HCA : Should It Be Ready For Next Rally ?

HCA Healthcare, Inc., (HCA) provides health care services company in the United States. The company operates general & acute care hospitals that offers medical & surgical services, including inpatient care, intensive care, cardiac care, diagnostic & emergency services & outpatient services. It is based in Nashville, Tennessee, comes under Healthcare (XLV) sector & trades as “HCA” ticker at NYSE.

HCA ended the biggest correction at $58.38 low in March-2020 since 2011 low. After that, it made a new ATH at $279.02 as impulse sequence wave I. It proposed ended II correction at $164.47 low. While above there, it expect to resume higher in III, which confirms above daily high to avoid any double correction in II.

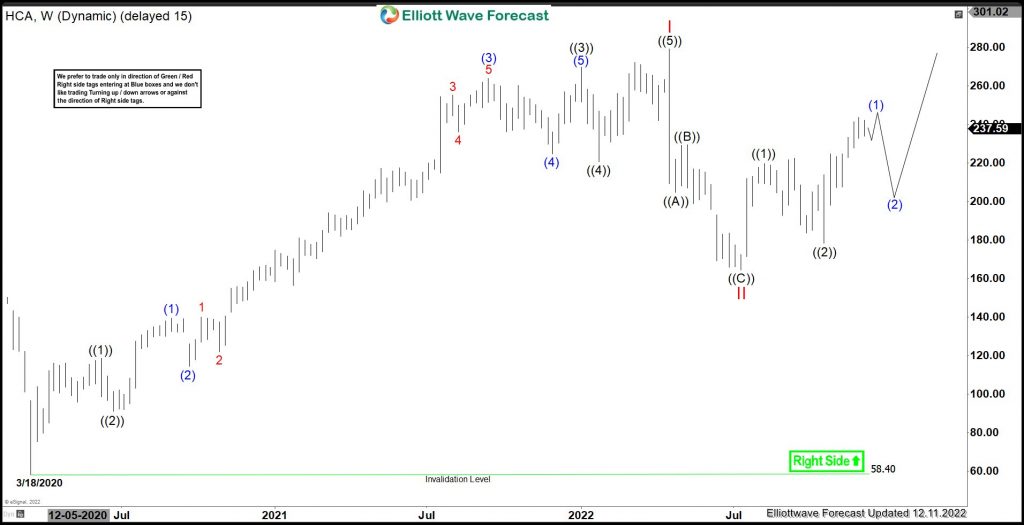

HCA – Elliott Wave Latest Weekly chart :

(Click on image to enlarge)

It placed ((1)) at $118.70 high on 6/08/2020 low & ((2)) at $91.21 low on 6/25/2020. ((2)) was corrected slightly above 0.5 Fibonacci retracement against ((1)). Thereafter, it started third wave extension, which ended at $269.75 high on 1/05/2022. Below there, it favored ended ((4)) at $220.50 low as 0.236 Fibonacci retracement of ((3)). Finally, it ended ((5)) at $279.02 high on 4/21/2022 as wave I in the sequence started from March-2020 low.

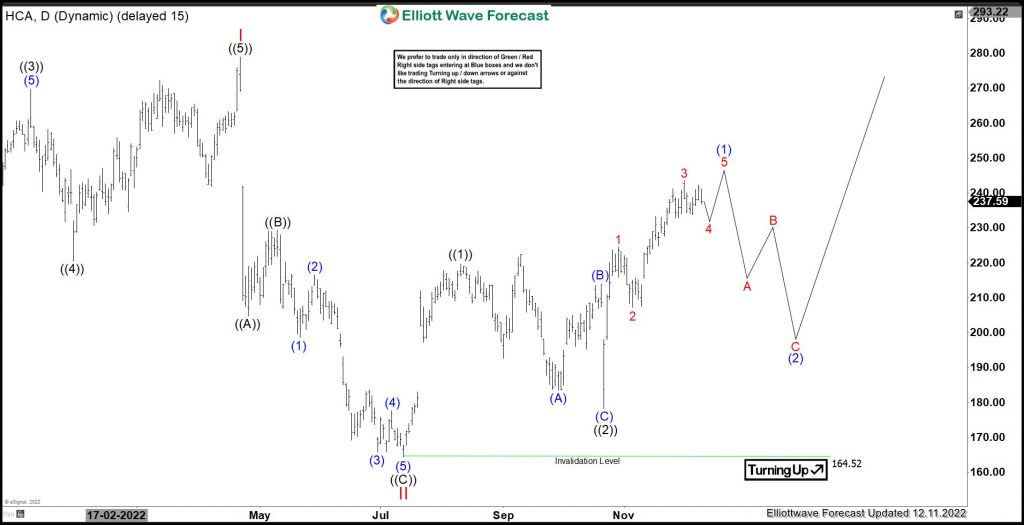

HCA – Elliott Wave Latest Daily chart :

(Click on image to enlarge)

Below $279.02 high, it proposed ended wave II at $164.47 low as zigzag correction. While above there, it either continue higher in III, which confirms when breaks above daily high of I. Alternatively, it can do larger double correction in II, which confirms below $164.47 low. Short term, it placed ((1)) at $219.68 high & ((2)) at $178.32 low. Above there, it expect further upside in ((3)). Currently, it expect a small pullback in wave 4 before final push higher in 5 of (1), followed by a correction in (2). Ideally, it should hold above ((2)) low in wave (2) correction to resume upside later in (3) of ((3)).

More By This Author:

Pan American Silver (PAAS) Bottom Can be In PlaceOil Extending Lower In Wave 5

SPX Is Looking To Finish A Cycle Towards A Blue Box

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more