Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Friday, May 9

U.S. Dollar / Swiss Franc (USDCHF) – Day Chart

USDCHF Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 4

POSITION: Navy Blue Wave 1

NEXT DIRECTION (LOWER DEGREES): Orange Wave 5

DETAILS: Orange Wave 3 appears completed; Orange Wave 4 now developing.

WAVE CANCEL/INVALID LEVEL: 0.89168

Market Analysis Summary

On the USDCHF daily chart, current market behavior shows a counter-trend phase with a corrective price pattern. This situation is identified as the development of orange wave 4, embedded within the broader structure of a downward impulse wave – navy blue wave 1. This configuration implies a temporary pause in the prevailing bearish trend, signaling potential for near-term consolidation or mild recovery.

The prior completion of orange wave 3 marks the beginning of this corrective move. Traders should expect this fourth wave to reflect common correction traits, which may include sideways movements or limited upward pullbacks.

Expected Market Movement

The analysis forecasts that orange wave 5 will follow next in the lower degree wave count, concluding the current bearish sequence. A key level to watch is 0.89168 – a price above this invalidates the current wave scenario and calls for reassessment of the bearish outlook.

Due to the corrective structure, upside remains limited unless the invalidation point is breached. This setup supports the bearish continuation perspective. Traders are advised to watch for signs signaling wave 4's completion, as this could provide a setup for entry aligned with the projected decline in wave 5.

Conclusion and Strategy Guidance

The analysis provides a clear view of the current corrective phase within a larger bearish trend. The critical invalidation level of 0.89168 should be used as a benchmark for managing risk and trade entries. Market participants are encouraged to align with the broader trend and adjust positions accordingly as wave 4 finalizes.

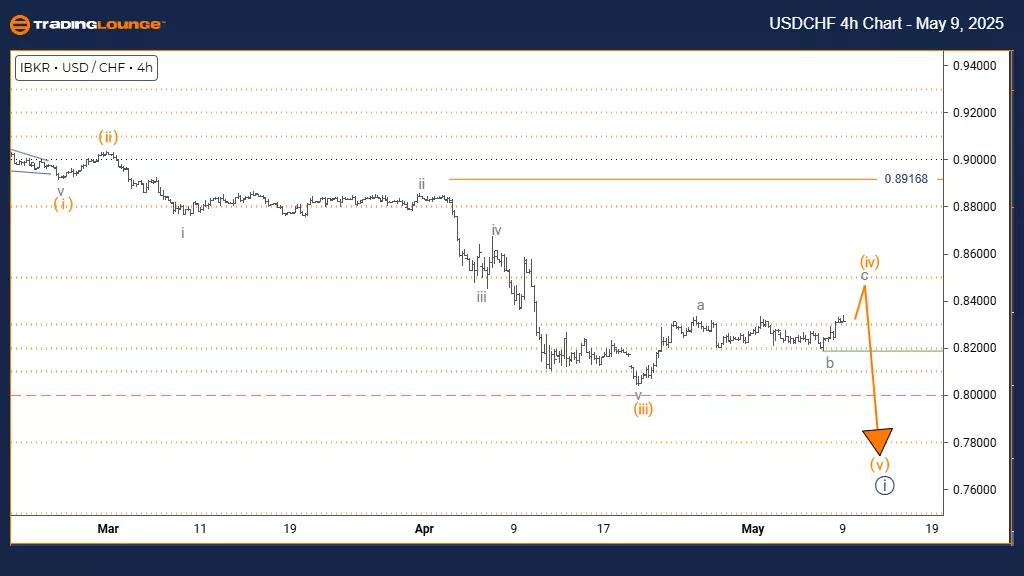

U.S. Dollar / Swiss Franc (USDCHF) – 4-Hour Chart

USDCHF Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 4

POSITION: Navy Blue Wave 1

NEXT DIRECTION (LOWER DEGREES): Orange Wave 5

DETAILS: Orange wave 3 appears complete; orange wave 4 now unfolding

WAVE CANCEL/INVALID LEVEL: 0.89168

Technical Market Overview

On the 4-hour chart, USDCHF is currently navigating through a counter-trend phase, marked by corrective movements. The price action indicates the development of orange wave 4, situated within a broader bearish wave sequence – navy blue wave 1. This highlights a temporary retracement within an overarching downtrend.

Orange wave 3 appears to have concluded, initiating the progress of orange wave 4. This wave is typically characterized by moderate rebounds or consolidation, implying limited upside potential within a bearish framework.

Outlook and Next Steps

Following the current correction, orange wave 5 is anticipated as the next development in the sequence, which will likely finalize the ongoing bearish impulse. The invalidation level at 0.89168 plays a crucial role – if breached, the wave count would require reassessment, possibly indicating a more complex correction or even a trend reversal.

Until this level is crossed, the bias remains bearish. Traders should be vigilant for signs of wave 4 completion, as these can signal potential entries for the expected continuation move in wave 5.

Trading Implications and Strategy

The overall structure supports a bearish outlook beyond this corrective phase. Market participants are advised to track wave development closely, particularly near the invalidation level. The setup allows traders to plan entries and manage risks based on the wave count while aligning with the broader trend.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Polkadot Crypto Price News For Friday, May 9

Elliott Wave Forecast: Block Inc. - Thursday, May 8

Elliott Wave Technical Analysis: Qualcomm Inc. - Thursday, May 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more