Weekly Waves: EUR/USD, US30 And Bitcoin - Mon., Dec. 19

Our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the US30 weekly chart, and the Bitcoin weekly chart.

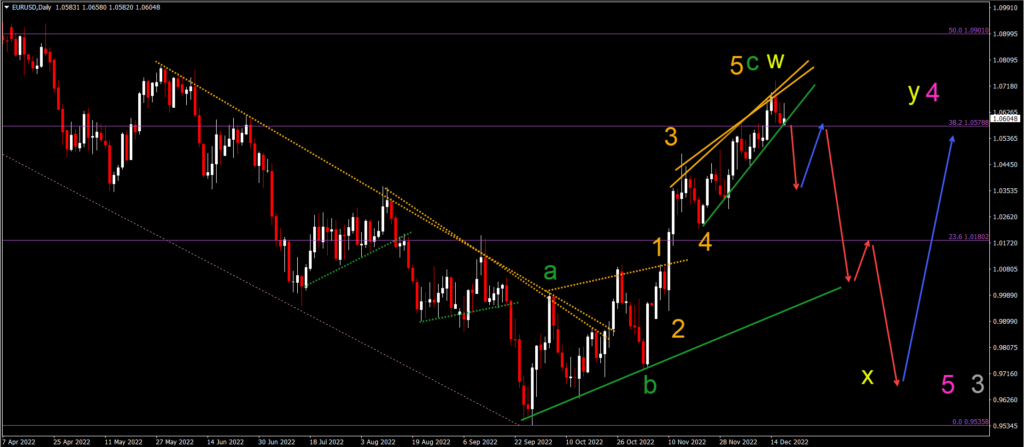

EUR/USD Bearish Candlestick Pattern Completes Bull Run

The EUR/USD is building a rising wedge chart pattern, which could indicate a bearish reversal soon:

- The EUR/USD is building a 5th bullish wave (orange).

- This 5th wave (orange) seems to be completed due to the strong bearish candlestick pattern last week.

- Price action is now testing the support trend line (green) of the rising wedge pattern.

- A breakout (red arrow) below the support line would confirm the end of the wave 5 (orange) of wave C (green) and wave W (yellow).

- A larger WXY (yellow) could develop within a wave 4 (pink) pattern.

(Click on image to enlarge)

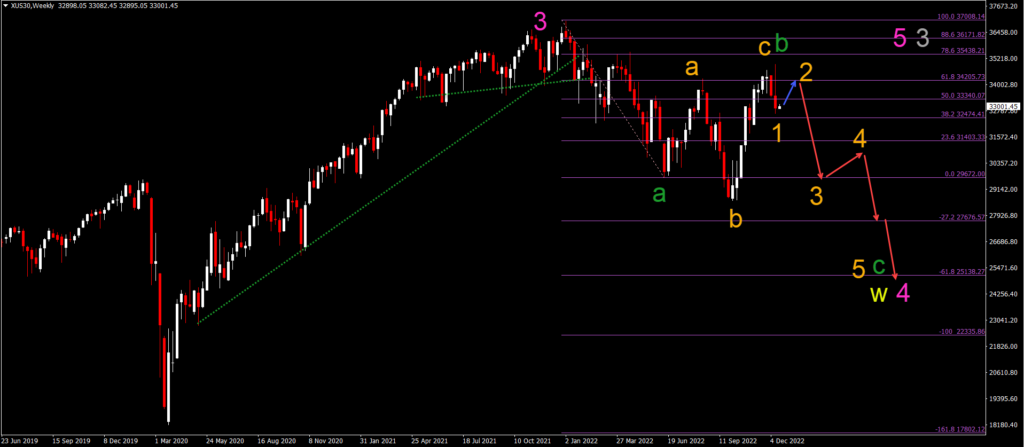

US30 Bearish Reversal Aims at $25k Support

The US30 chart made a strong bullish rally after breaking below the $30k support level. Let’s review the next expected price swings:

- The US30 has reached a key resistance zone due to the deep Fibonacci levels.

- The US30 showed strong bearish candlestick patterns at the resistance zone, which indicates a potential bearish reversal.

- The bullish swing is expected to be a wave C (orange) of a larger ABC (orange) correction in wave B (green).

- Now that the ABC (orange) of wave B (green) is completed, price action should start a downtrend within an impulsive wave C (green) of a larger ABC (green).

- The main bearish target is the -27.2% Fibonacci target at $27,676. The -61.8% Fibonacci target is located around the $25k support.

(Click on image to enlarge)

Bitcoin Rejection Weekly Candle

Bitcoin (BTC/USD) broke below the 78.6% Fibonacci retracement level and has been unable to break above that level ever since:

- The indecisive price action followed by last week’s bearish rejection candlestick pattern leaves the door open for a downtrend continuation.

- The next bearish price swing (red arrow) is aiming at the 88.6% Fibonacci around $11.2k.

- Price action could bounce back up (blue arrow) at this support Fibonacci level.

- A bullish bounce could mark the end of the bearish ABC (yellow) pattern within wave W (pink).

- A bullish bounce could be within a wave X (pink) of a larger WXY (pink) in wave 2 (gray).

(Click on image to enlarge)

More By This Author:

Should You Be Around Tesla Stock After It Has Shed 60% Off Its Value In 2022?

Goldman’s Forecast For The Next 50 Years Ahead

S&P 500 Is Up As the Market Gets Drunk On A “Soft Landing” Scenario

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more