The Dollar Is Our Currency, But It’s Your Problem

Image Source: Unsplash

Yields on Japanese government bonds have calmed down somewhat since last week’s earthquake. However, there were still a few minor aftershocks on the currency markets. The Japanese Yen remained unusually weak – or rather, the strength of the US Dollar against the Japanese currency was increasingly a thorn in the side of US economic policymakers.

Japan is known to be an exporting country. A weaker Yen makes Japanese products cheaper on the world market and thus acts as a small economic stimulus. For the US, however, this means stronger and cheaper competition for its own products. No wonder, then, that US President Donald Trump would prefer to see a weaker US Dollar. He, too, wants to boost the domestic economy with exports.

Accordingly, the US Treasury Department was called upon to take action. US Treasury Secretary Scott Bessent and the New York Fed simply had to signal to the market that they were prepared to intervene in the currency market. That was all it took: within minutes, the foreign exchange market made a clean 180-degree turn. The Japanese Yen jumped sharply against the US Dollar.

(Click on image to enlarge)

It is by no means a new revelation that President Trump prefers a weaker US Dollar. Back in 1971, then Treasury Secretary John Connally stunned the financial world when he declared that the US Dollar was the currency of the United States, but the problem of the rest of the world. A statement that seems more relevant today than ever.

We asked ChatGPT what variables influence a currency. The answer was as detailed as it was interesting. Basically, ten key factors can be identified:

1. Interest rates & monetary policy (higher interest rates = stronger currency)

2. Inflation & purchasing power (high inflation leads to devaluation)

3. Economic growth & productivity (investments have a positive effect)

4. Trade balance & current account balance (surpluses strengthen the currency)

5. Government debt & fiscal stability

6. Capital flows & financial markets (inflows strengthen the currency)

7. Political stability & geopolitics (uncertainty leads to capital outflows)

8. Confidence & narrative (credibility of institutions)

9. Commodities (rising commodity prices strengthen the currency)

10. Speculation & market positioning (very influential in the short term)

(Click on image to enlarge)

These ten points can be roughly summarized in a simple formula:

Currency = interest rates + confidence + capital flows + productivity minus inflation and political risks.

We are currently observing that an increasing proportion of the financial world is convinced that the US Dollar faces a decidedly bleak future. Accordingly, Trump’s recent statement that he basically does not care about a weaker Dollar was enough to cause the greenback to suffer another bout of weakness. But we remember one of the first lessons of financial market theory: when everyone thinks the same thing, the opposite usually happens.

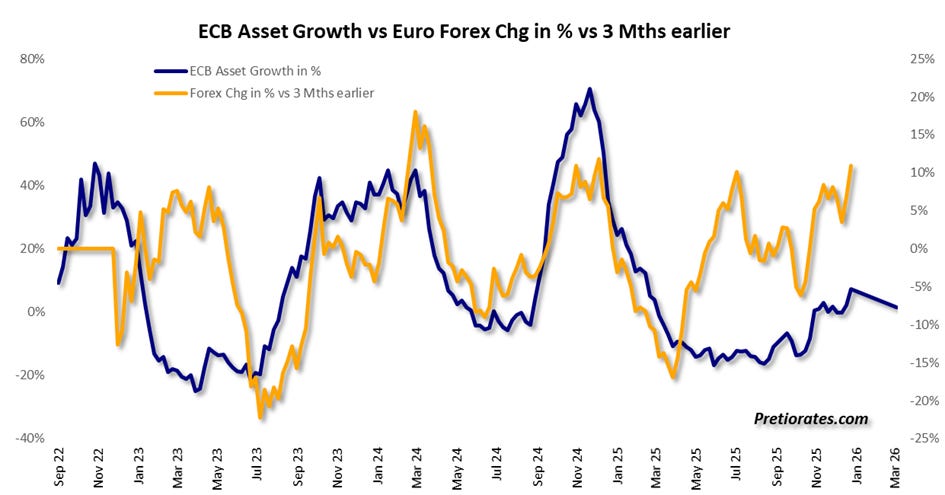

In fact, we have integrated most of the ten currency-related variables mentioned above into our own models. And these models clearly indicate that we should expect a weaker Euro in the coming months.

