Daily Market Outlook - Wednesday, May 28

Image Source: Pixabay

US and European stock-index futures dipped, and Treasuries ended a three-day advance due to ongoing worries about the fiscal stability of the US economy. Asian markets erased earlier gains, with Hong Kong stocks being among the significant losers in the region. Treasury yields for longer maturities fell, and a 40-year bond auction in Japan experienced the lowest demand since July. South Korean semiconductor stocks increased before Nvidia's earnings report scheduled for later Wednesday. Investors remain cautious about the fiscal situation in the US following President Donald Trump's trade war and tax cut initiatives, which have raised alarms about the growing deficit. The Federal Reserve has emphasised that it will wait for more evidence before considering interest rate cuts. Meanwhile, the “Sell America” trend has negatively impacted the dollar, which has declined nearly 7% this year.

The sharp rally in Japanese Government Bonds (JGBs) on Tuesday, triggered by an unusually timed Ministry of Finance (MoF) announcement regarding potential changes in the maturity of future issuances, proved to be an ill-timed setup for Wednesday’s 40-year auction. Despite a reduced auction size (¥500 billion versus ¥700 billion previously), the clearing yield of 3.135% exceeded market expectations of 3.085%, while the bid-to-cover ratio of 2.21x fell short of the recent average of 2.64x. As a result, the 30-year benchmark yield, which had dipped to 2.85% on Tuesday, climbed to 2.95% this morning. Although this remains below last week’s peak of 3.20%, the performance of JGBs continues to draw significant attention from financial markets in the near term. Japan’s Finance Minister, Shunichi Kato, stated that the situation is being "closely monitored". The next Bank of Japan (BoJ) meeting, scheduled for June 16-17 and expected to include potential updates on quantitative tightening (QT), along with the MoF’s meeting with primary dealers on June 20, feels distant given recent market volatility. Meanwhile, Tuesday’s rally in U.S. Treasuries (USTs) partially reversed overnight following the JGB auction results, leaving the 30-year UST yield just 2 basis points shy of the critical 5% threshold once again. This sensitivity to JGB movements isn’t limited to UST yields. The International Monetary Fund (IMF) yesterday emphasised the United Kingdom’s need to "reduce vulnerability to gilt market pressures," highlighting how global bond market volatility directly influences the Chancellor’s fiscal challenges.

US consumer confidence showed a notable rebound in May, following a sharp decline in April. The Conference Board index surged to 98.0 from 85.7, surpassing the March reading and nearly returning to February levels. This improvement contrasts sharply with the University of Michigan survey, where the preliminary May reading experienced a slight further drop after April’s plunge. The divergence between these two surveys is striking. The University of Michigan index remains exceptionally pessimistic—not only in this comparison but also in our US economy dashboard, where its current reading is more than two standard deviations below the long-term average, making it the weakest indicator in the table. Considering recent consumer and economic performance, the Conference Board index appears to provide a more balanced reflection of sentiment, as it aligns more closely with historical averages. Specifically, the timing of Trump’s agreement with China likely contributed to the reported bounce in the Conference Board index. Survey responses were collected during the week following this development, suggesting that the positive sentiment surrounding the agreement may have played a role. This dynamic could also lift the final May reading of the University of Michigan index slightly when it is released on Friday.

Today's macro economic events: ECB Inflation Expectations, Richmond Fed Survey, Remarks from Fed's Kashkari, and Release of FOMC Minutes.

Overnight Headlines

- New Zealand Cuts OCR To 3.25%, Signals Further Easing Ahead

- BoJ Gov Ueda Vows To Monitor Risks From Long-Yield Surge

- Japan 40-Year Bond Sale Demand Is Weakest Since July

- Asia’s $7.5T Bet On US Assets Unravels Amid Policy Uncertainty

- Trump: Putin Is ‘Playing With Fire’ As Ukraine Assault Escalates

- UK Seeks To Negotiate Down Trump’s 10% Tariffs

- China Seeks To Slow Yuan’s Gains After Months Of Propping It Up

- OPEC+ Output Plans Keep Pressure On Oil Futures

- BoK Poised To Cut Rate Ahead Of Election As Risks Deepen

- Citadel Securities Profits Surge 70% On Trading Revenue Boom

- Nvidia Suppliers Resolve AI Rack Issues, Boosting Sales Outlook

- TSMC To Launch Chip Design Hub In Germany

- China Offers To Fund Colombian Projects If US Blocks Loans

- Meta Splits AI Team To Speed Up Product Deployment

- Salesforce To Acquire Informatica In $8B Deal

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1170-80 (600M), 1.1195-00 (1.2BLN)

