The Two-Track Consumer Credit Market

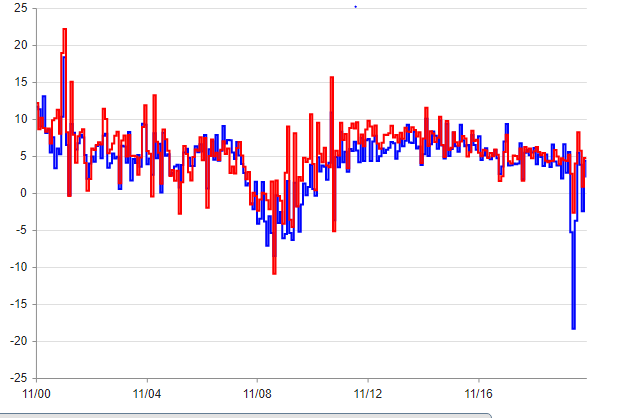

The basis of an economic recovery lies with the consumer, yet consumer behavior continues to show inconsistency. Households are of a split mindset when it comes to borrowing. US consumer revolving credit----principally credit cards and consumer loans----has decreased at an annual rate of 6%, as consumers cut back on purchases in many areas, especially in hospitality, entertainment, and leisure travel. However, the pandemic seems to have no impact on nonrevolving credit--- mortgages, fixed-term loans---which have increased at an annual rate of 4%. (Figure 1).

Figure 1 Growth in US Non-revolving credit (red) and Revolving Credit (blue)

(Click on image to enlarge)

Source: FRED

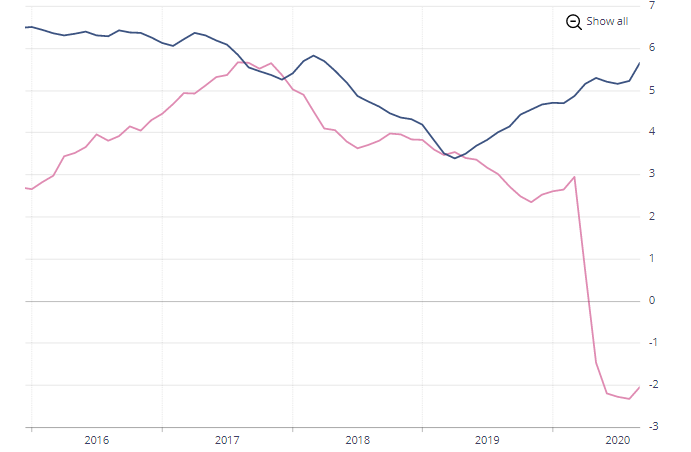

The Canadian experience is also one of great divergence. Consumer credit growth took a huge dive in the spring of 2020 and continues to show negative growth. In total contrast, the Canadian mortgage market has rarely seen such strong growth as Canadians bid up the prices of homes, especially in the large metropolitan areas. (Figure 2). Since thousands of households have opted for payment deferrals on their mortgages, it is probably too early to judge how robust the mortgage market is. Canadian banks have been lowering mortgage rates in a highly competitive market and prospective purchasers have a wide assortment of mortgage products to chose from. Overall, realtors have come off one of their best years in a decade, in terms of both volume and sale prices.

Figure 2 Growth in Canadian Mortgage Credit (blue) and Consumer Credit (purple)

(Click on image to enlarge)

Economists are debating the implications of this two-track consumer behavior. Some argue that consumers are paying down revolving credit card debt and this represents a huge pent-up demand once the economies are fully open for business. This is magical thinking. If consumers learn anything from this pandemic it is that they must save in the event of future crises that may shut down economic activity drastically. There is a need for precautionary savings ( https://talkmarkets.com/content/economics--politics/business-and-households-amass-cash-to-withstand-the-pandemic?post=286016 ). In the case of mortgage credit, many purchasers view their home as a form of forced savings and an asset that can also be called upon in the future to assist during a time of economic stress. Thus, the two-track behavior is not inconsistent, but a reflection of how the pandemic has changed consumer attitudes in a time of such great uncertainty.

Sadly a lot of people are unaffected by lower credit rates because lots of their debt has high rates that don't drop with interest rates like credit card debt which was rising. People are getting desperate. The rest are lowering their risk by paying off debt and saving. I think this is creating habits of permanence. Don't expect increased wild spending anytime soon from consumers.

I fully agree with that conclusion.