Dollar Rally Shields Overseas Investors

Image Source: Unsplash

Looking to keep track of global markets and cross-asset price action? Every morning in The Morning Lineup we provide commentary on developments since the prior US close, covering major macro catalysts, geopolitics, economic data, local market price action, earnings, and more. This morning we talked about the price reaction to the latest tariff headlines and how cross-asset relationships between stocks, bonds, and the dollar are not behaving the same way as they did during market stress in the wake of April's Liberation Day. An excerpt from this morning's note is below.

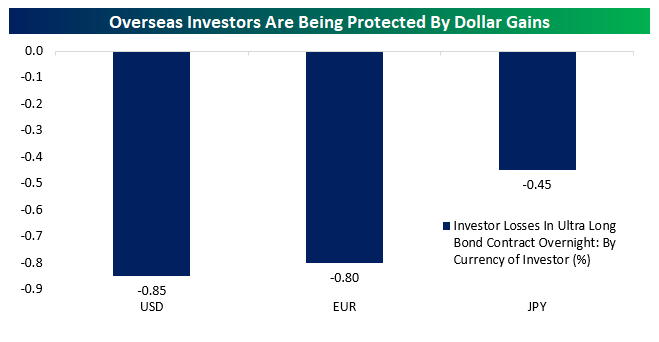

As we’ve discussed a number of times over the past several months, the flow and market price data does not support the idea that non-US investors are fleeing en masse as was feared in the wake of the Liberation Day tariff announcement. We continue to watch price action and the relationship between movements in stocks, rates, and the dollar for signs of that dynamic, and they were again lacking overnight. While UST yields have moved higher as stocks have sold off, the bear-steepening has been relatively modest with 30y yields up less than 5 bps this morning. The dollar has actually rallied today. As shown below, unhedged investors denominated in EUR or JPY are actually seeing smaller losses on US duration overnight than USD-based investors, the opposite of what we would expect if new tariffs were generating a capital flight scenario.

Of course, that lack of pricing for capital flight could reflect the exact same dynamics that we see from equity market behavior with very low implicit pricing for the bad outcome. If markets reverse their behavior, the three-way correlation between stocks, bonds, and the dollar could re-emerge as part of a behavioral and narrative shift, but for now we are not seeing that behavior in how markets are behaving under the current narrative regime. We will continue to watch for any shift in that regime.

More By This Author:

Tariff Troubles

Back-To-Back Bulls

Cattle Futures And Cattle To Corn Ratio Hit Record Highs

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more