- 1.1230 (502M), 1.1250 (243M), 1.1260-65 (350M)

- 1.1300 (1.83BLN), 1.1345-55 (973M), 1.1375-80 (586M)

- 1.1390-00 (3.34BLN), 1.1445-55 (1.35BLN), 1.1500 (791M)

- USD/JPY: 142.93-00 (2.7BLN), 143.90-00 (2.4BLN), 144.85 (395M)

- 145.00 (2.9BLN), 145.50 (1.1BLN)

- EUR/JPY: 162.05 (394M), 164.30 (350M), 165.00 (281M)

- USD/CHF: 0.8100 (302M). GBP/USD: 1.3400 (260M), 1.3550 (207M)

- AUD/USD: 0.6325 (430M), 0.6390-00 (647M), 0.6500-05 (471M)

- NZD/USD: 0.5475 (520M), 0.5525 (305M), 0.5725 (1.1BLN)

- 0.5815 (300M), 0.6050 (202M), 0.6085 (293M)

- USD/CAD: 1.3775 (245M), 1.3830-40 (579M)

CFTC Data As Of 23/5/25

- Speculators have increased their net short position in CBOT US 5-year Treasury futures by 95,898 contracts, bringing the total to 2,275,941. They have reduced their net short position in CBOT US 10-year Treasury futures by 38,920 contracts to 851,431. Additionally, speculators raised their net short position in CBOT US 2-year Treasury futures by 45,099 contracts to 1,267,331. Meanwhile, they cut their net short position in CBOT US Ultrabond Treasury futures by 15,087 contracts to 246,135 and trimmed their net short position in CBOT US Treasury bonds futures by 5,596 contracts to 72,033.

- Equity fund speculators have increased their net short position in S&P 500 CME futures by 9,949 contracts to 297,229, while equity fund managers have elevated their net long position in S&P 500 CME futures by 14,799 contracts to 872,421.

- The net long position for the Japanese yen stands at 167,330 contracts, the euro at 74,453 contracts, the British pound at 23,993 contracts, and the Swiss franc holds a net short position of -23,767 contracts. Lastly, the net short position for Bitcoin is recorded at -1,952 contracts..

Technical & Trade Views

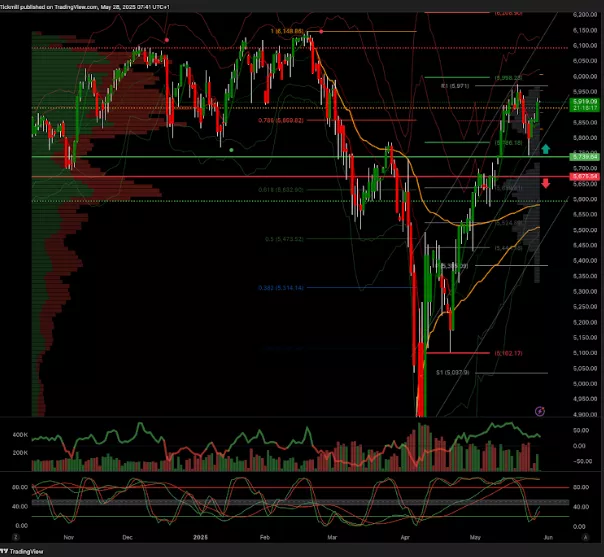

SP500 Pivot 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

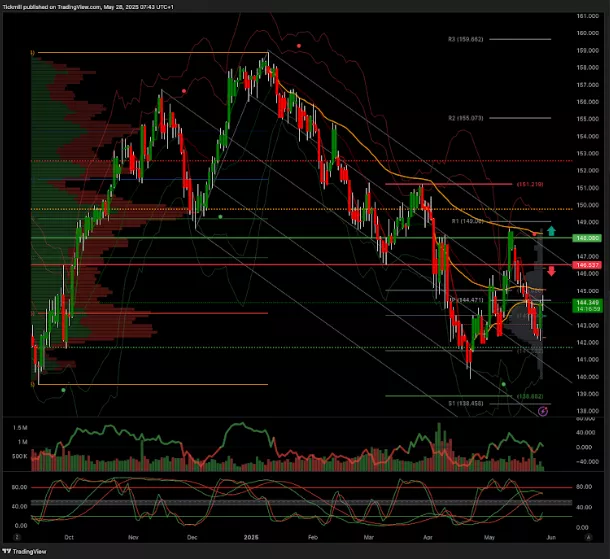

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 100k target 96.7k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, May 27

The FTSE Finish Line - Friday, May 23

Daily Market Outlook - Friday, May 23