The Recession Of 2022H1 – Rec Vehicles, But No Spam

Reader Steven Kopits, in response to a posting of alternative indicators, writes:

I am pretty comfortable with both my H1 2022 call and with the role of gasoline/diesel consumption and VMT as indicators of economic stress or comfort, as the case may be.

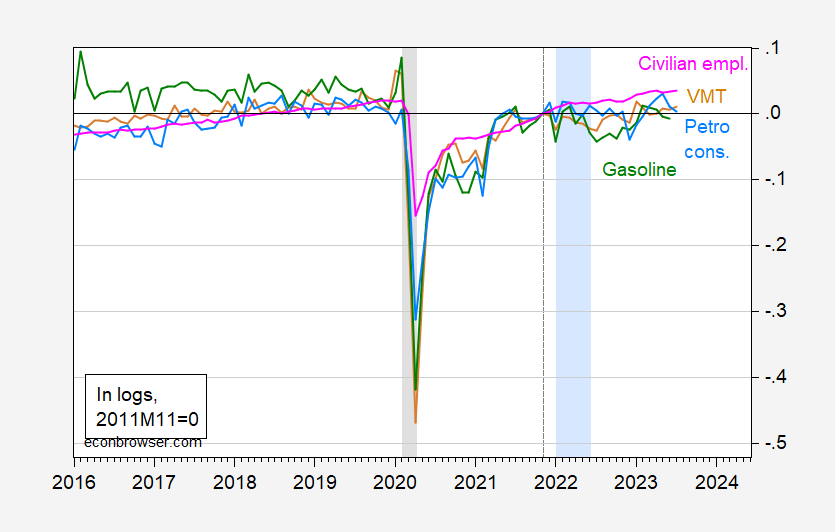

Here is a longer span of alternative indicators, to highlight the fact that using VMT, gasoline consumption or petroleum use, would suggest we have been and remain in a recession.

Figure 1: Civilian employment from CPS (pink, right log scale), Vehicle Miles Traveled (tan, right log scale), Petroleum Consumption seasonally adjusted by author using Census X13/X11 ARIMA (light blue, right log scale), and Gasoline Supplied s.a. by author (green, right log scale), all 2021M11=0. NBER defined peak-to-trough recession dates shaded gray. Hypothetical 2022H1 recession dates shaded light blue. Source: NHTSA, EIA via FRED, EIA STEO, NBER and author’s calculations.

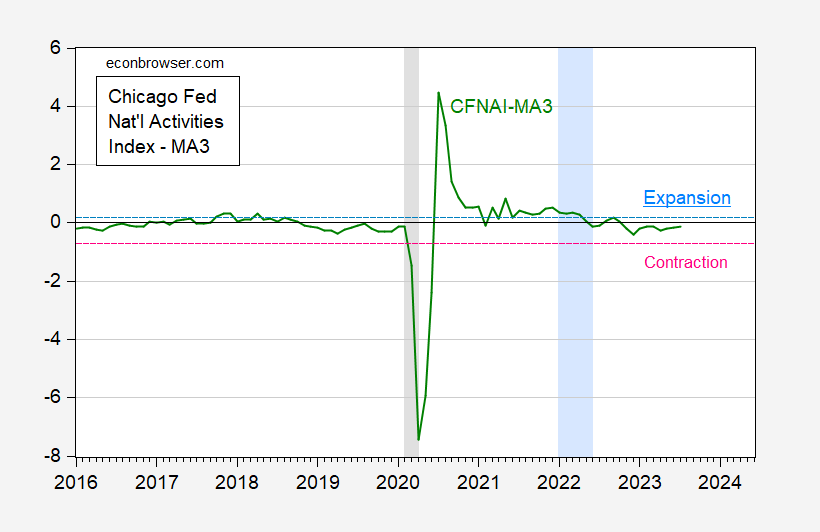

This is in contrast to other conventional indicators, such as the Chicago Fed National Activity Index. I plot CFNAI MA3 over the same time period as Figure 1 below, to show the contrasting evolution. Note that the CFNAI MA3 did not breach the contraction threshold in the hypothetical 2022H1 period.

Figure 2: CFNAI-MA3. If in expansion, coming from above and falling below pink line, then entering recession. If in recession and coming from below and rising above light blue line, then entering expansion. NBER defined peak-to-trough recession dates shaded gray. Hypothetical 2022H1 recession dates shaded light blue. Source: Chicago Fed via FRED, NBER.

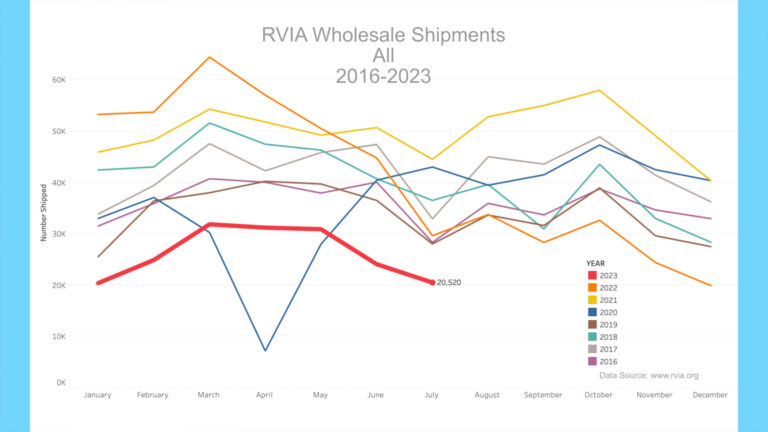

While I haven’t found SPAM sales numbers over time, I did find monthly RV sales. Note that the first half of 2022 (actually through May) was a bumper year in sales, exceed record amounts in 2021 – for obvious reasons.

Source: Marucci (2023). Data through July 2023.

Now, if one wanted to infer incipient recession from the rapidly declining RV sales, one could make a reasonable argument (see my 2019 post on using RV sales to predict recessions). However, I would say that the distortions associated with the pandemic make that a dangerous proposition.

In sum: If you still think the 2022H1 recession call was reasonable, then I have a bridge in NY to sell you.

More By This Author:

Term Spread Watch – Is This Time Different?

Monthly GDP And Coincident Index

Mean And Median Average Hourly Earnings Growth Compared