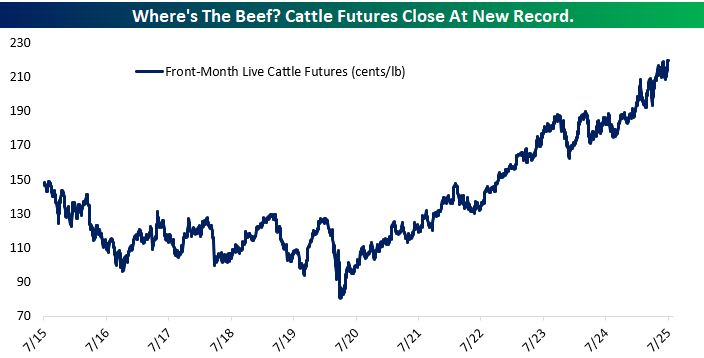

Cattle Futures And Cattle To Corn Ratio Hit Record Highs

Beef prices continue to sizzle. Live cattle futures just closed at a new all-time high, climbing to $2.20 per pound after a multi-year rally that’s been quietly unfolding since mid-2020. While inflation has cooled in many parts of the economy, the beef market remains red-hot, driven by a combination of shrinking cattle herds, ongoing drought conditions in key ranching states, and steady consumer demand for beef across both retail and food service channels.

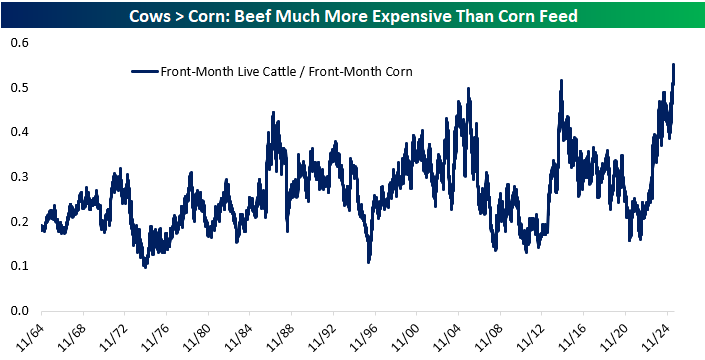

What makes this even more striking is how cheap corn, the primary feedstock for cattle, has remained in relative terms. A long-term chart of the cattle-to-corn ratio shows that beef has never been this expensive relative to feed costs, with the spread hitting its highest point in over six decades. For cattle producers, this is an extremely favorable setup: high output prices and low input costs translate into wide margins.

This divergence has interesting implications. Publicly traded meat processors could benefit from stronger margins. It also speaks to broader commodity cycles: while grain prices have cooled post-Ukraine shock, protein prices have marched higher. If you’re looking for margin tailwinds in the ag and food supply chain, the beef market is one to chew on.

More By This Author:

Heavy Into MetalsFossil: From 8,000% To 6%

Profit Taking And Discount Shopping

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more