(Click on image to enlarge)

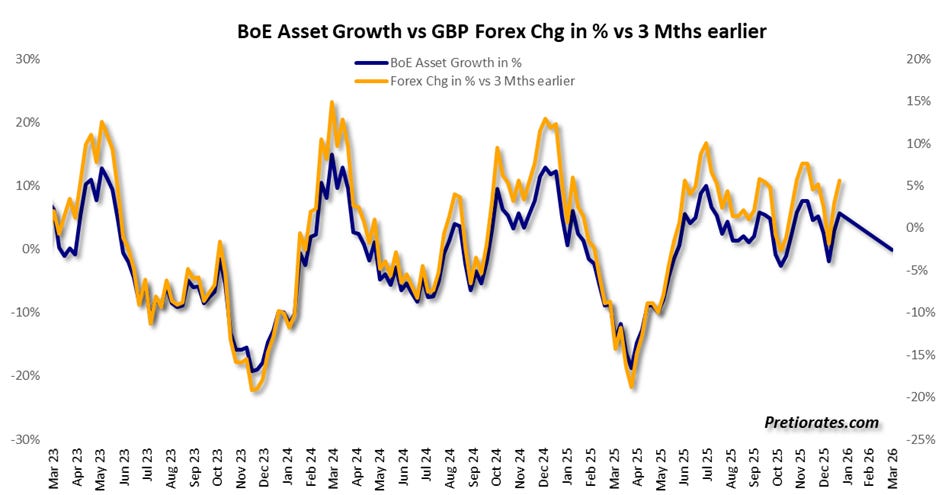

A very similar picture emerges for the British pound. Here, too, there are many indications that the currency is likely to lose value in the coming months. However, a weaker Euro and a weaker pound inevitably mean one thing: a stronger US Dollar.

(Click on image to enlarge)

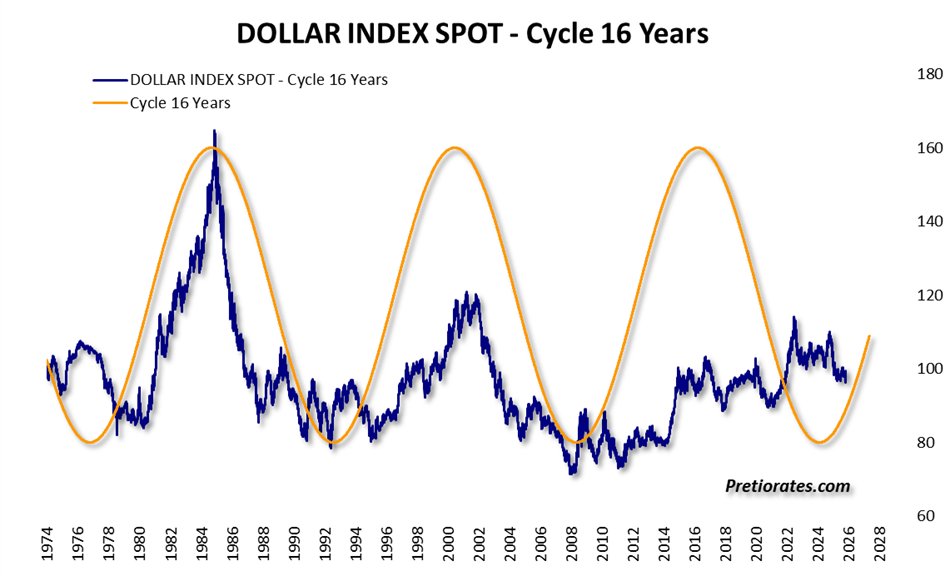

Currencies are also subject to cycles that are influenced by both economic and political developments. Particularly striking is a very long-term cycle of around 16 years, which has been surprisingly reliable in setting the direction in the past. These 16 years correspond exactly to four US presidential cycles. Currently, this cycle would suggest that the US Dollar is likely to strengthen in the coming years.

