Forex: Overshoots And Undershoots

Image Source: Unsplash

I can’t seem to tear myself away from this market, even when I’m out on the golf course! But fear not—I promise I’ll leave you in peace for the rest of the month during weekdays!

The yen strutted its stuff during the Asian trading session, causing USD/JPY to plummet to an intra-day low of 148.51. Yesterday, the yen’s sprint gained momentum thanks to the BoJ’s surprise hawkish update, hinting at a newfound eagerness to hike rates and normalize Japan's monetary stance. Toss in a slightly dovish Fed and a cascade of stop-loss triggers, and you’ve got the yen soaring higher than a kite on a windy day.

While this outcome somewhat aligned with our crystal ball predictions However, even factoring in one or two 0.15% hikes from the BoJ this year and envisioning a three-rate cut nudge from the Fed, the carry differential still heavily tilts in favour of the USD through 2024. This is particularly true when US exceptionalism flexes its muscles through the AI channel, which seems to support the dollar purely on a flow basis.

FX traders appear to be avoiding most currencies except the yen, and a few Asian counterparts are joining the bandwagon. We've often likened this to picking the least grimy shirt from the laundry basket.

Crucially for the yen, yesterday’s policy update bolstered the perception among market players that the BoJ and the government are now cozying up to support the currency. It was confirmed that Japan intervened again to prop up the yen, totalling JPY 5.5 trillion in July.

But the burning question remains: Are we on the brink of a deeper reversal in USD/JPY?

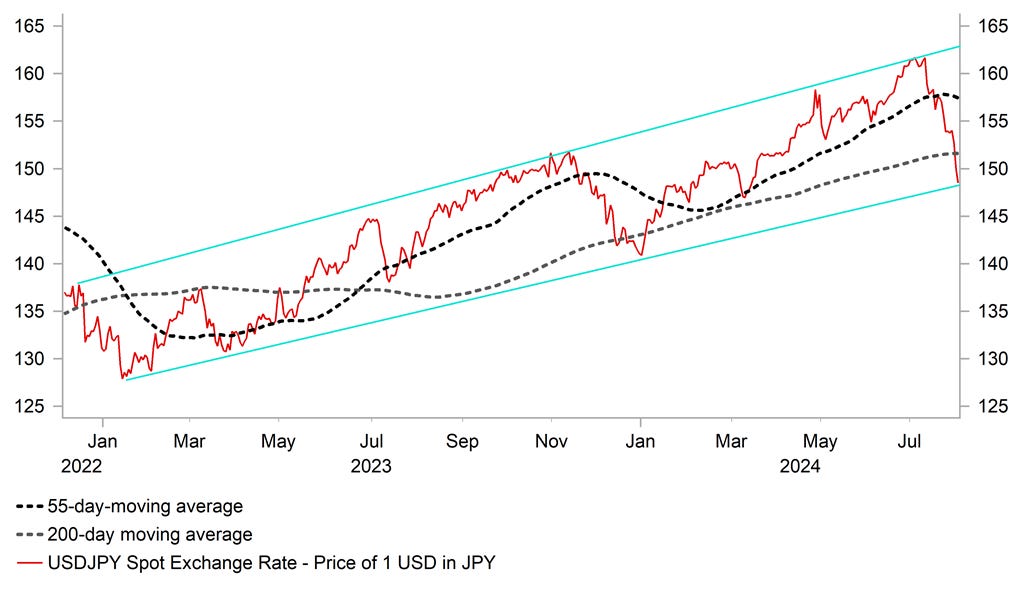

Following the BoJ’s hawkish policy update, the yen’s gains intensified once the USD/JPY broke below the 200-day moving average, which hovered around 151.50. The pair continued its descent overnight, testing support from the uptrend line linking the lows of early and late 2023, which is around 148.50. A decisive break below this level would end the uptrend since early 2023, signalling a more significant reversal for USD/JPY heading into year-end, potentially aiming for the mid-to-low 140.00s. (MUFG)

However, let’s not kid ourselves: if you squint hard enough, you can always find a technical level to justify a bad trade. From a macro perspective, while the uptrend is broken, the still steep carry differential in favour of the dollar—especially through the US exceptionalism channel—makes throwing the towel on the dollar harder. Hence, on this morning's stop-loss-driven overshoot, we went long USDJPY for the first time in a month to dip our toes in the carry trade waters. Nonetheless, our primary strategy through August remains short USD/JPY as a hedge against a tech meltdown—a trade we have not abandoned.

Do you ever get the feeling I like to trade against the market? Well, I do, and this is partly why I don’t often share specific FX trading ideas. I'm always unsure about my audience's risk management or skill level.

I’m thinking today: Positioning at the speculative level is much better balanced than at the start of July. We've already witnessed an 8% correction since then, akin to an express elevator dropping ten floors in an overshoot fashion. It would take much more bad news to trigger a chaotic plunge, aka the October 1998 levels of chaos. While we doubt the correction will extend all the way to 140.00, the soft US rate environment and the looming spectre of Trump advocating for a weak dollar in the lead-up to November will keep USD/JPY as jittery as a cat on a hot tin roof. The 151.00-/152.00 range might be the best USD/JPY levels we see on any corrective bounce, so don't miss that opportunity to sell big.

Here’s the deal: For FX traders, it’s crucial to have multiple trading accounts or, like myself, use various platforms to place hedges or short-term reversal trades. Trading on different venues offers distinct advantages, as swaps and spreads—transaction costs—can vary significantly from platform to platform and currency to currency. This strategy allows traders to optimize their positions and reduce costs, ultimately enhancing profitability.

Meanwhile, the yield on the July 2025 Fed fund futures contract has dropped by around 9bps to 3.84%, implying just over 150bps of cuts in the year ahead, with the first cut more than fully priced in by September (28bps). US rate market participants are growing more confident that the Fed will lower its policy rate closer to its neutral estimate of just below 3.00% in response to slowing inflation.

This shift opens the window to the yen's safe-haven propensity, presenting a potentially explosive opportunity. As market dynamics change, the yen's role as a refuge in times of uncertainty becomes even more pronounced, making it a compelling channel for traders seeking to capitalize on these developments.

I must stress that short-term dollar rates are moving lower, exposing the dollar to downside risks if US data is weak. That risk is glaringly evident ahead of tomorrow's US jobs report. A significant downside miss could finally topple the dollar and dent the US stock market, as calls for a 50 basis point hike in September echo, suggesting the Fed is well behind the curve.

More By This Author:

Knocking On September’s Rate Cut Door

Inline Earnings Simply Isn't Good Enough & Look Out Below Say's This Yen Trader

The USDJPY 151.50-152.00 Bermuda Triangle