Elliott Wave Forecast: Block Inc. - Thursday, May 8

ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis

Our latest Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) and highlights BLOCK, INC - XYZ (SQ2).

We observe that ASX:XYZ could have potentially bottomed around the 61.42 level, completing a five-wave move downward. Following this, wave 1) - orange appears to be nearing completion. Subsequently, wave 2) - orange may push the price lower before opening up the opportunity for a strong upward movement in wave 3) - orange.

ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis

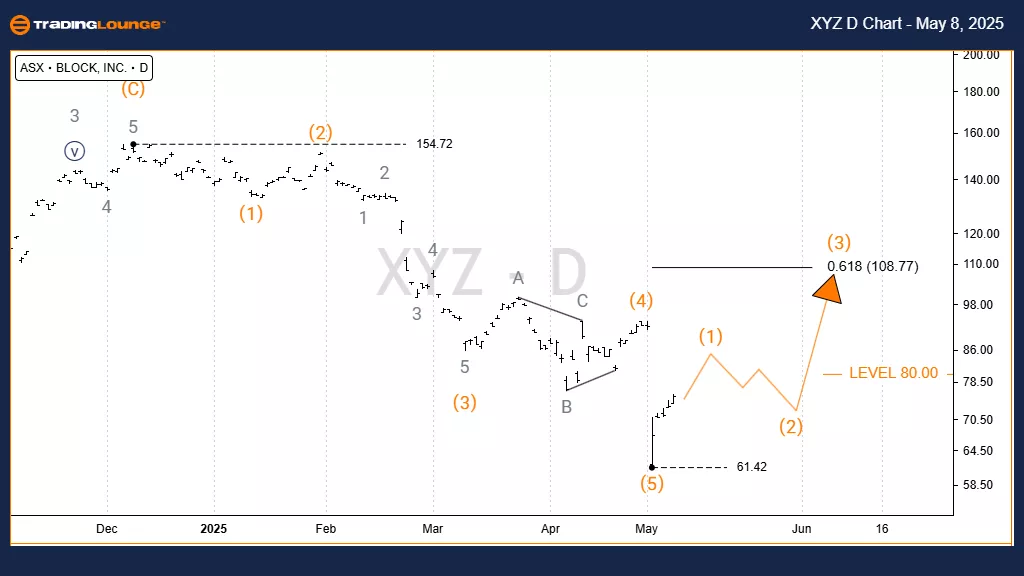

1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 1) - orange

Details:

There is a strong likelihood that XYZ has reached its bottom at 61.42, following a complete five-wave sequence from the high of 154.72. We expect a move back upwards to begin shortly.

Once wave 1) - orange concludes, we anticipate a downward move in wave 2) - orange. Observing the completion of wave 2) - orange will provide confirmation, enabling the next rally phase in wave 3) - orange.

Invalidation Point: 61.42

ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis

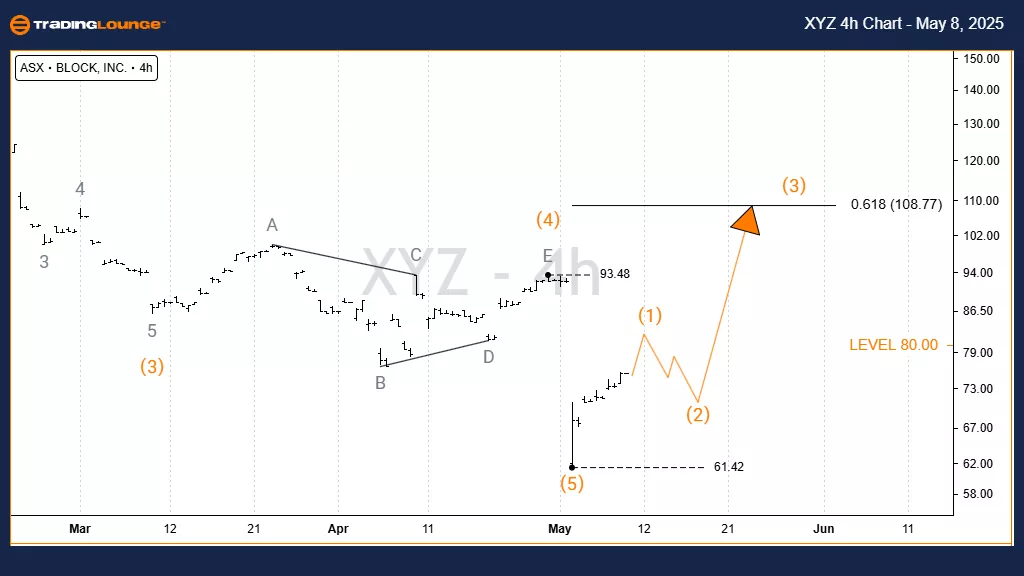

TradingLounge (4-Hour Chart)

ASX: BLOCK, INC - XYZ (SQ2) 4-Hour Chart Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 1) - orange

Details:

The price action suggests that XYZ could have completed its bottom at 61.42 after a five-wave sequence since the 154.72 peak. The expectation is for wave 1) - orange to finish soon, followed by a corrective wave 2) - orange pushing lower. Upon the conclusion of wave 2) - orange, the setup for a new rally in wave 3) - orange becomes viable.

Invalidation Point: 61.42

Conclusion:

Our Elliott Wave analysis and forecast aim to deliver insights into current market dynamics for ASX: BLOCK, INC - XYZ (SQ2).

We provide clear validation and invalidation points to strengthen confidence in the wave counts presented. By combining analytical depth with strategic price levels, we strive to offer readers an objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Elliott Wave Technical Forecast: Newmont Corp.

Elliott Wave Technical Analysis: Palo Alto Networks Inc.- Wednesday, May 7

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Wednesday, May 7

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more