Elliott Wave Technical Analysis: Euro/U.S. Dollar - Wednesday, May 7

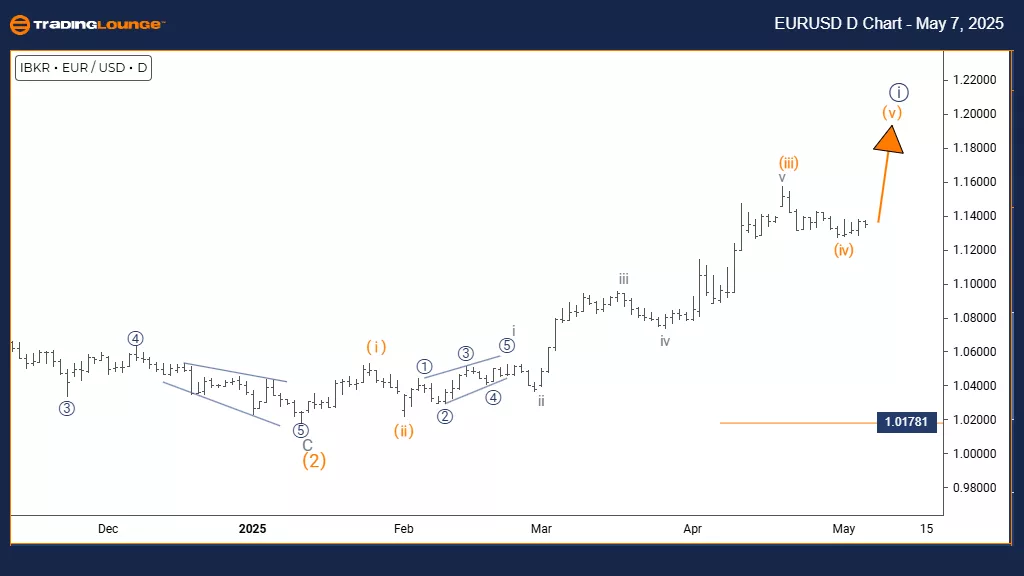

Euro/ U.S. Dollar (EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange Wave 4 looks completed; Orange Wave 5 now active.

Wave Cancel/Invalid Level: 1.01781

The EURUSD daily chart analysis shows a bullish trend nearing its final stages through an impulsive Elliott Wave pattern. The pair completed Orange Wave 4 and moved into Orange Wave 5, forming part of the larger Navy Blue Wave 1 structure. This setup suggests one last push upward before a possible major correction.

Orange Wave 5 marks the final stage of this bullish sequence. It could show strong momentum or weakening strength as it finishes. The end of Wave 4 prepared the market for this move, which may test or surpass previous swing highs before losing momentum. The current pattern suggests the fifth wave is close to finishing the impulsive sequence.

The daily chart gives a crucial view of the structure, highlighting the late phase of the bullish trend. Entering Navy Blue Wave 1 at a higher degree points to a possibly larger move still developing. Watch the invalidation level at 1.01781 carefully. A drop below this point would require a new analysis of the wave count.

Traders should monitor Wave 5 for signs of ending, such as bearish divergence on momentum indicators or visible reversal patterns. The analysis suggests readiness for a trend change as Wave 5 nears completion, though wave extensions could extend the rally longer than usual.

Technical indicators and price behavior are vital for spotting when the bullish momentum fades and a correction begins. After finishing Wave 5, the market is expected to start Navy Blue Wave 2, a corrective move likely offering a pullback opportunity before any bullish trend resumes.

Observing price action carefully is key to confirming the completion of the current wave and recognizing the start of the next phase. The daily analysis points to the importance of this transition for medium-term trading strategies.

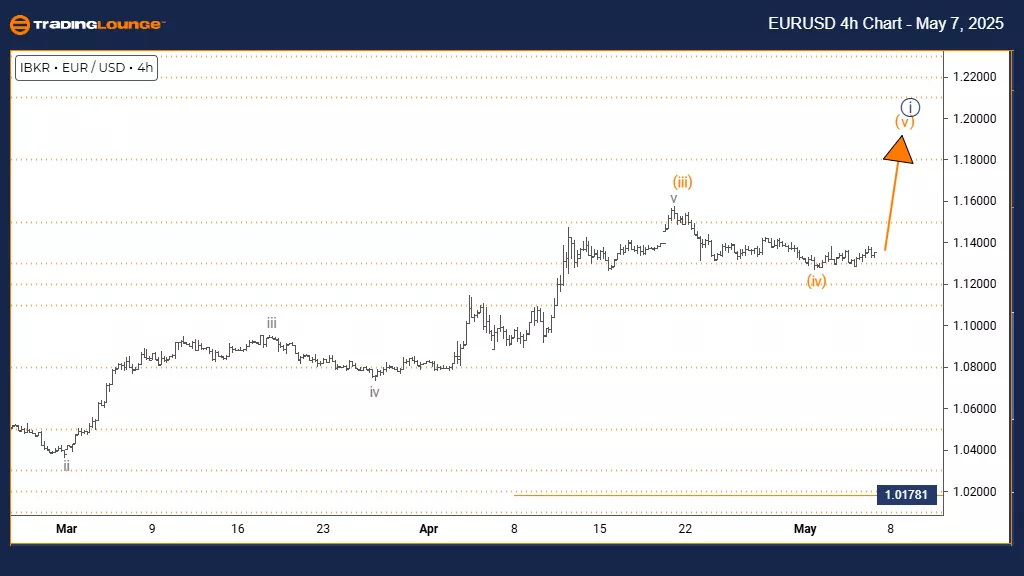

Euro/ U.S. Dollar (EURUSD) 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5 (started)

DETAILS: Orange Wave 4 appears completed; Orange Wave 5 is underway.

Wave Cancel/Invalid Level: 1.01781

The EURUSD 4-hour chart analysis shows a bullish trend developing through an impulsive Elliott Wave pattern. The currency pair has completed the Orange Wave 4 correction and moved into Orange Wave 5, forming part of the larger Navy Blue Wave 1 structure. This setup suggests one last upward push before a likely larger correction.

Orange Wave 5 marks the final stage of the current upward move. It typically shows either strong momentum or weakening strength as it nears completion. Finishing Wave 4 set the stage for this move, which could test or exceed previous highs before ending. The current structure points to an upward move close to completion within the impulsive sequence.

The next expected phase is Navy Blue Wave 2 after Orange Wave 5 finishes. This upcoming wave is projected to be corrective, possibly offering a pullback after the rally ends. A crucial level to monitor is 1.01781, the invalidation point for the wave count. A break below this level would need a new interpretation of the wave structure.

Traders should watch for traditional termination signs of Wave 5, such as bearish divergence on momentum indicators or reversal patterns. The 4-hour timeframe gives important insight, suggesting that the immediate upward trend could be ending. However, remember that Wave 5 extensions can push the rally further than expected.

Technical indicators and price action are vital to confirm when bullish momentum fades and corrective Wave 2 begins. This analysis recommends keeping an eye on trend completion signals while respecting the invalidation level that would change the current view. Transitioning into Wave 2 would suggest a short-term pause in the broader uptrend before any continuation.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Cardano Crypto Price News For Wednesday, May 7

Unlocking ASX Trading Success: Car Group Limited - Tuesday, May 6

Elliott Wave Technical Analysis: Cocoa Commodity - Tuesday, May 6

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more