The USDJPY 151.50-152.00 Bermuda Triangle

Image Source: Pixabay

Ahead of the much-anticipated central bank meetings with the Fed and BOJ later this week, the market seemed as indecisive as a cat at a crossroads, struggling to find a clear direction. Ultimately, the day ended with a slight risk-off tone, which gave the dollar a subtle boost in the grand scheme of things. The EUR/USD dipped below 1.0825, reminding everyone that a forever cautious Fed is on tap.

The only market highlights worth noting included a more significant-than-expected drop in the Dallas Fed Manufacturing Activity Index and a modest decline in Japan’s unemployment rate. These factors support the view that the Fed should start recalibrating rates soon and could drop some hints in the upcoming July meeting. Meanwhile, the BOJ should also be eyeing a rate hike.

From my vantage point, I'm scratching my head, wondering why USD/JPY isn't dipping towards 153.00. The sluggish price actions must drive those who recently shorted USD/JPY up the wall. Entering trades during central bank blackout periods, like the BoJ’s, which starts two business days before their Monetary Policy Meetings (MPMs), can lead to endless mind games and poor trading decisions. It’s like navigating a maze in the dark—frustrating and fraught with missteps.

Although the Fed is often considered the central banker of the world, typically viewed as the ultimate high-stakes central bank event, and while this week's NFP will undoubtedly pack a punch, the Bank of Japan meeting might just be the biggest central bank event of the year. Here's why:

The BoJ's policy moves have been shrouded in mystery and speculation, keeping traders and investors on the edge of their seats. Any shift in their stance could send ripples across global markets, particularly in the FX space, where USD/JPY and JPY-funded carry trade pairs are perched precariously. A major volatility event is lurking, ready to spring into action, making this one of the year's most anticipated central bank meetings.

The 151.50 - 152.00 USD/JPY zone is like the Bermuda Triangle for the option crowd, causing street-wide jitters. There's a high level of ambiguity around what happens when we test that zone in a non-intervention setting, not to mention the mystery of what exactly gets us there.

First, why is this important? From my back-of-the-napkin calculations (okay, I actually used a spreadsheet, but you get the idea, it’s a crude take), the carry trade break-even—or tipping point, if you prefer—is near 152.00 or at that level. Additionally, 151.50 is the 200-day moving average between which there is a massive volume of cross-asset plunge protection options and voluminous JPY orders stacked and loaded that market markers must contend with. To make things even more interesting, I'm confident we'll soon be testing the area. However, the specific catalyst could be extremely sinister in the case of a volatility explosion or less toxic if it's a dovish Fed lean.

A significant down-move in USD/JPY could still ripple through the VIX channel. With the NDX prone and driving volatility up, carry trades—which typically thrive in low-volatility environments—are starting to crater. But they will likely implode if the spot breaks 152.00 USDJPY, creating an intraday Armageddon where the unwinding carry trade extends the risk-off narrative via a negative feedback loop through cross assets.

The second scenario, while still leading to a very toxic intraday sell-off, would be if USD/JPY breaks on a more hawkish BoJ than expected, simply triggering risk-off.

The third scenario is a more dovish Fed than expected, which could be a much less incendiary flashpoint as stock markets could remain supported on dips, thereby limiting the JPY risk aversion propensity.

I think positioning long Yen via the unwinding of carry trades via risk aversion from the tech selloff is the ultimate bear hug. It's like preparing for a financial hurricane—batten down the hatches and ride out the storm!

