USDJPY: How A Dollar Dynamic 2.2 Can Impact The Yen

A very interesting dynamic that we got in the last 2 months in the market was the advanced dollar dynamic 2.2. During this dynamic, the move in the USDJPY is of greater magnitude than the move in the dollar pairs.

Therefore, then Yen pairs trade sideways to higher (if USDJPY trades higher) or sideways to lower (if USDJPY trades lower).

Since 10.21.22 when we had the secondary peak in the USDX and peak in USDJPY the market has been trading within that dynamic. Let’s first have a look at the USDX since 10.21.22. We can see that it has dropped since that peak to the lowest point of 9.21%.

USDX 10.21.22 Dynamic 2.2

(Click on image to enlarge)

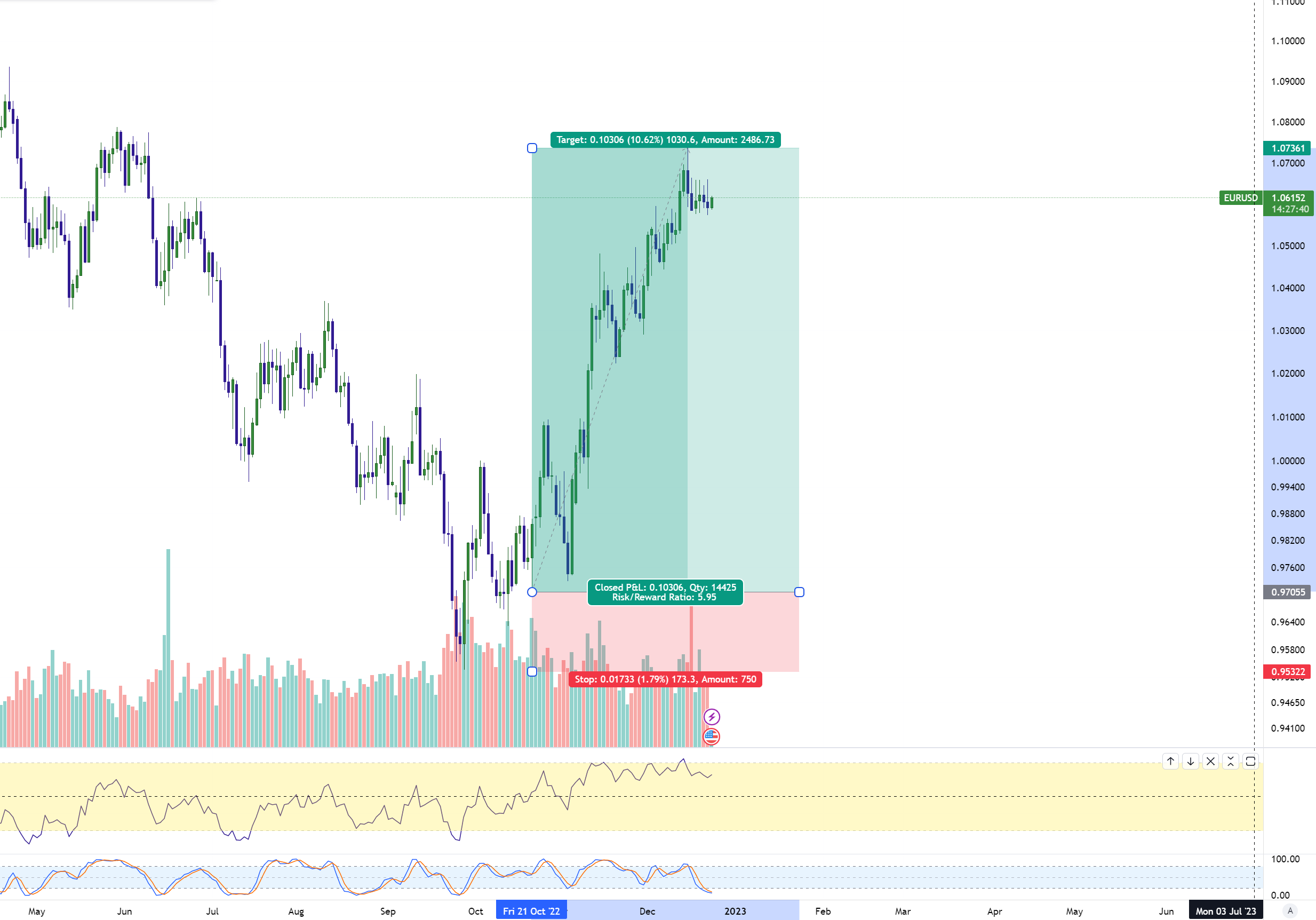

Now let’s have a look at how the main USDX pair EURUSD has moved since 10.21.22. We will see that the move was 10.62% which is comparable to the one of USDX itself.

