Silver, Spreads, And Beads Of Sweat

Image Source: Pixabay

Silver has been the undisputed star of the markets in recent days and weeks, reaching another new all-time high. However, it wasn’t just the price that was record-breaking, but also the flood of individual reader inquiries in our mailbox. We are very pleased about this, as it is a clear sign of your trust. However, many of these questions were very similar. Therefore, we kindly request that you post your questions as comments below the article – we promise to answer them. This will make two parties happy: other readers with similar questions – and us. Because the more comments, the better the algorithms, and the higher the website traffic. Our hoped-for reward for this work.

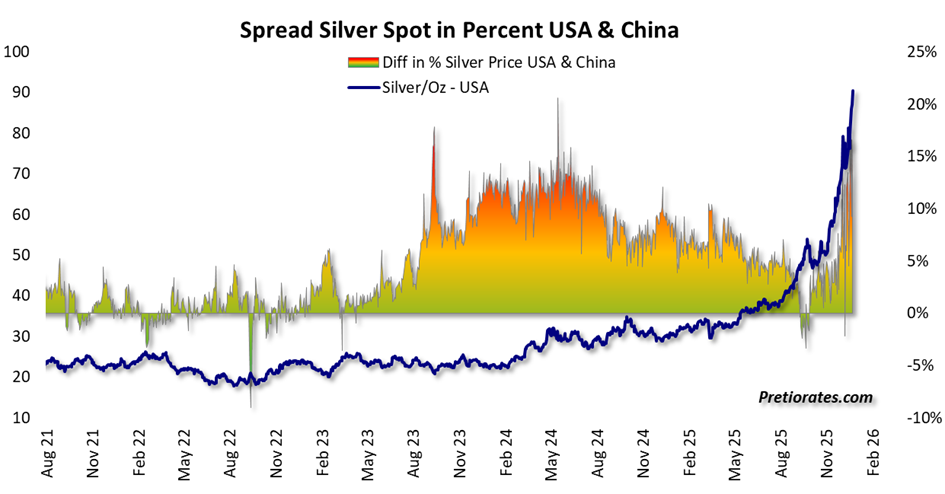

Let’s talk again about the devilishly good silver. On the western stock exchanges, prices temporarily exceeded $92 per ounce today. But that’s just the prelude – the real bombshell came from Shanghai. There, silver was already changing hands at over $103. The premium between East and West thus climbed back above 12% and returned to the levels we saw in the spring and summer of 2024.

(Click on image to enlarge)

