Business And Households Amass Cash To Withstand The Pandemic

In the 1930s Keynes introduced the notion that one of the most important components of the demand for money was the need to hold cash balances for contingency purposes, also known as liquidity preference. Keynes introduced the concept that uncertainty is one of the prime reasons for holding cash. Excess preference for liquidity was one of the underlying reasons why he argued that economies failed to achieve full employment. At times like this, with a resurgence of COVID-19, liquidity can be prized above all else. Starting in the second quarter of 2020, incomes started to drop like a stone, and then emergency government transfer payments went into action and mitigated much of the fall in personal and business income. Nonetheless, consumers held back purchases of services and, to a lesser extent, of goods. While economies were simply whipsawed between falling incomes and government support programs, the savings rate soared.

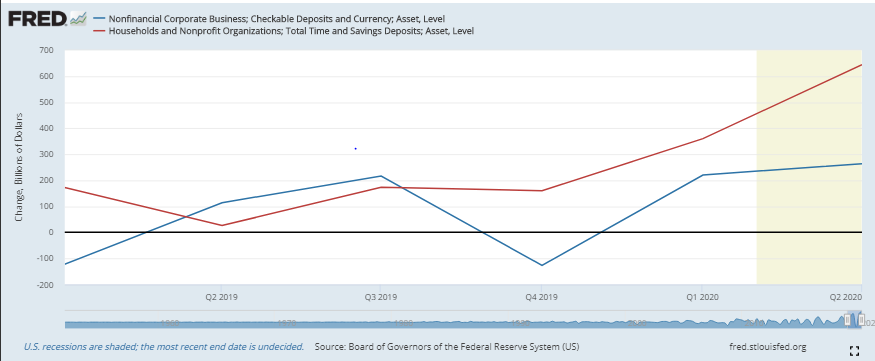

In Q2 the US savings rate ballooned to 33% and in Canada to 28%, compared to the historical average rate of around 4%. In Q3, the savings rate has fallen back to approximately 14% in each country. Current indications are that the rate will remain at that level for the balance of the year while consumers remain cautious. Evidently, consumers are paying down some credit cards and other consumer loans ( foregoing consumption). Interestingly, it is the rise in cash deposited in commercial banks that can account for much of the jump in the savings rate.

A recent CIBC report on Canada revealed that households’ cash deposited in chequing and savings accounts in Canada rose by 12% y/y. The CIBC estimates that this excess cash is by far the largest on record and is equivalent to 4% of consumer spending. Considering the paltry rate of interest offered by the banks, this growth is even more dramatic, especially since most of the deposit growth is in the form of non-interest- bearing chequing accounts. The CIBC economists also identified that cash was king for Canadian businesses, which are now growing their cash positions by close to 15% y/y.That growth is coming from operating accounts, which are experiencing a 30% y/y pace of growth in Canada.

The US experience is similar as bank deposits actually grew slightly faster than bank assets. It seems that commercial banks do not have as much difficulty in attracting deposits as one would expect in a low-interest environment. Many believed that after the 2008 crisis, that liquidity preferences would result in the gradual disappearance of cash balances. Low-interest rates encourage investors to move away from savings deposits and into higher-yielding asset classes. Precautionary demand, once disdained, now is a major factor in inhibiting economic growth.

Figure 1 US Corporate and Household Bank Deposits

(Click on image to enlarge)

Lest we get too excited by the prospect that consumers will loosen their purse strings soon, much of these cash balance are held for pure precautionary reasons. The pandemic is far from being over; vaccines are still in the early stages of development; new lockdowns are being considered, and workers and business owners are trying to figure out what permanent changes will take hold in a post-COVID-19 world. Uncertainty may well be greater now than earlier in the year when savings were so high.

The CIBC report makes the compelling statement that “keeping cash positions at current levels is hardly optimal and is thus unsustainable”. Nonetheless, we can expect that households and businesses will maintain elevated cash positions this winter, driven by so much uncertainty. The Keynesian precautionary demand for cash is very much alive and well.

Excellent piece Norman. A lot of household spending power, if confidence is resumed.

My guess is that even when the real economy has a bit of momentum, consumer confidence will continue to be dicey since there are so many difficult challenges in the environment to digest -- job security, investment and pensions, etc.

At least here in the USA the confidence in the government has been reduced a bit. My confidence in both the Fed and the outgoing president has been reduced quite a bit.

In fact, my thinking has been that we need another ballot choice for every office, that choice being "No Confidence, None of the above, get a different candidate." That addition would not tend to infringe on any personal rights, and so it may not even require a constitutional change.

Lack of any confidence in the adequacy or integrity of a political group or person can be very frustrating.

Interesting indeed. And it should be obvious to all that with the times being very uncertain, and the imposition of lock-downs being very real, that there is no way an adequate income is certain. Thus the only choice is to have some form of available liquid assets, which so far includes banked savings. Of course the motivation to use the banks is dropping along with the interest rates. And with no cash placed into the banking system the banks will have nothing to work with. That does not bode well for the banks, does it?.

So far the banks have been able to attract deposits. The alternative for safe keeping is short-term government debt which is a near- form of cash.

The longer-term problem is insufficient spending and too much saving which holds back economic growth.