Elliott Wave Technical Analysis: Polkadot Crypto Price News For Friday, May 9

Image Source: Pixabay

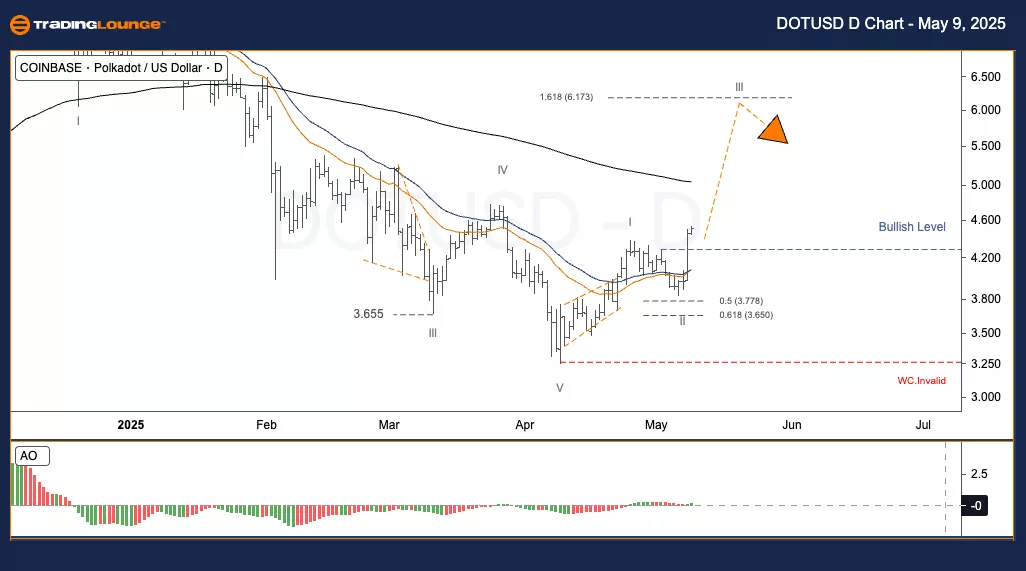

Elliott Wave Analysis – TradingLounge Daily Chart

Polkadot/U.S. Dollar (DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse

Current Wave Position: Wave 3

Next Higher Degree Direction:

Wave Cancel Invalid Level:

DOTUSD Trading Strategy – Daily Chart

Polkadot (DOT) continues to indicate a bullish reversal, having finished wave II as a Zigzag correction at the 50%–61.8% Fibonacci retracement level. The price action has now decisively crossed the Bullish Level, signaling a strong beginning of wave III, which historically represents the most powerful part of the trend per Elliott Wave principles. The immediate upside target is $6.17. Traders should structure their buy strategies according to the ongoing wave pattern to ride the larger market movement.

Trading Strategies

Primary Strategy

✅ Swing Traders (Short-Term)

Entry Signal: Price breach above Bullish Level at $4.40 indicates the start of Wave III.

Risk Management

🟥 Price moving below the red support line (Wave Cancel Invalid Level) invalidates the current wave setup.

Elliott Wave Analysis – TradingLounge H4 Chart

Polkadot/U.S. Dollar (DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse

Current Wave Position: Wave 3

Next Higher Degree Direction:

Wave Cancel Invalid Level:

DOTUSD Trading Strategy – H4 Chart

DOT’s bullish reversal aligns with Elliott Wave logic, following a completed wave II Zigzag pattern at a critical Fibonacci support area (50%–61.8%). The price has since broken the Bullish Level, affirming entry into wave III. With a target near $6.17, short-term and medium-term traders can plan buy entries aligned with the wave direction for trend optimization.

Trading Strategies

Primary Strategy

✅ Swing Traders (Short-Term)

Entry Signal: Price moves past Bullish Level of $4.40 to confirm wave III.

Risk Management

🟥 Breach below the red invalidation line negates the wave forecast.

Analyst: Kittiampon Somboonsod, CEWA – TradingLounge

More By This Author:

Elliott Wave Forecast: Block Inc. - Thursday, May 8

Elliott Wave Technical Analysis: Qualcomm Inc. - Thursday, May 8

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Thursday, May 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more