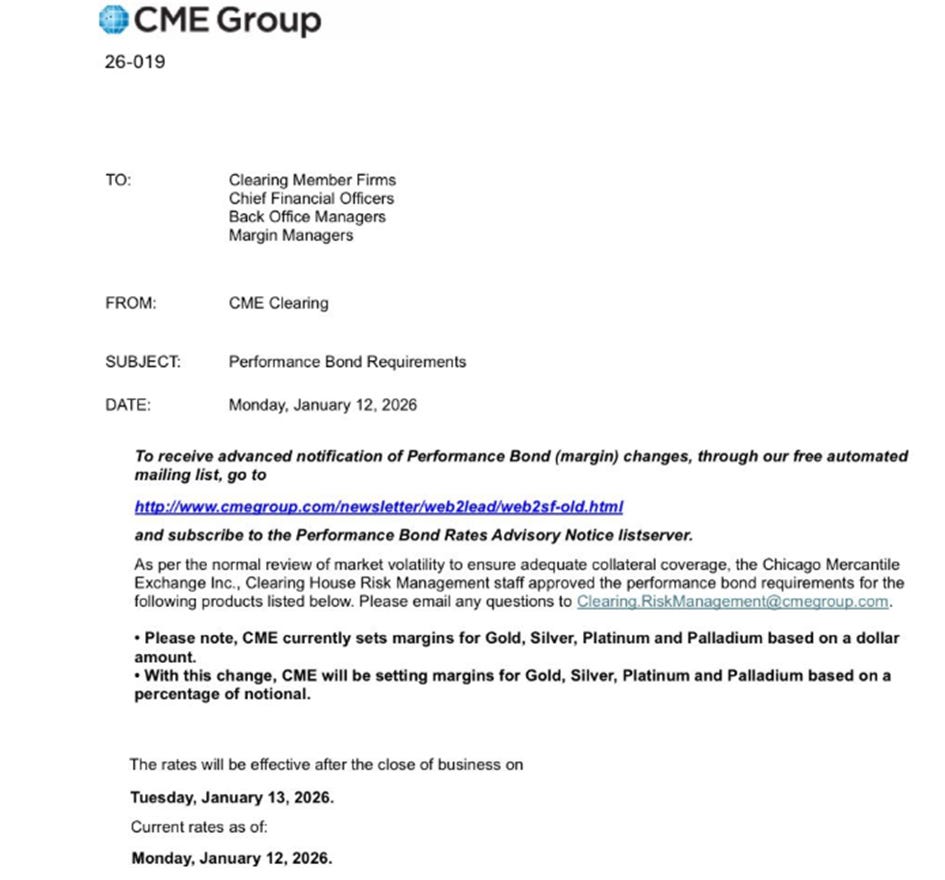

The CME has once again tightened the margin screw – and once again without the desired calming effect. No wonder: the actual action is in the physical market, not in futures. Particularly interesting: in future, margins are to be set as a percentage rather than a fixed amount. We have already addressed this very point in our thoughts on “Silver Delta Hedge”.

(Click on image to enlarge)

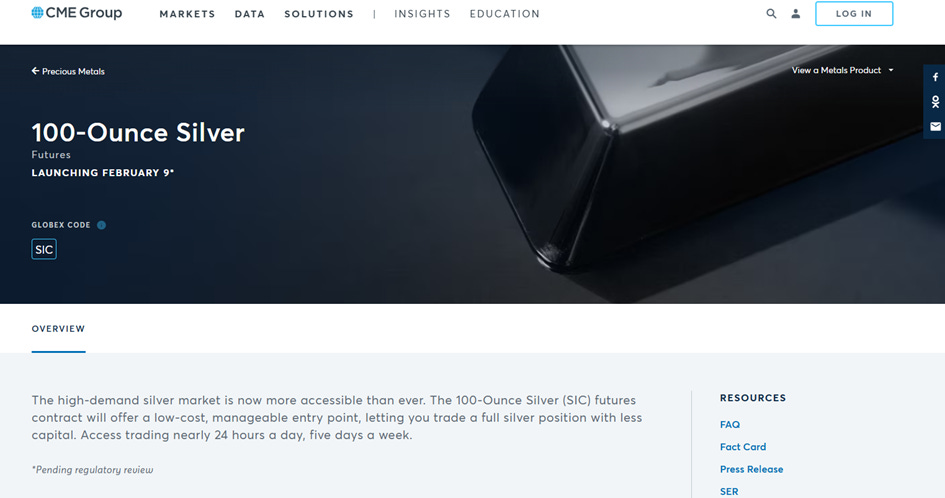

Even more exciting: futures on the CME are traditionally traded in 5,000-ounce contracts. Now the exchange is planning to add mini contracts for 100 ounces – but exclusively with cash settlement, i.e., without physical delivery. For us, this is another clear indication that physical silver is in short supply. The logic behind this seems obvious: demand from smaller investors is to be directed toward paper-based products in order to ease the pressure on the physical market.

(Click on image to enlarge)

For us investors, this raises two key questions:

1. How can there be such large price differences between Shanghai, London, and New York?

2. How much further can the price of silver rise?

The answer to the first question is basically simple: if there is a price difference between two exchanges, it is usually immediately offset – the computer buys cheap and sells dear. Arbitrage is the magic word. However, this requires that the asset in question is the same and can be easily delivered and exchanged. This is precisely where the catch lies: China is subject to strict capital controls, and precious metal trading is monitored by the People’s Bank of China. Timely delivery of the heavy metal to Shanghai is anything but trivial. Accordingly, only a few institutions venture onto this slippery slope.

