Back-To-Back Bulls

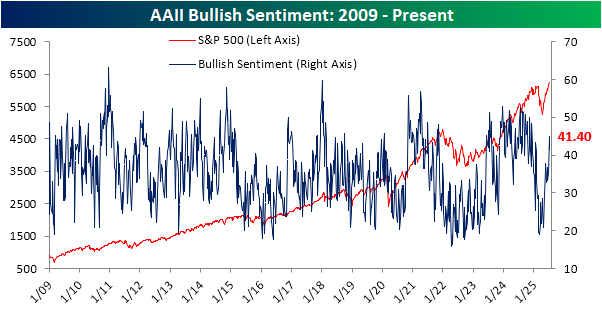

Albeit the move has been mostly recovered by now, the past week's pullback from fresh all-time highs has resulted in investor sentiment shifting lower. The latest gauge from the weekly AAII survey showed 41.4% of respondents reporting as bullish, down from a 30-week high of 45.0% headed into the July 4th weekend.

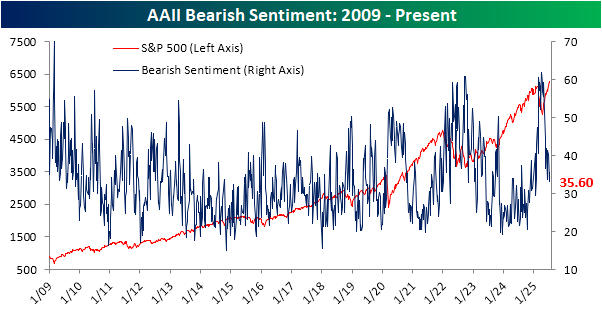

The drop in bullish sentiment meant that an increased share of responses shifted towards bearishness. 35.6% of respondents reported as bearish, up 2.5 percentage points week over week.

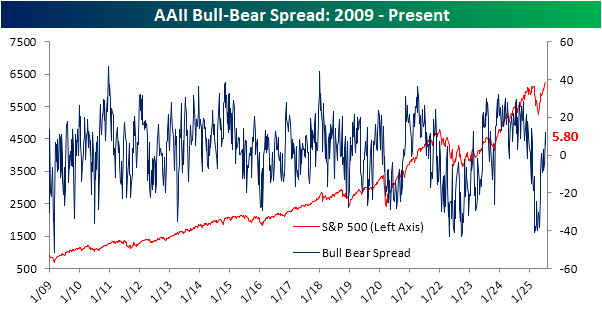

Given these readings, the predominant sentiment is still bullish as the bull-bear spread remains positive for a second week in a row at 5.8 points.

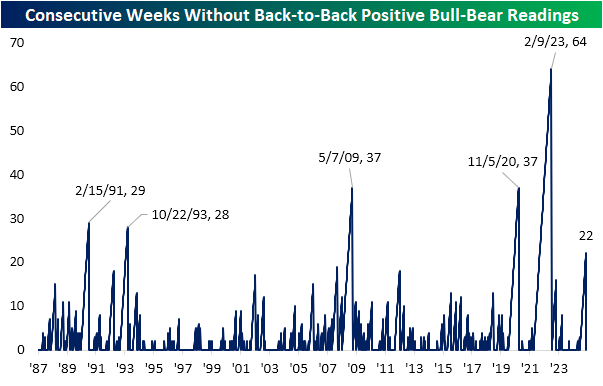

Even though the bull-bear spread was lower this week and current levels are far from earning any superlatives, the still positive reading did mark the first back-to-back positive readings in the spread since the last week of January. Alternatively, that snaps a 22-week-long streak without back-to-back weeks of positive bull-bear spreads. As shown below, such a streak has been uncommon. Throughout the history of the survey since 1987, there have only been five streaks that have gone on for longer.

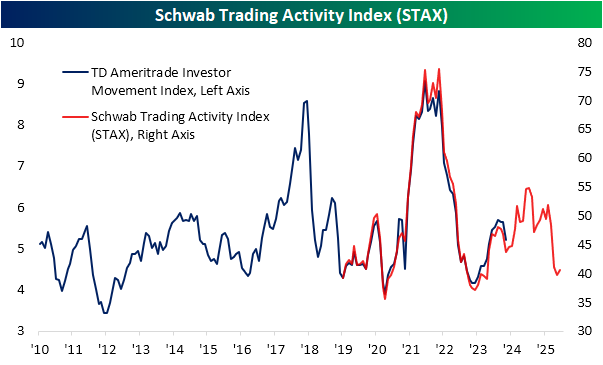

In addition to the usual weekly sentiment gauges, this week also saw an update in the Schwab Trading Activity Index (STAX). Formerly the TD Ameritrade Investor Movement index, before the merger between the two companies, the index differs from other sentiment gauges that tend to ask if an investor is bullish or bearish. Instead, this index uses a proprietary system to assign sentiment scores to retail investors based on their actual account activity. As shown, the June reading only indicated a modest improvement in sentiment after falling for three months in a row. In other words, since the April lows, retail investors had been fading the S&P 500's recovery back up to record highs, with June only marking a minor shift back toward bullishness among this investor base.

The report also details a few anecdotes about single stocks popular among retail clients. This month's report highlighted that—again contrary to the changes in these stocks' prices—recent Tech favorites saw major net selling like NVIDIA (NVDA), Microsoft (MSFT), and Coinbase (COIN). On the other hand, other major Tech names like Tesla (TSLA) and Amazon (AMZN) were noted as seeing consistent purchases among retail investors.

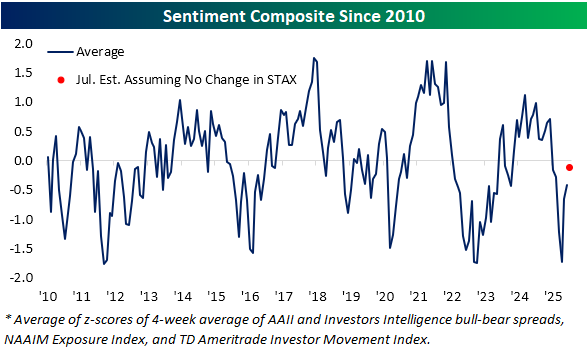

Putting sentiment readings together, below we aggregate this STAX index with the AAII survey and two other weekly sentiment readings: the NAAIM Exposure index and Investors Intelligence survey. Together and equally weighted, the average across these indicators pointed to continued improvements in sentiment in June, and readings for so far in July would point to further improvements down the road.

More By This Author:

Cattle Futures And Cattle To Corn Ratio Hit Record HighsHeavy Into Metals

Fossil: From 8,000% To 6%

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more