has created geopolitical instability, a prime ingredient in supply chain failures.

China, on the other hand, will likely be trustworthy toward most of the world in supplying necessary components. Maybe not so much towards the USA, because we don't deserve the reliability based on bad tariff behavior. After all, China has done things to bail out and prop up the US economy in the past, like buying commodities after the Great Recession.

China did not bail out the financial sector like this idea put forth in 2008, but it did buy up coal and other commodities. And it continued to be a driver of the world economy as Barack Obama requested.

In the light of little real demand for 5G is it worth it for the USA to risk the world economy to gain superiority in 5G? No one really cares, so, is 5G just misplaced capital wasted? At least Trump should keep China driving the world economy since we have proven we have absolutely no ability to do it.

Fed and Tariffs

From TheoTrade we get this insight about Fed behavior. The Fed may think low inflation will be offset by tariff price increases:

Low inflation has been a concern of the Fed even with these tariffs. With inflation low, the Fed has come up with numerous products and services to blame.

However, it rarely mentions how low inflation would be without tariffs. We won’t see a decline in inflation because new tariffs are about to kick in. Oxford Economics believes that because economic growth will be hurt by the tariffs, there won’t be a net effect on inflation. We will see in the coming months how accurate that thesis is.

Trump wants Judy Shelton to be on the Fed Board of Governors. She believes that the Fed response to the Great Recession was wrong. While I agree, she is too aggressive with interest rate policy. She advocates zero interest rates and we aren't even in a recession.

Of course, that is in keeping with the Trump campaign writings which advocated the destruction of the new normal of low-interest rates and slow growth. By lowering rates very low, Trump hopes the economy would catch fire, causing a massive boom in the economy. That would ultimately destroy bonds as collateral if long rates spiked far above 3 percent. But the end result would likely be a severe crash, hopefully for the next POTUS to tackle. We hope this thinking does not prevail.

Disclosure: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment ...

Update 2: Even if Trump does want a stronger economy, it may be that we would lack the immigrant workers necessary to drive a housing boom. New housing sells appliances and other products. An uptick can come in the form of a bubble. But even if housing could boom, Trump's racism has sealed the minorities out that build the houses! If he wants an Aryan state, and immigrants from Norway, there still won't be anyone to build a housing bubble.

Update: Trump is about to impose additional tariffs on Mexico. These have nothing to do with the deal he already made with Mexico. This article speaks to the unreliability of Trump and the United States, supply chain unreliability. The Trump radicals are pushing China to realize this unreliability, as well as Germany and Mexico. It is a waste of time to negotiate a trade deal with Donald Trump. Investors should be alarmed.

Gary, a lot of good arguments on the injury to Americans from the tariffs. You are right about the nonsense from Blinder. That macro number tells you nothing about the structural impact of trade ( just ask farmers or specialty steel users)--- I am surprised that Blinder said that.

Turning to the Chinese side, one thing to consider is : China jumps the tariff wall by moving production to other Asian countries and collecting the profits and economic rents from moving offshore. Vietnam and Laos can and would love to have more exported production. Another bigger issue is the restructuring of the Chinese economy. Now China has high savings rates--around 25%. It is pursuing policies to increase domestic consumption and that shift would divert more production from the export market to domestic buyers while maintaining national output growth at the same rate. There are still about a 1 billion Chinese who do not live in the richest 10 biggest cities. These people are ripe for more consumer goods made domestically.

Last thing: Xi Jinping will be in power for life--at least 25 years. He will wait out Trump and any future misguided presidents

I wish our leaders would take your thoughts seriously. There is a lot of damage being done by #POTUS45