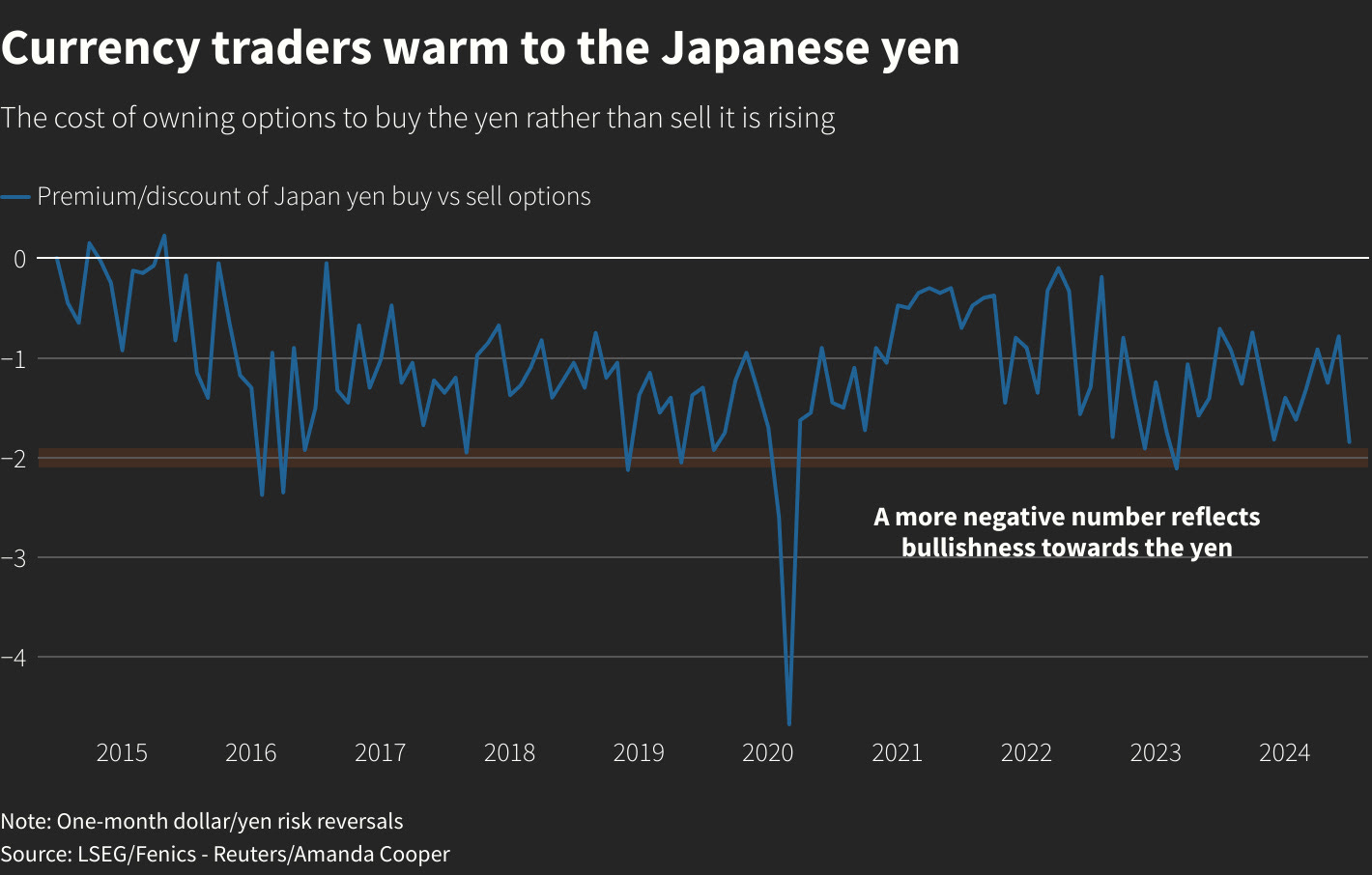

But here's the kicker for the pure JPY play: the drop in front-end US yields should limit its weakness while bolstering its safe-haven appeal. Hence, traders are gradually moving into selling USD/JPY rally mode instead of buying the dip. Intuitively, this makes sense when both sides of the equation support the same directional call; BoJ seems likely to hike by the time the Fed cuts. This lean is also heating up in the options market.

Reuters graphics.

More By This Author:

Investors Gear Up For Earnings Deluge And Critical Fed Update

Yen Takes A Bullish Jog Amid Tokyo Fix Frenzy

The Calm Before The Storm