The second question is, of course, even more pressing. With a price increase of almost 100% since November, silver is one of the absolute frontrunners. However, no one can predict the exact peak, but there are indicators that provide clues.

The price increase is now taking on parabolic proportions. In such phases, the so-called bubble chart proves surprisingly useful. Since the start of the parabola in spring 2025, it has been confirmed several times – including with the latest movement. The bottom line: above the $100 mark, the air is likely to become noticeably thinner.

(Click on image to enlarge)

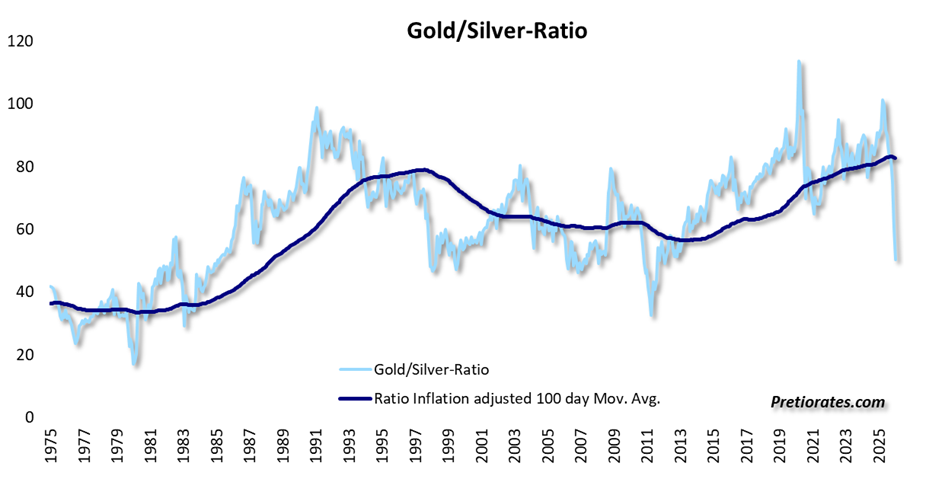

With the rapid rise in silver, the gold/silver ratio has also nearly halved, after standing above 100 less than twelve months ago. At first glance, this sounds like an exaggeration in favor of silver. However, a look at history quickly puts this picture into perspective: In 2011, the ratio fell below 32 at times. With today’s gold price at $4,620, that would correspond to a silver price of around $144.

(Click on image to enlarge)

