Elliott Wave Technical Analysis: Cardano Crypto Price News For Wednesday, May 7

Image Source: Pixabay

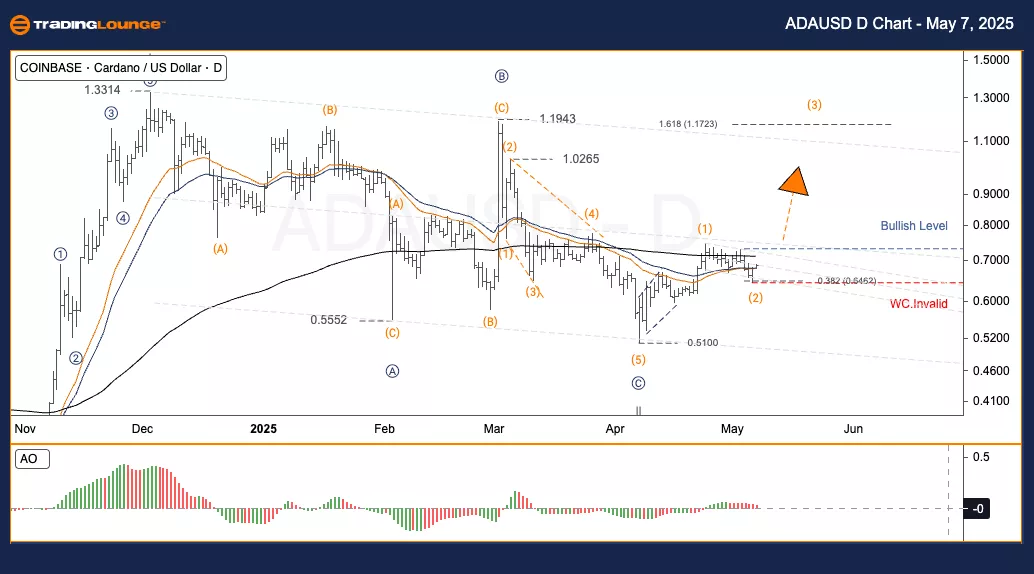

Elliott Wave Analysis TradingLounge Daily Chart

ADA/ U.S. Dollar (ADAUSD)

ADAUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction for Next Higher Degrees: —

Wave Cancel Invalid Level: —

ADA/ U.S. Dollar (ADAUSD) Trading Strategy

Cardano is forming a “retrend to rally” within a wave 2 pattern. This typically concludes between the 0.382–0.618 Fibonacci retracement levels. A break above major resistance could confirm the start of wave 3, which might push prices beyond $1.00 in the upcoming major trend.

Trading Strategies

Strategy

Approach

✅ Short-term traders (Swing Trade)

Watch for a breakout above $0.73 to engage with the developing wave trend (3).

Risk Management

🟥 Wave Cancel (Invalid Level): $0.640 (If the price falls below, the wave count would be invalid.)

Elliott Wave Analysis TradingLounge H4 Chart

ADA/ U.S. Dollar (ADAUSD)

ADAUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction for Next Higher Degrees: —

Wave Cancel Invalid Level: —

ADA/ U.S. Dollar (ADAUSD) Trading Strategy

Cardano is exhibiting a “retrend to rally” in its wave 2 phase, generally culminating between the 0.382–0.618 Fibonacci zones. If the asset breaks major resistance, it could initiate wave 3 and potentially drive the price above $1.00.

Trading Strategies

Strategy

Approach

✅ Short-term traders (Swing Trade)

Await a breakout over $0.73 to align with the emerging wave 3.

Risk Management

🟥 Wave Cancel (Invalid Level): $0.640 (Price below this invalidates the current wave count.)

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Unlocking ASX Trading Success: Car Group Limited - Tuesday, May 6

Elliott Wave Technical Analysis: Cocoa Commodity - Tuesday, May 6

Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Tuesday, May 6

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more