EURUSD 10.21.22 Dynamic 2.2

(Click on image to enlarge)

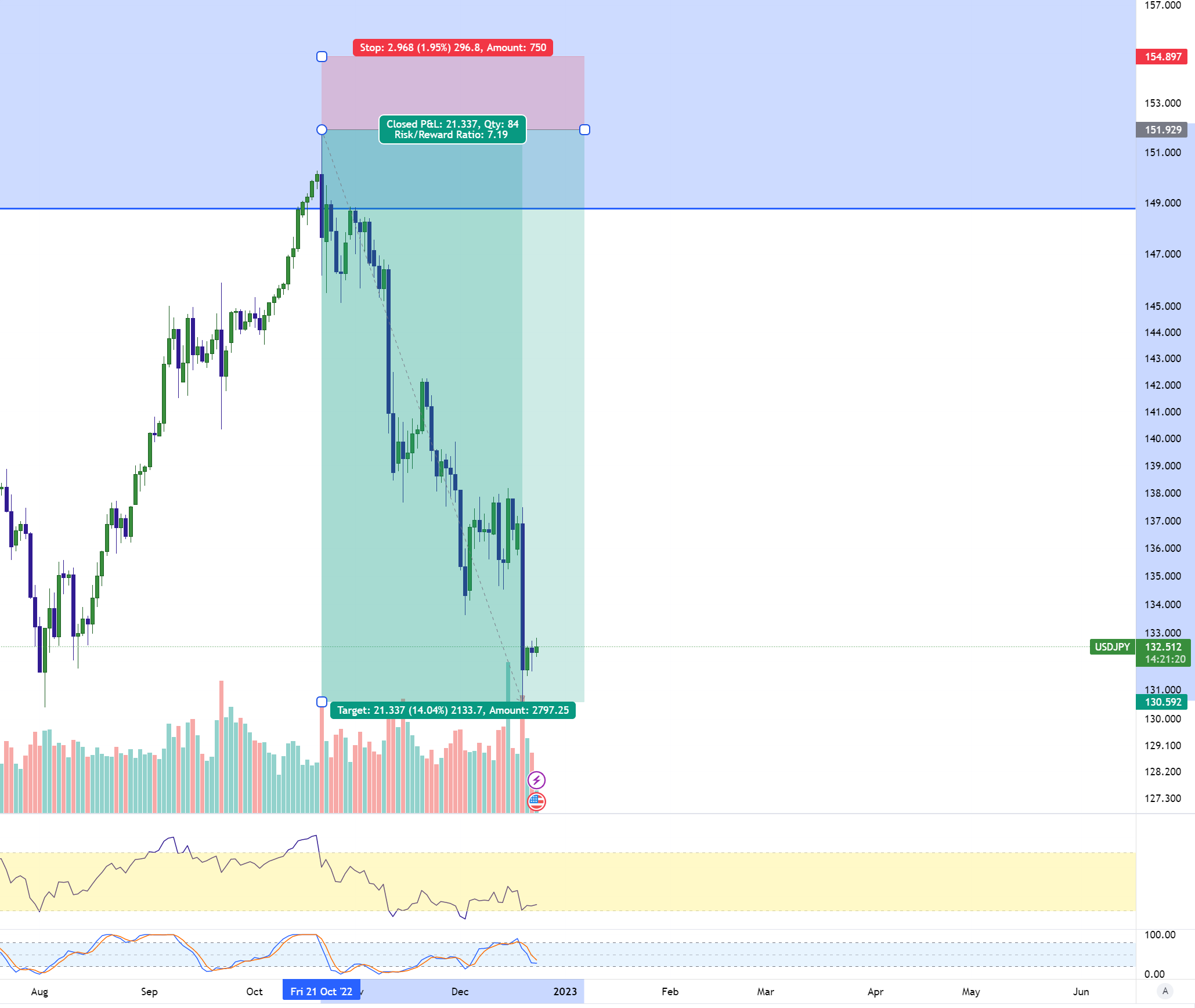

Now let’s see how the USDJPY move was greater than the dollar pairs and the dollar itself. We can see a 14.04% move in this case.

USDJPY 10.21.22 Dynamic 2.2

(Click on image to enlarge)

And lastly, let’s see how a YEN pair behaved during this dynamic. Let’s see AUDJPY which has been sideways to lower since 10.21.22.

AUDJPY 10.21.22 Dynamic 2.2

(Click on image to enlarge)

The very technical market overall and this is one of the things we teach here at Elliott Wave Forecast. We look at the market in many ways and identifying the dynamics will help us pick the best instruments to trade. We do not like to trade choppy and sideways markets.

More By This Author:

VISA Completed A Double Correction And Rally

$XLY Forecasting the Decline and Selling The Rallies at Blue Box

HCA : Should It Be Ready For Next Rally ?

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more