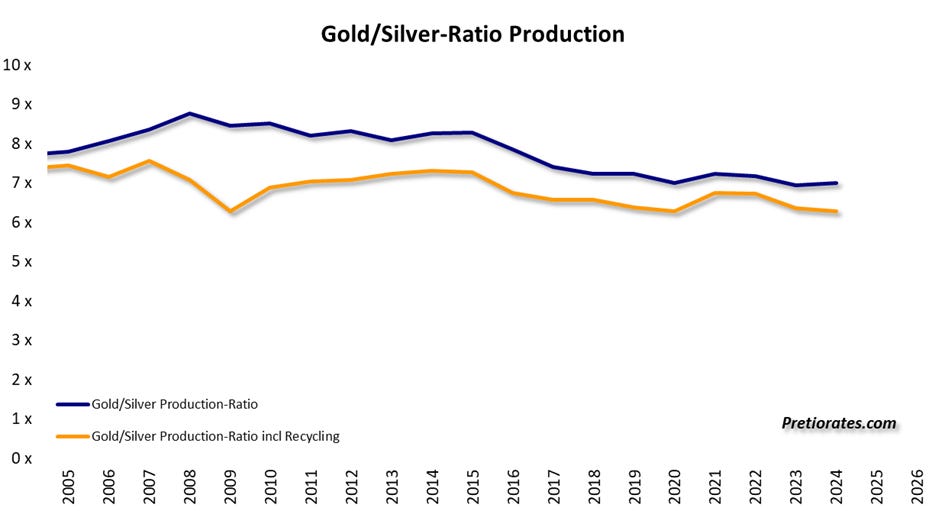

At first glance, the last two charts might scream «classic bubble». We see it differently. For us, this is not a bubble, but a long-overdue revaluation. Geologically, silver is only about 20 times more abundant than gold, but mines produce only about seven times more silver. That is why we have always believed that a ratio above 50 is actually absurd.

(Click on image to enlarge)

For decades, silver was dirt cheap. Unlike gold, however, silver has strong and growing industrial demand, which now accounts for more than 50% of total consumption. This has not only led to a supply deficit over several years, but also to significantly less elastic demand. In fact, it is less elastic than the demand for gold. However, this does not automatically mean that silver must continue to rise indefinitely.

Now that silver has gone from being the Cinderella of metals to a celebrated star, the likelihood that we are approaching a price plateau is also increasing. It is hardly possible to generate much more euphoria. The key now is to closely monitor the signs of this euphoria. If it subsides, a significant correction will already have occurred.

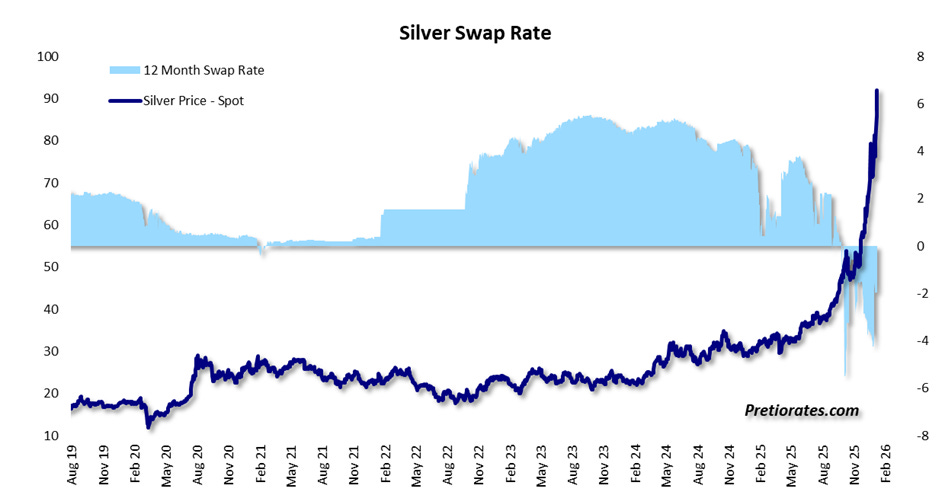

The premium in Shanghai remains particularly important: as long as silver is trading at around 10% more there, demand in the West is likely to remain strong. Lease and swap rates are equally relevant. If these remain tight, this confirms that the physical market is still under pressure. If the two rates ease, at least a temporary peak is approaching. Most recently, the lease rate fell to 3%, while the swap rate rose to -1.6%. Hmm...

(Click on image to enlarge)

This tells us that we are close to a possible peak. Whether this is an interim peak, a short-term peak, or even a longer-term high, no one knows. What we do know, however, is that only by selling part of our holdings can we be sure of bringing home the bacon. If silver continues to rise, we will sell another portion at higher prices. Whether this is due to supply bottlenecks or the covering of mysterious short positions is ultimately secondary. Anyone who relies solely on these rumors of open short positions from bullion banks, which have been haunting trading floors for 30 years, runs the risk of forgetting one thing: to secure some of the great silver profits in good time.

More By This Author:

Welcome To 2026, Expect The UnexpectedSilver Delta Hedge

Noise, Myths And Mechanics In The Silver Market

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more