Markets Rally As Fed Signals Cuts Ahead, Transitory Tariff Impact

Investors are pounding the buy button following yesterday’s Fed decision, which included an unchanged quarterly forecast of two rate reductions this year. And while the updated dots featured upward adjustments to inflation and unemployment as well as weaker growth, Chair Powell reassured market participants by grading the economy as solid and opined that tariff impacts are likely to offer just a transitory inflation bump. He acknowledged, however, that stronger price pressures in the present will delay progress in achieving the central bank’s 2% objective but seemed to shrug off the potential for trade friction to contribute meaningfully to longer-term cost forces. Meanwhile, measures to slow the pace of balance sheet run-off to only $5 billion per month from $25 billion are also contributing to Treasurys rallying as it removes pressure from fiscal bond issuance. Furthermore, today’s economic calendar validated the committee’s confidence, presenting subdued jobless claims, a recovery in existing home sales and an upside beat on the Philly Fed’s manufacturing gauge.

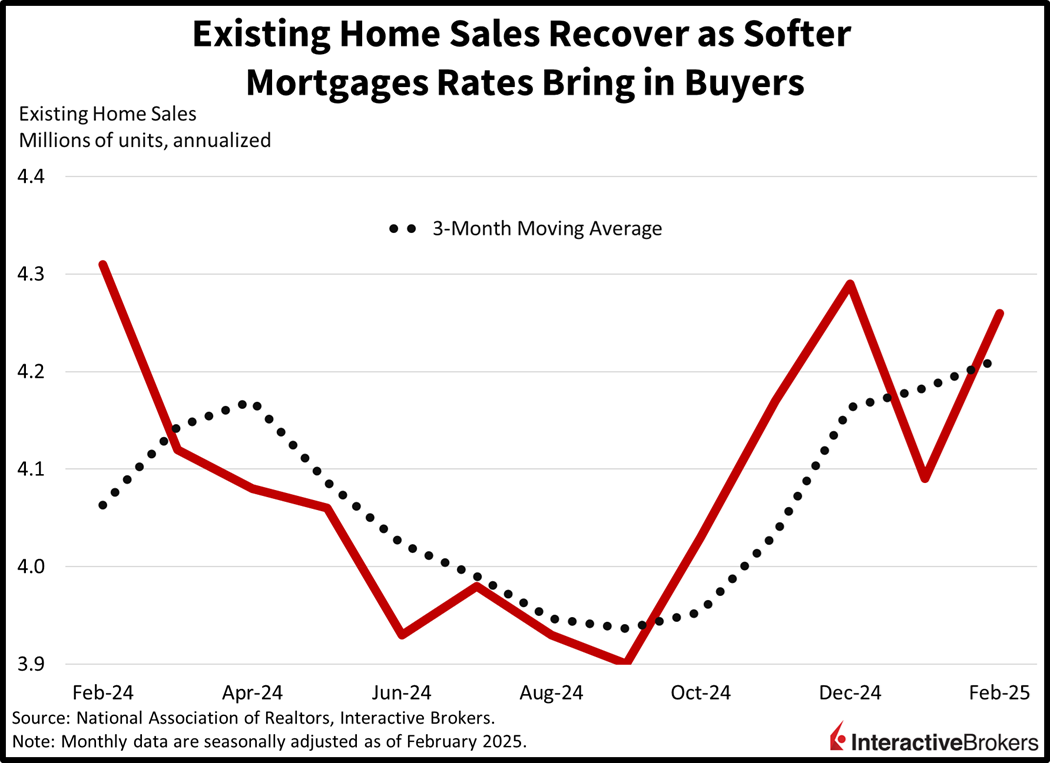

Mortgage Relief Pumps Up Home Sales

Existing home sales recovered last month as mortgage rate relief and greater supply drove stronger closing volumes. Transactions grew 4.2% month over month (m/m) to 4.26 million seasonally adjusted annualized units (SAAU), exceeding the 3.95 million consensus estimate and the 4.09 million from January. But there were bifurcated performances across property types and regions, with the single-family component rising 5.7% m/m but the condominium and cooperative segment declining 9.8%. Additionally, the West and South supported results, sporting gains of 13.3% and 4.4% m/m, but the Northeast saw a 2% drop while the Midwest was unchanged. Inventories rose 5.1% m/m and 17% year over year (y/y) to 1.24 million units as the median price ascended to $398,400, a 3.8% y/y increase. Overall, though, the tempo of transactions is still down 1.2% y/y.

