VISA Completed A Double Correction And Rally

Visa Inc. (V) is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards.

Visa is one of the world’s most valuable companies.

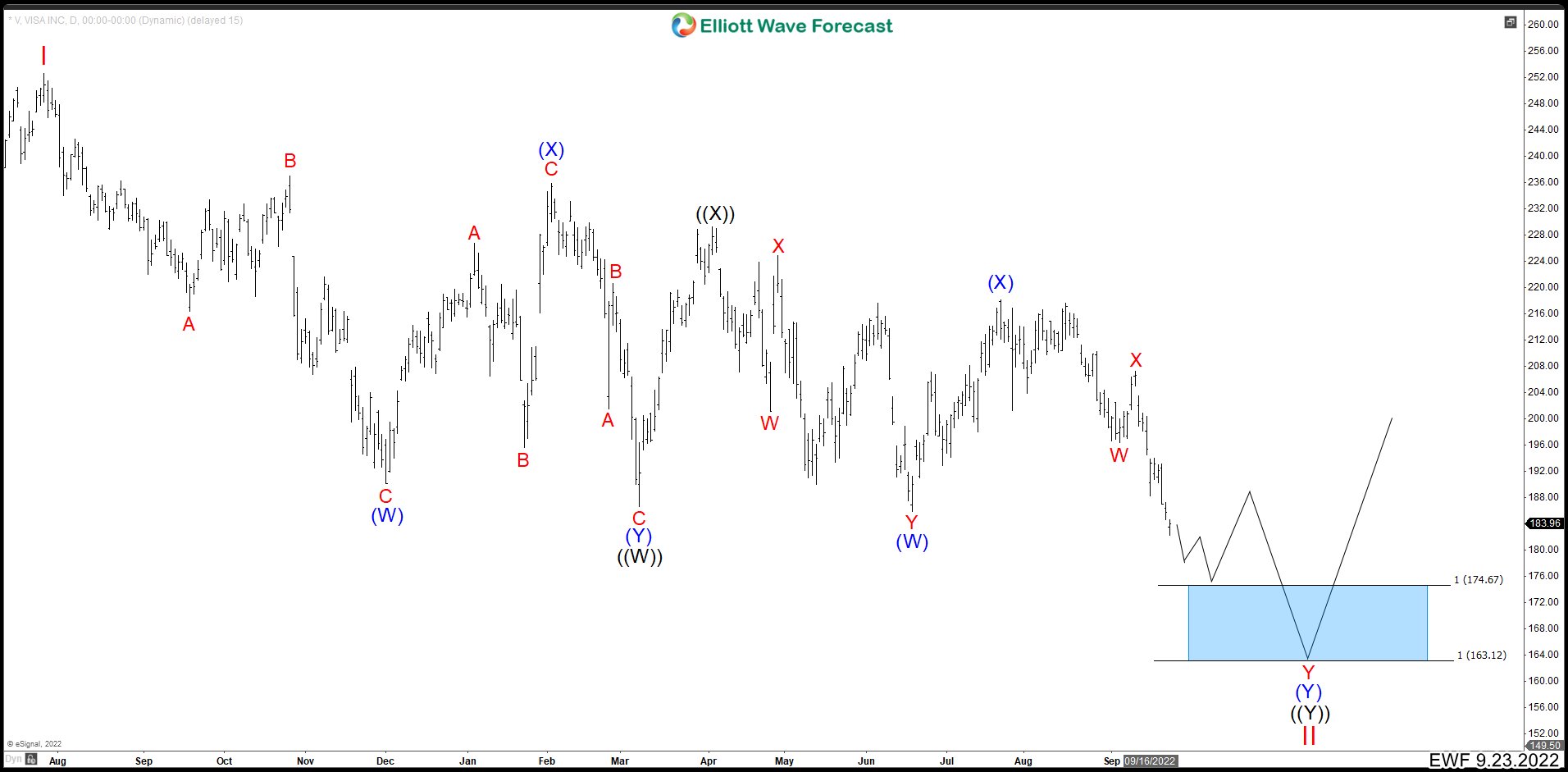

VISA Daily Chart From September 2022

Visa ended an important market cycle in July 2021 that started in March 2020. The rally reached 252.67 which we labeled as wave I, and from there a corrective movement started. The structure broke an important support at 186.63. This breaking told us that we should see more bearish movement until we find a new support.

