Yen Takes A Bullish Jog Amid Tokyo Fix Frenzy

Image Source: Pixabay

Forex

Today's Tokyo fix gave the Yen a healthy bullish run, as the market interpreted the stronger fix as a sign of potential hawkish moves from the BoJ—rightly or wrongly. Orders were stacked heavily on the bid side, just above 153, so there was no serious test of that key level so far. If it does give way, we could see a more pronounced pre-BoJ JPY rally extension, especially if USDJPY buys dry up.

This morning's direction of travel makes sense, as it's always helpful ( for the JPY) when both sides of the equation support the same directional call: the BoJ seems likely to hike by the time the Fed cuts.

CITIBANK Fixes Yen At 153.77/$, 0.29 Stronger

MUFG Bank Fixes Yen At 153.76/$, 0.37 Stronger

MIZUHO Bank Fixes Yen At 153.75/$, 0.31 Stronger

NOMURA Fixes Yen At 153.76/$, 0.37 Stronger

SMBC Fixes Yen At 153.75/$, 0.40 Stronger

From an options and rates market perspective, I don't see much risk in holding short USDJPY positions through this week's main events: the BoJ, FOMC, and NFP. Of course, in the FX world, no matter how good you are at mastering the error-balancing bicycle, the great unknowns always have a way of biting you in the backside. Heaven forbid the BoJ decides to snatch defeat from the jaws of victory.

Market Sentiment and Upcoming Events

Markets continue to expect the Fed to start cutting rates in September. US yields inched down on Friday, while the DXY USD index softened. The next couple of months of inflation and jobs data will be crucial in influencing the pace of rate cuts ahead.

Meanwhile, USDJPY had a sharp down move last week, with declines extending to 152 before rebounding to end the week at 153.76. With eyes on the upcoming BoJ and FOMC meetings, we expect more volatile trading in the USDJPY throughout the day.

We've seen plenty of down moves in USDJPY, whether from intervention or price checks. However, these recent shifts have coincided with a drop in front-end yields in the US. Hence, it's a more sustainable JPY rally, lessening the Yen's weakening propensity while strengthening its safe-haven readiness.

BoJ's Potential Move and Market Reactions

We see the BoJ hiking this week, although the decision is now more finely balanced. BoJ officials failed to provide definitive guidance despite senior ruling party official Toshimitsu Motegi urging the BoJ to clarify its rate-hike resolve.

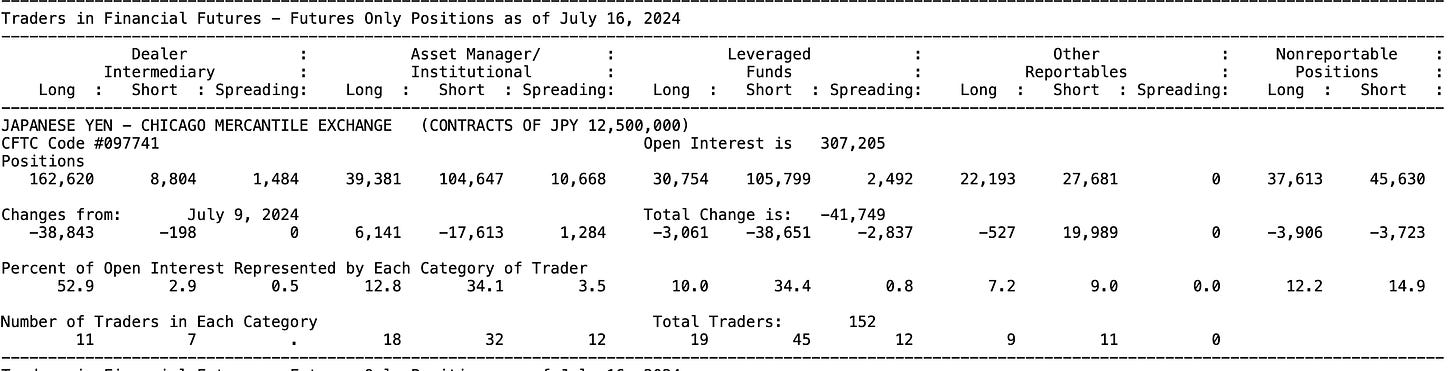

The latest IMM weekly positioning data covering the week to 16th July revealed that Leveraged Funds significantly cut back their short JPY positions by the largest amount since March 2011. With the carry trade yelping last week and 2-year UST yields taking a 10-meter cliff dive, positions have pared slightly more as the lean-to-buy JPY in weakness rather than sell into strength becomes more prevalent.

(Click on image to enlarge)

Turning the Tide in Favor of a Stronger JPY

If you're still bearish on the JPY, here are a few reasons to reconsider:

-

More proactive/opportunistic intervention from Japan to push down USD/JPY.

-

There is more compelling evidence that US inflation continues to slow and the US labour market is slackening, reinforcing expectations for more active Fed easing.

-

Recent comments from leading Japanese politicians expressing frustration over the slow pace of BoJ policy easing ahead of next week’s meeting.

-

Recent comments from former President Trump expressed concern over the high level of USD/JPY and warned that he would impose higher tariffs on Japan if action is not taken to address JPY's weakness.

Why stick with the Trump trade when VP Harris is narrowing in the popular polls? The answer is easy: popularity polls do not equate to electoral college votes, so unless she makes significant ground in key states in “ who are you voting for” polls, the Trump trade is still on the burner.

I find this the best polling source to follow:

https://projects.fivethirtyeight.com/polls/president-general/2024/national/

More By This Author:

The Calm Before The Storm

Week Ahead: Will The Rollercoaster Be On Full Swing Again?

Stocks End On A High Note, “Volmageddon” Might Have To Wait