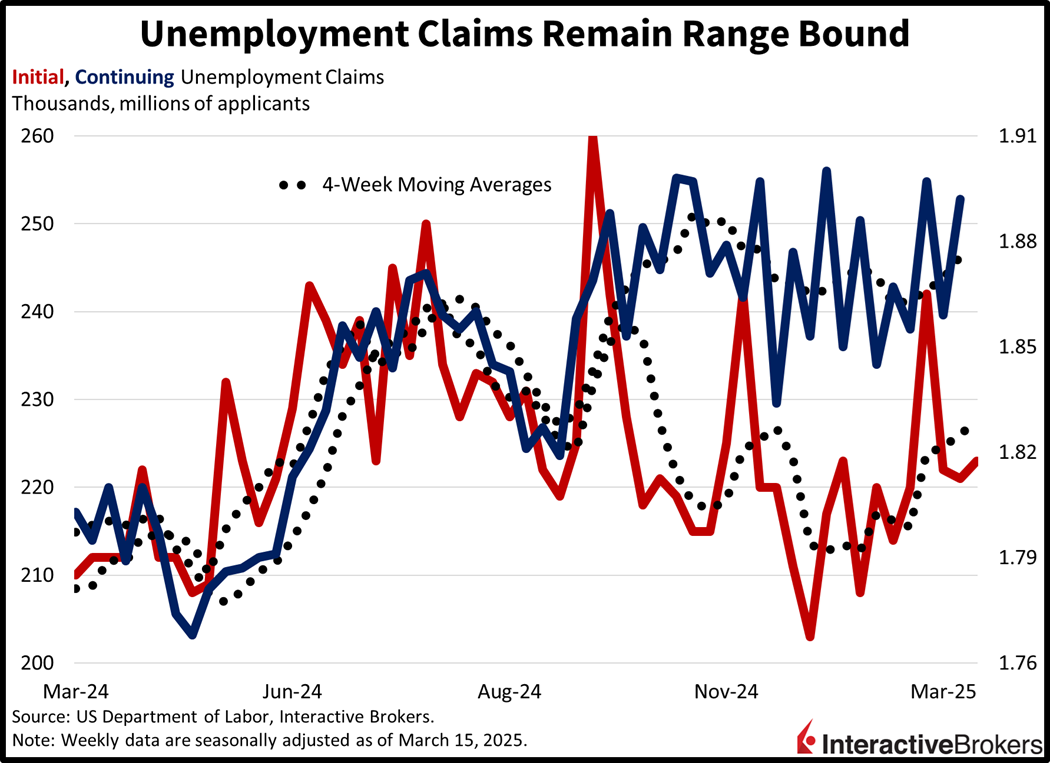

Unemployment Filings Remain Tempered

Turning to the labor market, trips to the unemployment office increased slightly in the last two weeks and are trending modestly higher. Initial jobless claims climbed to 223,000 for the week ended March 15, below the 224,000 projection but beyond the 221,000 from the prior seven-day period. Continuing filings rose to 1.892 million for the week ended March 8, above the 1.890 million median estimate and the 1.859 million from the previous week. Meanwhile, four-week moving averages also ticked north on both fronts from 226,250 and 1.870 million to 227,000 and 1.876 million.

