Term Spread Watch – Is This Time Different?

A reporter asked me today whether this time was different, especially in light of all the positive coincident indicators (Q3 GDPNow has been at 5.6% for a couple of weeks; Fed staff has upgraded q4/q4 growth, Goldman Sachs pegs recession probability at 15%). I was (I hope properly) circumspect.

First, as I noted a month ago, the 50% threshold using standard probit models indicated a recession in 2023Q4 – which we’re not in yet, let alone getting data on.

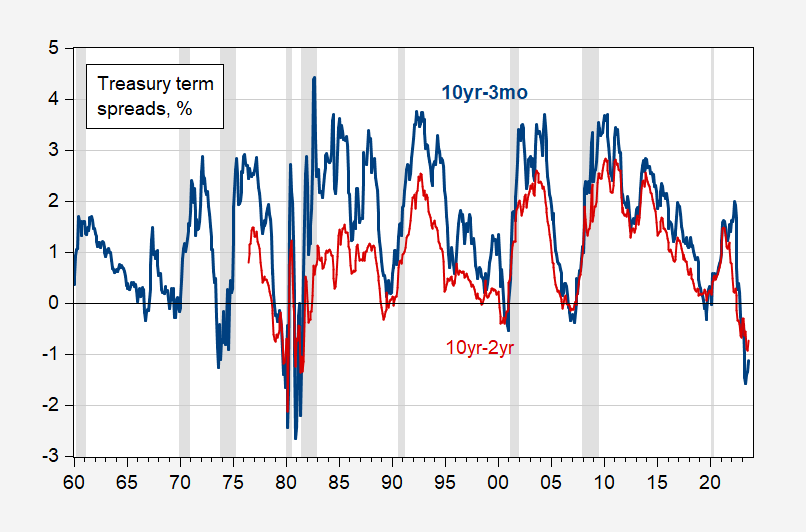

Second, the two-term spreads I follow — the 3m10s and 2s10s (10yr-3mo, 10yr-2yr spreads, respectively) have a pretty good track record. Only one false positive since 1960 for the 3m10s and no false negatives. Since 1976M06, only one missed recession (the 2020) for the 2s10s.

Figure 1: 10yr-3mo Treasury spread (bold blue), 10yr-2yr (red), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, NBER and author’s calculations.

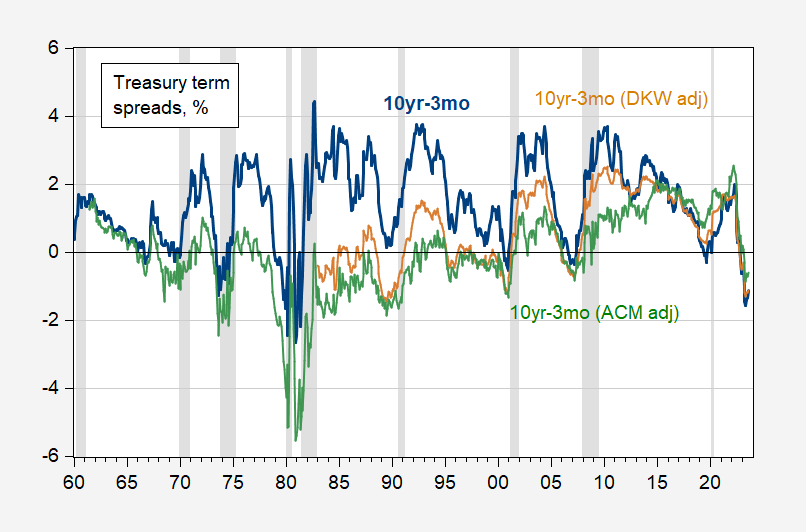

The main argument I hear for why 2023 might be different is that the term premium has been distorted by quantitative easing and tightening. One way to address this concern is by adjusting the 10yr rate by subtracting off (an estimated) term premium.

Figure 2: 10yr-3mo Treasury spread (bold blue), 10yr-3mo adjusted by D’Amico-Kim-Wei/Board real/inflation risk premium (tan), adjusted by Adrian-Crump-Moench NY Fed term premium (green), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Fed Board via FRED, NY Fed, NBER and author’s calculations.

Note that the implied term premia differ, so it’s unclear whether adjusting for premia tells a significantly different story regarding inversion predictive power. The DKW adjusted spread predicts recessions for 3 of the last 4 recessions (it misses the 2020 recession), but would’ve also had some false positives. The ACM adjusted spread spends too much time in negative territory in the pre-2000 period to be very useful.

Of course, these spreads all show up as statistically significant in probit regressions — but with significantly less pseudo-R2 than an unadjusted spread (about 0.18 vs. 0.28).

In any case, Kim and Hamilton (2002) note that term premia have predictive power for future economic activity (separate from recessions), so it is not clear that one should exclude them from the regressions.

So, I’m not sure why this time should be different. That being said, the term spread-recession link is a historical correlation, and indeed the past 7 years have been remarkable.

More By This Author:

Monthly GDP And Coincident Index

Mean And Median Average Hourly Earnings Growth Compared

Arguments About The Output Gap, 2017