Using the Elliott Wave Principle, we see that a complex 7-3-7 structure has been formed in V in daily timeframe. This means that the first cycle developed a double correction and we label it as wave ((W)). Then we have the connector ((X)) which corrected the drop from the peak. Lastly, we are building a new double correction to complete wave ((Y)) that it should bounce from the blue box proposed. (If you want to learn more about double correction or Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

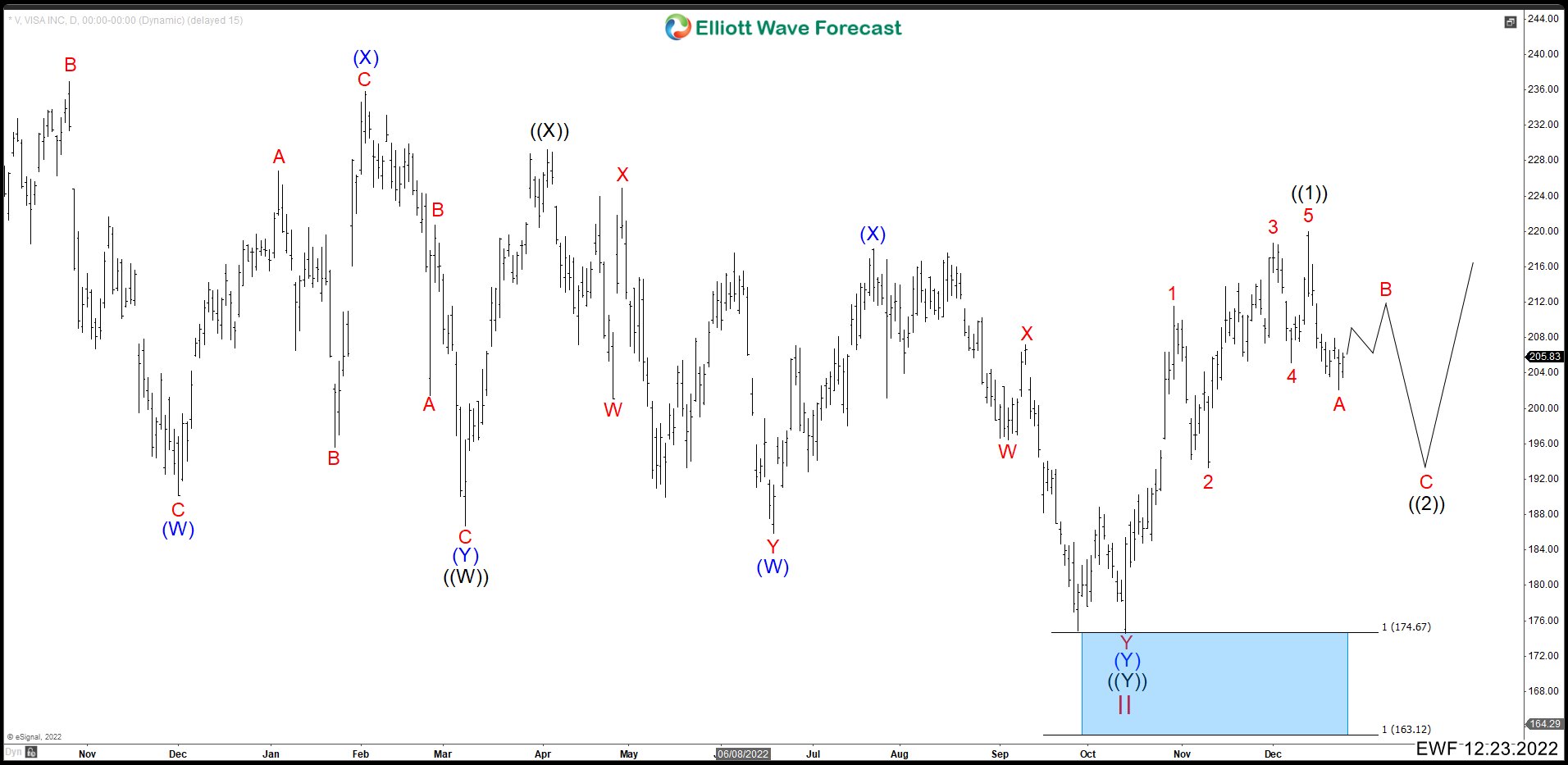

VISA Daily Chart From December 2022

VISA kept dropping and ended wave ((Y)) of II at 174.60 hitting the blue box in October. From there, the stock made an important rally building a leading diagonal. Wave 1 ended at 211.49. Pullback as wave 2 completed at 193.19. Then bounce again finishing wave 3 at 218.75 and wave 4 ended at 205.02 entered in the territory of wave 1. Last push higher to complete a leading diagonal ended wave 5 of ((1)) at 220.04.

Now, we are expecting 3 or 7 waves lower to correct the cycle from 174.60 low as wave ((2)) and then continue the rally again. We are looking for 3 waves lower as the chart. Wave A already ended at 202.04. We should see a bounce as wave B to fail below 220.04 high to look for one more low to complete wave C and wave ((2)) to rally again.

More By This Author:

$XLY Forecasting the Decline and Selling The Rallies at Blue BoxHCA : Should It Be Ready For Next Rally ?

Pan American Silver (PAAS) Bottom Can be In Place

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more