Inline Earnings Simply Isn't Good Enough & Look Out Below Say's This Yen Trader

Image Source: Pexels

The S&P 500 and the Nasdaq closed lower on Tuesday as investors continued to steer clear of tech stocks. This cautious mood is further amplified by the looming Bank of Japan (BoJ) and Federal Reserve (Fed) meetings, which are expected to have a significant cross-asset impact. The biggest surprise could come through the BoJ channel.

As growth concerns in the US and eurozone persist, the back end of the rate curves are dipping, adding another layer of complexity to the market. Not surprisingly, the Yen was the big mover overnight amid rumours of an outsized BoJ hike and the further unwinding of Mrs. Watanabe's heavily subscribed MXN/JPY carry trade.

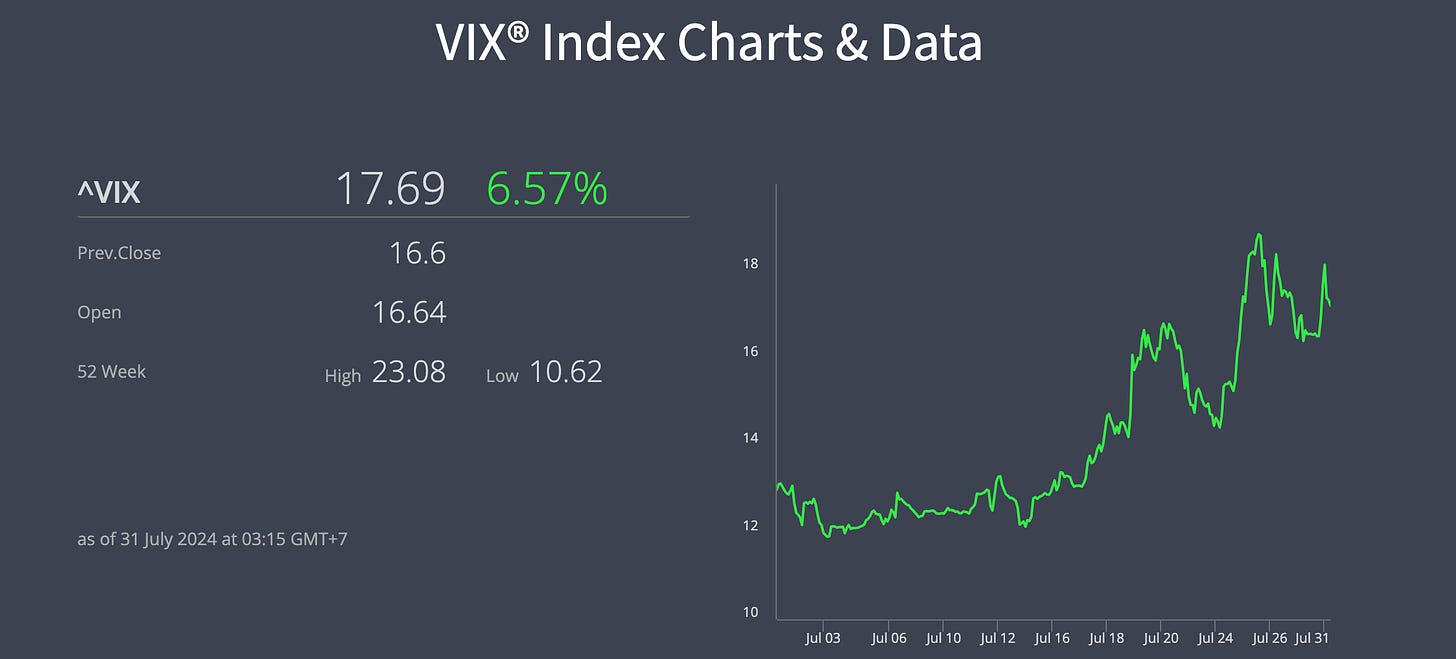

As we approach key carry trade break-even levels, the Bermuda Triangle for the options crowd, vulnerabilities emerge through a higher VIX channel, driven by what could be dubbed the "Summer of the Tech Swoon."