(Click on image to enlarge)

Philadelphia Manufacturing Slows

Manufacturing conditions have been decelerating slightly in the Philadelphia region this month, according to the Philly Fed’s gauge of factory momentum. The headline result of 12.5 exceeded estimates of 8.5 but came in softer than February’s 18.1. Across components, general activity, new orders and shipments decelerated but remained in expansion territory. Employment jumped to its highest level since October 2022 while cost pressures also climbed. Uncertainty weighed on expectations for future growth, however.

Markets Embrace Fed Projections

Markets are advancing across the board as investors scoop up stocks, fixed-income instruments, and greenback exposure as well as lumber and crude oil commodity futures. All major domestic equity benchmarks are higher with the Dow Jones Industrial, S&P 500, Nasdaq 100 and Russell 2000 indices gaining 0.5%, 0.3%, 0.2% and 0.2%. Sectoral breadth is split, however, with communication services, financials and consumer discretionary leading to the upside with increases of 0.7%, 0.5% and 0.3% but consumer staples, industrials and technology are travelling south; they are lower by 0.3%, 0.1% and 0.1%. Treasurys are catching bids as rate cuts and a meaningful reduction in quantitative tightening efforts drive interest. The 2- and 10-year maturities are changing hands at 3.96% and 4.22%, 2 and 3 basis points (bps) lighter on the session. The dollar is up on stronger expectations of US relative outperformance; its index is ascending 47 bps as the greenback appreciates against all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie tender. Commodities are trading in mixed fashion as crude oil and lumber are up 1.9% and 1.2%, while silver, copper and gold lose 1%, 0.4% and 0.3% on the session. Lumber is experiencing momentum on a better-than-expected real estate report, softer borrowing cost prospects and potential supply limitations on the back of trade tensions between Ottawa and Washington.

Powell Remains Confident

Fed Chair Powell reminded yesterday’s listeners that the central bank is focused on hard economic data rather than soft statistics. Indeed, figures derived from spreadsheets are indeed more valuable than details gathered from survey respondents, which can be increasingly subjective. But we have seen deterioration in both, considering consumption momentum has been weak to start the year, as detailed in January’s Personal Income and Outlays report as well as the two retail sales prints that we’ve received so far in 2025. Furthermore, the Atlanta Fed’s GDP gauge is much more heavily skewed to harder publications and it’s been pointing to a first-quarter negative for about a month. But since we have yet to see a material turn in the labor market, Fed Chair Powell communicated confidence in the economy while acknowledging the considerable uncertainty on the horizon. In conclusion, it’s safe to say that the unknown impacts of significant trade restructurings and government spending reductions are confounding policymakers, executives and investors alike.

International Roundup

Bank of England Keeps Key Interest Rate

Citing global trade uncertainties and a weak domestic economy, the Bank of England (BoE) decided this morning to hold its key interest rate steady at 4.5%. While eight committee members supported the decision, one policymaker opposed the measure, preferring a 25-bp reduction. The BoE stated that trade, geopolitical concerns and market volatility have intensified recently. Last month, the bank cut its 2025 GDP growth forecast from 1.50% to 0.75%.

Aussie Job Losses Propel Rate Cut Bets

In a shocking surprise, the Aussie economy lost 52,800 jobs last month, well below the consensus estimate calling for a 30,800 gain and January’s 30,500 increase. The result was partially driven by the labor participation rate falling from 67.2% to 66.8% as folks voluntarily exited the labor market. A spike in resignations resulted, in part, from easing cost pressures. The unemployment rate, at 4.1%, was unchanged and matched the consensus forecast.

Hong Kong CPI Eases

The Hong Kong Consumer Price Index climbed 1.4% y/y in February, easing from 2% in the preceding period and falling below the estimate of 1.8%. On a m/m basis, the benchmark fell 0.1% after climbing 0.4% in February.

More By This Author:

Homebuilder Sentiment Plunges Despite Lighter Mortgage RatesFOMO > Facts?

Beware The Ides Of March

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more