Seeing Through The Fog Of Inflation

Image Source: Pexels

The biggest risk in an inflationary environment is not the loss of the value of money but the loss of the information value of money. After all, after some delay, there is an adjustment to values to reflect the inflation that has occurred. Wages rise, prices adjust, interest rates adjust, markets adjust. If all these adjustments were instantaneous, then inflation would have no effect. The nominal values would be only nominal, the actual underlying values would be unchanged and everybody could go about their business as if nothing had happened.

Unfortunately, inflation doesn’t work that way. Money conveys information: “What is X worth in some constant measurement system?” By baselining value, it provides the informational basis for everything else: labor, goods, real estate, markets and services. When that information flow is disrupted because the ‘constant’ measurement system is suddenly and unpredictably changing, then delays in information lead to tremendous economic disruption. It is hard to value anything when there is no stable measurement of value. This is why you can often see drops in nominal market values even in inflationary environments. In theory, a company is providing a steady source of revenues and income that ought to be reflected in increasing nominal income as the currency deflates. In reality, the company has to contend with tremendous uncertainty in determining and allocating value. This can kill short-term value even as long-term values shoot up (nominally) as the relative loss in the currency’s value is baked in. Mortgages are a wonderful example. High-interest rates – fixed for extended periods – drive down prices in the short-term. At the same time, rising wages and other costs raise prices long-term. Long term prices rise dramatically (again, nominally). Compare prices in 1970 and 1990. Nominal values quadrupled; inflation-adjusted prices didn’t change. In the short term, though, you’re paying more for that information uncertainty and it can drive down prices (although it certainly hasn’t yet).

The question that has to be asked in this environment is: what is a good counter-inflationary investment? I’ve long supported the idea of a truly stable currency that could be created by an investment bank overnight. If you know anybody who could implement it, introduce me 😊

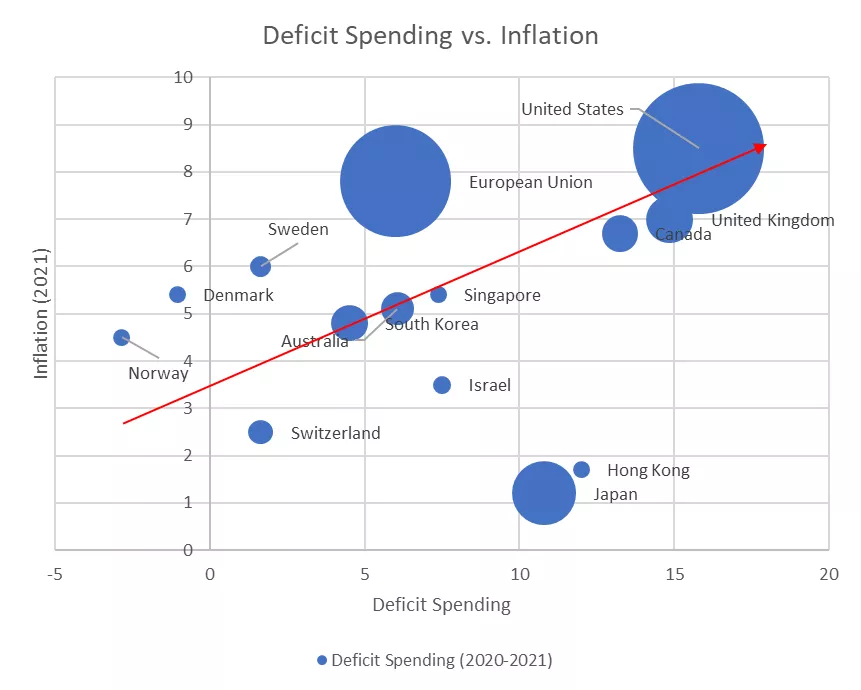

But short of that innovation – which would only retain value, not return it – what can you do? Part of this depends on the source of the inflation. If it is due to the printing of money or government debt, you can seek currencies where governments didn’t overspend. If it is due to systemic factors (more cash than productivity for other reasons) then your response may be different depending on the nature of the problems. The latest data I could find (shown below) shows a mix of factors. Inflation seems to rise with deficit spending, but it is certainly not zero even as deficits drop. Interestingly, an earlier version of this graph showed a much clearer correlation between deficits and inflation. This suggests that expectation might be one of the ‘other forces’ driving up prices even in places without the same levels of money printing. Life in these places is indeed getting more expensive, and not just nominally so. Money is scarce, but there is inflation nonetheless.

.

.

Given the uncertainties, where do you go? You can’t really identify the causes, so you want businesses that are least affected by information delays. This means that on both the buy and sell sides they have very rapid price adjustments. The real focus has to be on sales. You can buy things with delays and set prices and maybe get them a bit wrong – but if your sales price is constantly updating you’ll suffer fewer effects than others. Of course, it would help if your customer base is also somewhat immune, but miracles are limited. All of this points to the following characteristics:

- Rapidly updating sales pricing

- Short lead times and rapidly updating costs (so uncertainty isn’t being priced into what they buy)

- Track record of growth through economic downturns

There is one more critical, but rare, attribute.

- If the business contains a store of value independent of the currency then you have another inflation escape.

There are a few industries that would seem to fit. Online advertising has instant price changes, almost meaningless costs and consistent growth. It also has these characteristics already baked into stock prices. Another industry stands out: airlines.

Consider:

- Sales prices are updating more than once a second.

- While aircraft purchases are long-term, they are very long term. So, deliveries at relatively old prices will continue to be made years from now. They don’t need to buy new aircraft now.

- They have a track record of growing through economic downturns (albeit a bit more slowly)

- And they have frequent flyer programs, which are a self-contained currency.

The problem with this industry is that there is tremendous competition, at least outside the U.S. This drives prices and costs into near parity and results in a stable, but not very good, business. The ideal is a business that piggybacks on one of these industries (thus escaping the either high valuations or low returns) while retaining as many of the anti-inflationary characteristics as possible. This rules out OEMs of major systems (either computers or aircraft), whose prices update quite slowly and might find themselves in very competitive businesses. My lack of market knowledge in IT limits my ability to identify suitable companies there. But I know of (and work for) a great example in the aerospace field.

I’m sure ours is not the only inflation escape there is. In searching for safe haven in the inflationary storm, I’d focus on the informational disruptions caused by inflation. The problem isn’t the devaluation of money – the problem is the inability to project what money will be worth. Businesses that can work around this exist and they are worth your attention.

Disclaimer: Articles I write for TalkMarkets represent my own personal opinion and should not be taken as professional investment advice. I am not a registered financial adviser. Due diligence and/or ...

more

Just saw the news,. What the heck is going on in Israel now? Sounds like a lot of chaos.

Good read, thanks.