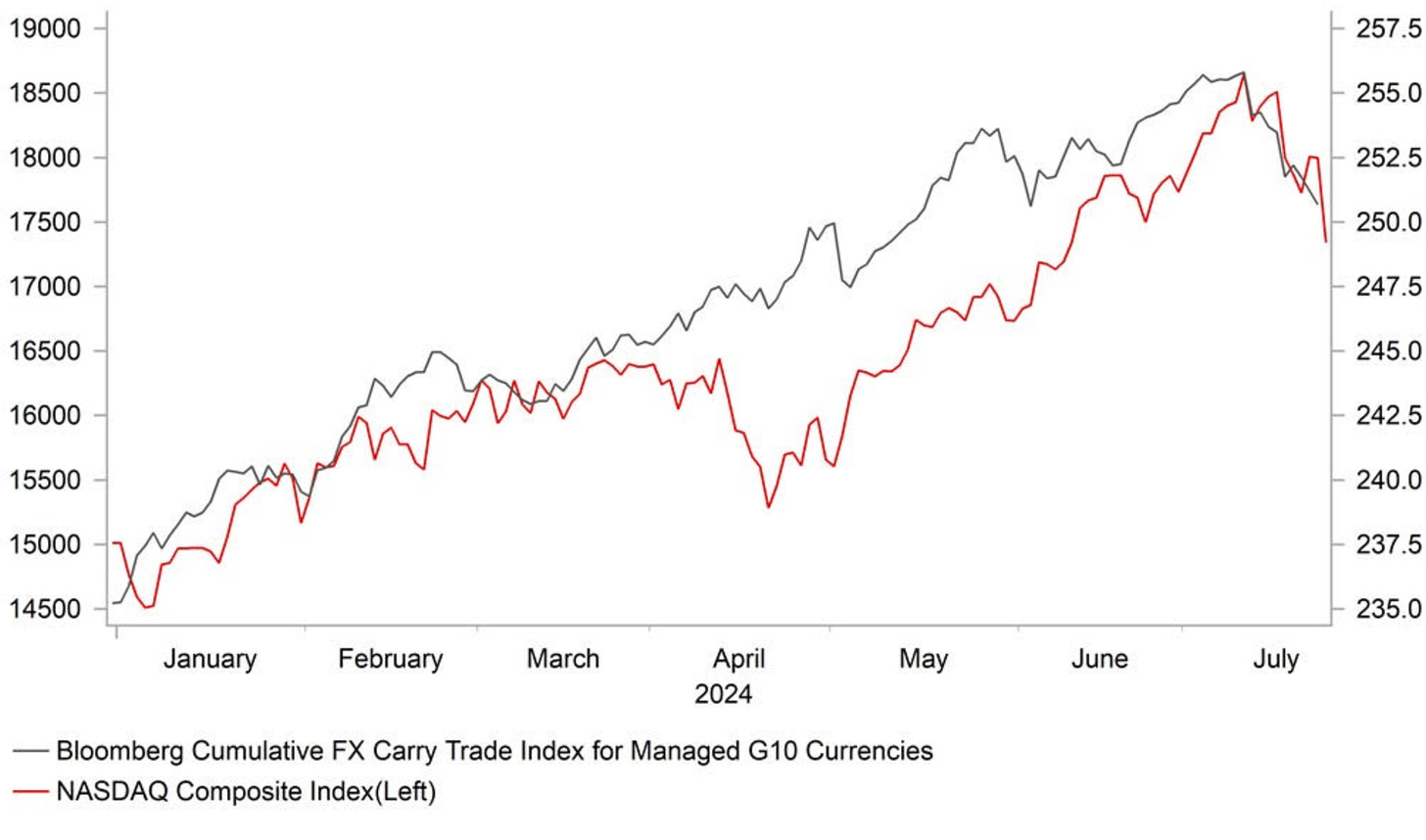

The chart below illustrates this situation well, showing the correlation between the Bloomberg Cumulative FX Carry Trade Index for Managed G10 Currencies and the Nasdaq Composite Index. The Nasdaq's performance has been volatile, reflecting investor skittishness and the broader market's unease. As the BoJ and Fed prepare to make their moves, all eyes are on how these decisions will ripple through global markets, potentially igniting significant volatility through a possible broader carry trade unwind negative feedback loop.

Mega-cap tech is teetering on a high wire in a market that screams bubble trouble. The street is growing increasingly wary of the colossal spending by U.S. tech giants on artificial intelligence, and simply hitting revenue targets isn't going to cut it anymore. After a rocky few weeks, investors aren't in the mood to reward CEOs for meeting expectations; they want to see "more" money.