(Click on image to enlarge)

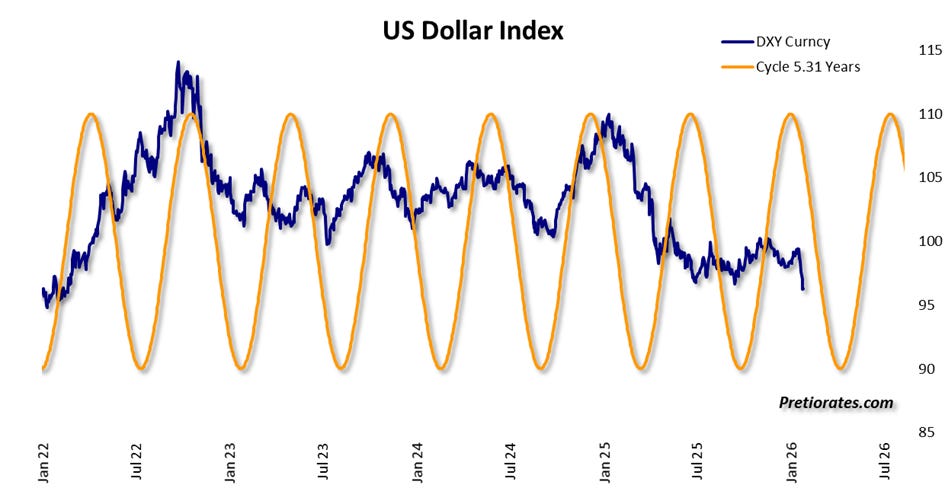

A shorter time horizon of around 5.31 years reveals another cycle – not perfect, but certainly noteworthy. It is still having a negative impact, but this cycle will also turn in the second quarter of 2026 and become a supporting factor for the US Dollar.

(Click on image to enlarge)

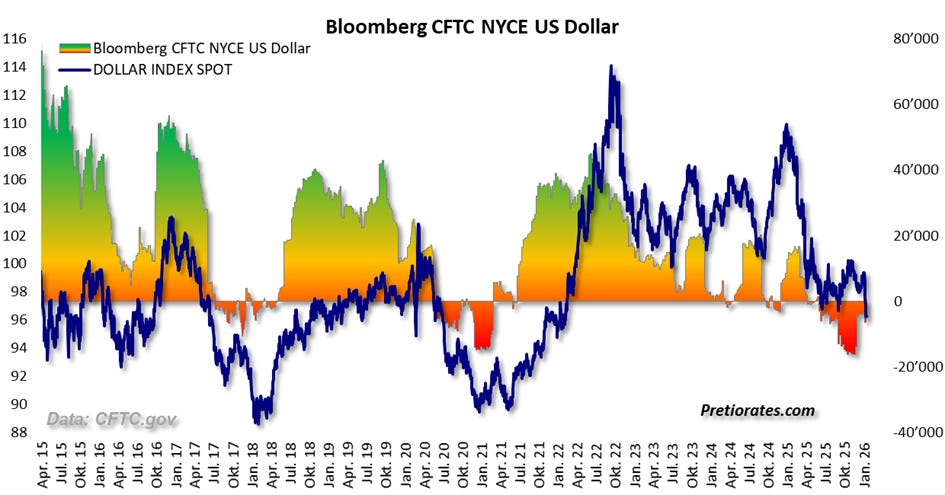

The extremely negative market sentiment toward the US Dollar is also clearly noticeable and visible in the futures market. Professional investors, known as «non-commercials», as recorded by the CFTC, were recently net short. However, a look at history shows that whenever this group was net short, an impressive Dollar rally usually followed in the subsequent quarters.

(Click on image to enlarge)

All these factors lead to the assumption that the current weakness of the US Dollar is in its final phase – in stark contrast to the prevailing market sentiment. In previous issues, we have repeatedly put forward the hypothesis that the Japanese or the European bond markets could come under pressure first. The US has a decisive advantage with the US Dollar, which remains the world’s reserve currency.

For capital seeking to flee Japan and Europe, the US Dollar remains virtually the only alternative on a large scale. However, unsettled capital is still seeking refuge almost exclusively in one of the smaller alternatives: Gold, probably due to the negative sentiment surrounding the Dollar. Another option would be cryptocurrencies. But we will address this idea in one of our next thoughts...

More By This Author:

Is The Japanese Bond Market Now Pulling The Plug?

Silver, Spreads, And Beads Of Sweat

Welcome To 2026, Expect The Unexpected

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more