The Pandemic Is Encouraging The Deleveraging Of The Economy

Conventional wisdom believes that the consumer is just itching to spend once the economy opens fully. The lifting of COVID-19 restrictions will unleash a flood of consumer spending that will drive growth, perhaps to rates not seen in decades. Bond yields have moved up smartly, signaling to many to expect a strong recovery with some acceleration in inflation. Financial markets have embraced the ‘reflation‘ trade. But are consumers about to launch a recovery? Looking at the degree of deleveraging that is a major by-product of the pandemic, it is far from certain that a recovery will be in full swing later this year.

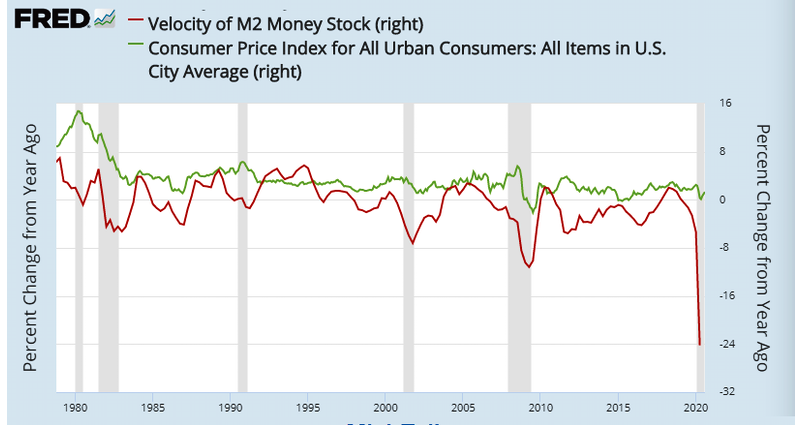

Declining velocity of money. By all measures, today’s expansion of the monetary base should result in inflation well in excess of the Fed’s target of 2%. However, the collapse in velocity has fully offset the potential impact of money supply growth. The velocity of money ----ratio of nominal GDP to the money supply----- is used to gauge consumers’ willingness to spend money. When there are more transactions being made throughout the economy, velocity increases, and the economy is likely to expand. Yet, today the opposite is true as velocity continues to decline. Velocity has cratered to such an extend as to negate any inflationary impacts of the surge in money supply growth (Figure 1).

(Click on image to enlarge)

Figure 1 Velocity of M2 and the CPI

Rising Savings Rate. We hear constant antidotes that consumers have no opportunity to spend------no travel, limited restaurant service, no in-person entertainment, sports, and so on. As a result, personal savings reached historic high levels in the depths of the lockdowns. Since mid-2020, the US personal savings rate has dropped, although it continues to remain elevated, at approximately 12%. But it is conceivable that the pandemic has and will continue to alter consumer savings patterns. Any return to the pre-COVID savings rate of 6-7% is not likely even when the economy fully opens. Relatively high savings rates have demonstrated their importance at times of financial stress, a lesson not easily forgotten.

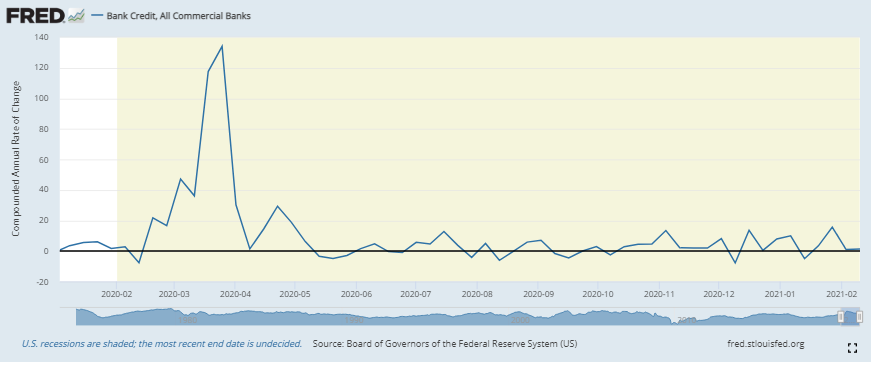

Contraction in bank credit. After an initial spurt in emergency lending in the spring of 2020, the commercial banks entered into a period of hibernation. Commercial bank credit for both consumers and business barely expanded since April 2020 (Figure 2). Given that deposits are way up, the decline in the deposit-to-loan rate signifies that the banks are reluctant lenders (Figure 2).

Figure 2 Growth of Bank of Credit

So, the business news is still beating the drum of expected inflation. However, inflation does not arise in a world undergoing considerable deleveraging. Rising savings rates, slumping bank credit, and collapsing velocity are just the anthesis of what one would expect in an inflationary environment. Finally, there has been no change in Fed policy regarding the funds rate or quantitative easing---both are well-entrenched. Today’s testimony by Chairman Powell made it crystal clear that “the economy is a long way from our employment and inflation goals”.

interesting point about the collapse in the velocity of M

Very few talk about the collapse of velocity. Yet it is so pronounced as to completely offset anything on the monetary base.