Elliott Wave Technical Analysis Day Chart - New Zealand Dollar/U.S. Dollar

Image Source: Pixabay

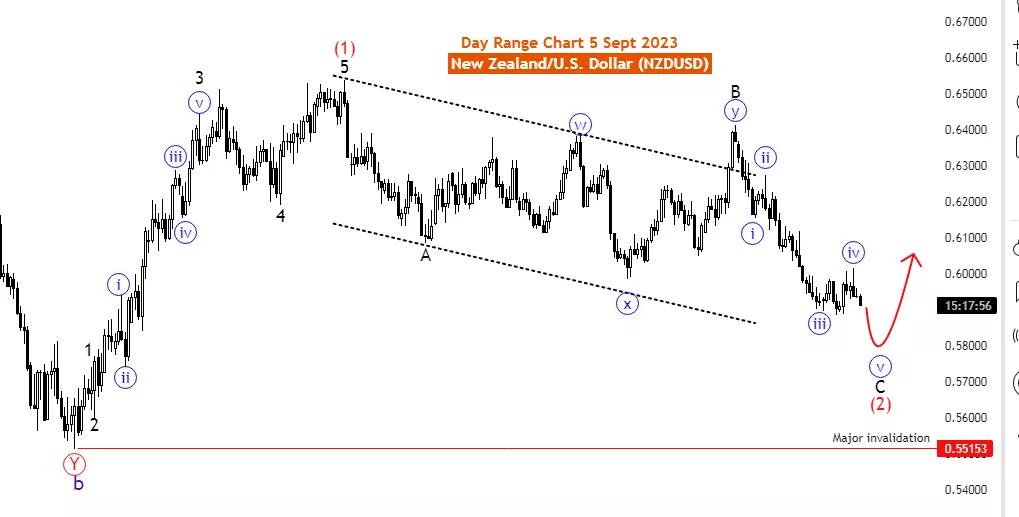

NZDUSD Elliott Wave Analysis Trading Lounge Day Chart, 5 September 2023

New Zealand Dollar/U.S. Dollar (NZDUSD) Day Chart

NZDUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: impulsive

Structure: 5 of C

Position: main red wave 2

Direction Next higher Degrees: Red wave 3

Details: Blue wave 5 of C of 2 in play. Wave Cancel invalid level: 0.55153

The NZDUSD Elliott Wave Analysis for 5 September 23, offers insights into the Day Chart of the New Zealand Dollar/U.S. Dollar currency pair (NZDUSD) using Elliott Wave theory, providing traders with valuable information for potential trading strategies.

The Function is defined as Counter Trend, indicating the likelihood of a corrective or reversal phase against the prevailing market trend. This information is crucial for traders looking for opportunities to capitalize on counter trend movements.

The Mode is identified as impulsive, signifying strong and forceful price action. Impulsive modes suggest that significant market moves are underway, offering traders the potential for substantial trading opportunities.

The Structure is described as 5 of C, denoting the current phase of the Elliott Wave pattern. Specifically, it signifies that the market is in the fifth wave of a larger corrective pattern labeled as C. Understanding the Elliott Wave structure helps traders position themselves within the broader wave count.

The Position indicates that the market is in the main red wave 2. This insight clarifies the current wave count within the larger Elliott Wave framework, helping traders better comprehend the market's position in the wave cycle.

The Direction Next Higher Degrees emphasizes the importance of Red wave 3, suggesting that the market is expected to continue moving in the direction of this third wave at a higher degree. This knowledge assists traders in aligning their trading strategies with the anticipated market direction.

The analysis highlights that Blue wave 5 of C of 2 is currently in play, indicating that the market is within the fifth wave of a corrective pattern. Traders can use this information to identify potential entry and exit points or to gauge the market's sentiment.

The Wave Cancel invalid level is specified as 0.55153, serving as a reference point for traders to assess the validity of their analysis. This level helps traders determine whether their trading strategies align with the current market conditions.

In summary, the NZDUSD Elliott Wave Analysis for 5 September 23, is a valuable tool for traders. By examining the Function, Mode, Structure, Position, Direction, and key wave levels, traders can make informed decisions about their trading strategies. However, it's essential to complement this analysis with other technical and fundamental indicators to make well-rounded trading choices and manage risk effectively.

More By This Author:

Elliott Wave Technical Analysis : Tron/USD, Monday, September 4

Elliott Wave Technical Analysis: Texas Instruments Inc. - Friday, Sep. 1

Day Chart Elliott Wave Technical Analysis: AUD/JPY - Friday, September 1

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817