Take Microsoft (MSFT), for example. On Tuesday afternoon, the company reported overall sales and cloud revenue that matched estimates following a tumultuous session marked by connection issues and outages. Their top line grew 15% to $64.7 billion in fiscal Q4, just a hair above the $64.5 billion consensus. The reaction? A collective shoulder shrug.

Balance sheets are looking fine, but the crux of the issue is elevated positioning and sky-high valuations, which are leading to sharp shifts in both positioning and share prices. Investors are in "show me the money" mode, and anything less than stellar won't do. So, as the tech giants continue to walk this tightrope, it’s clear that the market’s patience is wearing thin. Buckle up because it's going to be a bumpy ride!

NUTS & BOLTS

These are the moments when you really need to look under the hood, read between the lines, and maybe even consult a crystal ball before jumping to conclusions about a data release.

At first glance, you might think, "Wait, U.S. consumer confidence went up?" and "Hold on, job openings are still over 8 million?" Intriguing, right? But hang on to your hats because the revisions tell a different tale.

So, before you start making market moves based on the headlines, take a few extra moments to dive into the details. After all, the devil—and often the truth—is in the details!

Below is a summary of Jennifer Lee’s analysis, Senior Economist at Bank of Montreal, on U.S. economic data. Notably, she provides this insight from a Soft Landing perspective.

Consumer confidence took a surprising turn upwards. According to the Conference Board, the headline index climbed by 2.5 points in July, landing at 100.3. This was unexpected, but let's not pop the champagne just yet. The increase wasn't enough to wipe out June's downwardly revised result and only brought the index to a modest two-month high. The real excitement was all about the future—expectations grew by 5.4 points to hit a six-month high of 78.2, while the present situation slipped for the second consecutive month, down 1.7 points to a three-year low of 133.6.

But here's where it gets juicy: the job market isn't looking as rosy as it once did. Although more respondents still say jobs are plentiful compared to those who say jobs are hard to get, that gap is closing fast. The share of people saying it's tough to land a gig rose to 16%, the highest since March 2021. This narrowed the labour differential to a three-and-a-half-year low. It seems we might see some upward pressure on that 4.1% jobless rate.

Now, let's talk about job openings. They didn't fall as much as expected. There were fewer job openings for the third time in the past four months. Still, thanks to an upward revision to May (with 311k more openings than initially reported), June saw only 46k fewer openings, bringing the total to 8.184 million. That's still 1.2 jobs for every unemployed person. However, all the reductions were in the private sector and spanned manufacturing, financial activities, education, and health care. Leisure and hospitality bucked the trend with more openings. Interestingly, perhaps due to labour market jitters, fewer people quit their jobs, and fewer were hired. Despite the survey's response rate not being stellar, it aligns with the Conference Board's report.

Bottom Line: Slower consumer spending and weaker job growth open the door for a potential September rate cut. Stay tuned!

On a side note

One of the key lessons for retail traders amidst this pre-BoJ rollercoaster ride in JPY prices is that a central bank lacking clear direction can make things wild. Stick to your convictions! If you've done your homework and built up a comfy position over the past four weeks, you'll have the confidence to capitalize on moves like yesterday's jump to 155.

Even though I covered that trade this morning below 153, we're still holding a core short position that's well in the money. We believe USD/JPY is approaching some explosive levels. So, keep your cool, trust your strategy, and be ready to ride the waves!

When I first started venturing out on my own in 2019, I had the pleasure of working with two brilliant Bank quants. Our initial goal was to design an AI-driven B-book for brokers, but we soon expanded our ambitions to build the first version of what we dubbed "Star Wars." This algorithm was specifically designed to exploit market vulnerabilities at certain tipping points. My current correlation analysis suggests one such tipping point is right around the corner, intricately linked to the carry trade unwind.

Long story short, we hit a wall trying to sell our AI B-book model to brokers. The sales folks running those companies simply couldn't grasp what we were doing, and their in-house desk traders were predictably negative—who wants to be replaced by a computer, right? LOL. As for "Star Wars," we never fully activated it, although I have bits and pieces of it up and running this month. Just as we were about to launch, Covid hit, and we had to shelve the projects indefinitely. With everyone working on a new project, it's tough to get back in the creative saddle again.

More By This Author:

The USDJPY 151.50-152.00 Bermuda Triangle

Investors Gear Up For Earnings Deluge And Critical Fed Update

Yen Takes A Bullish Jog Amid Tokyo Fix Frenzy