Unlocking ASX Trading Success: Car Group Limited - Tuesday, May 6

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

Today’s Elliott Wave update focuses on the Australian Stock Exchange (ASX) listing: CAR GROUP LIMITED – CAR.

Our analysis suggests that ASX:CAR may have just finished a corrective wave, labeled as (4) - orange Zigzag, signaling bullish potential worth monitoring.

This brief analysis will highlight a potential new trend and key invalidation levels crucial for this outlook.

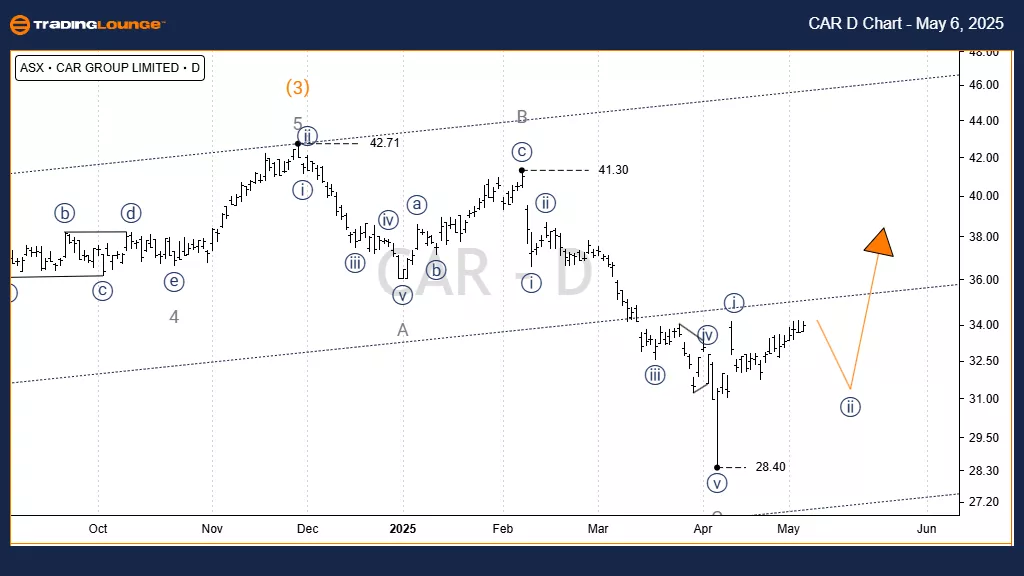

ASX: CAR GROUP LIMITED – CAR 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ii)) - navy, Wave (5) - orange

Details:

Wave (4) - orange started forming after the peak near 42.71 and likely concluded at the low of 28.40, as a Zigzag marked A-B-C - grey.

The C - grey wave structure consists of five waves, indicating its completion.

Now, wave (5) - orange is likely in progress, having finished wave i)) - navy.

Currently, wave ii)) - navy is extending lower but is expected to complete soon, leading to a bullish move with wave iii)) - navy.

Invalidation Point: 28.40 (Price must stay above this level to maintain this analysis.)

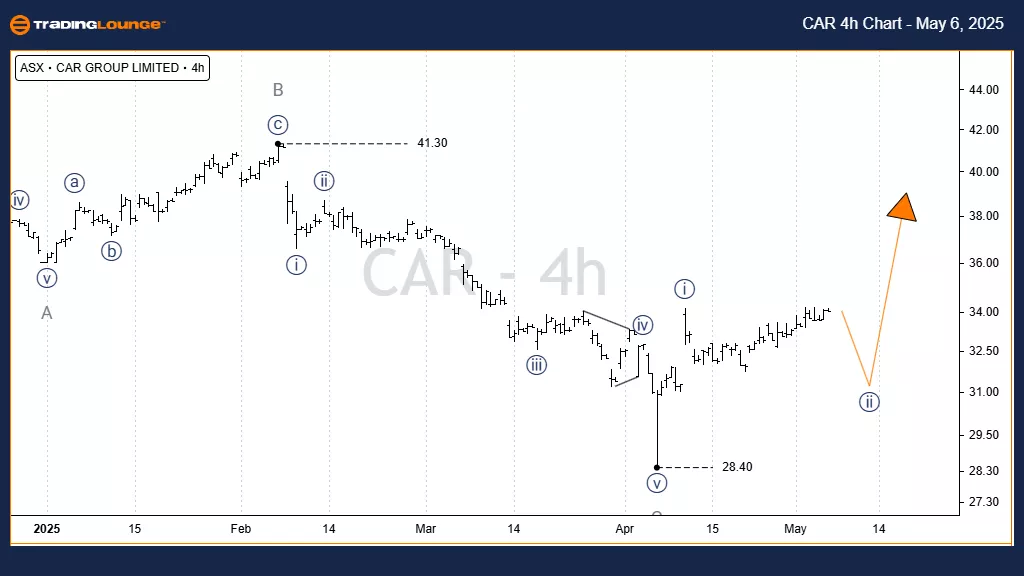

ASX: CAR GROUP LIMITED – CAR 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii)) - navy of Wave (5) - orange

Details:

From the low at 28.40, wave i)) - navy unfolded and completed.

Wave ii)) - navy is currently developing and pushing slightly lower.

Once it completes, wave iii)) - navy is expected to push higher, possibly aiming near the previous high around 41.30.

Invalidation Point: 28.40 (Price must remain above this level to support the bullish count.)

Conclusion

Our analysis for ASX: CAR GROUP LIMITED – CAR offers a structured view of current market conditions and future trends.

We highlight key levels that validate or invalidate our wave structure to strengthen confidence in the analysis.

By providing detailed insights and a professional perspective, we aim to assist readers in trading effectively and objectively.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Unlocking ASX Trading Success: Insurance Australia Group Limited - Monday, May 5

Natural Gas - Elliott Wave Technical Analysis

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Monday, May 5

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more