Daily Market Outlook - Friday, May 23

Image Source: Pexels

Asian stocks saw a rebound as investor confidence increased, setting a regional index on a path for a sixth consecutive week of gains, while Treasuries stabilised with diminishing worries about US fiscal policy. The yield on the 30-year US Treasury remained stable at 5.04%. Meanwhile, the Dollar Index fell 0.2%, marking a total decline of 1.2% for the week—the largest shift in six weeks. This week's bond market movements reflected investor anxiety regarding the fiscal stability of the US economy, heightened after Moody’s Ratings downgraded the country’s credit rating last week. This development disrupted a period of relative calm in financial markets, following a month of upheaval due to President Donald Trump’s tariff initiatives. US stocks even approached a bull market. The rebound in Treasuries on Thursday followed a recent selloff in the bond market, prompted by fears surrounding the rising US debt burden. Investors are apprehensive that Trump's recently passed tax legislation, which narrowly cleared the House, will further escalate the nation's already growing deficit. With 30-year Treasury bond yields topping 5% again on Wednesday, the nation's lenders introduced a stark economic reality check for Trump’s fiscal approach.

Mixed signals emerged from the latest PMIs, but the inflationary impact of US tariffs remains evident. The closely watched S&P Global flash PMIs revealed a surprising rebound in US economic activity yesterday. The Composite Index climbed to 52.1, up from 50.6, surpassing the critical 50 threshold, driven by a surge in new orders. Additionally, a sharp increase in the future activity component signalled optimism, likely reflecting some relief over the partial easing of tariff measures compared to April's surveys. However, the continuation of reported price increases in the US was less surprising, with the press release attributing this “overwhelmingly” to tariffs. In contrast, the UK saw a dip in price indices, creating a notable divergence, particularly when compared to the euro area. This decline in UK prices can be attributed to falling fuel costs and improved GBP exchange rates, which reduced the cost of imported raw materials. Meanwhile, both the UK and eurozone Composite PMIs still indicated modest contractions in output, offering little in terms of strong signals for near-term GDP growth. In summary, the May flash PMIs deliver one clear takeaway: US prices are rising due to tariffs. As a result, the Federal Reserve remains in a wait-and-see stance, with immediate rate cuts off the table for now.

Next week, the US Memorial Day holiday aligns with the UK Spring Bank Holiday, resulting in a quiet start to Monday. The calendar for major data releases remains relatively light thereafter. The highlight is likely the US April PCE report on Friday; however, similar to the earlier CPI release, evidence of disinflation from the past carries less weight in light of rising expectations for future inflation. The FOMC minutes (Wednesday) might offer more insight, though Fed officials have consistently emphasised a ‘wait-and-see’ approach since the April meeting. Additionally, the latest Conference Board consumer confidence figures are due (Tuesday), which, despite a dip last month, still reflect a less pessimistic outlook compared to the University of Michigan survey. A wave of Fed speakers is also expected throughout the week. In the eurozone, flash May inflation data will begin to emerge, including figures from France (Tuesday) and Germany (Friday), ahead of the aggregate euro area data release the following week. In the UK, the schedule appears sparse, but the May Lloyds Business Barometer (Friday) is set for release. It is also reasonable to anticipate a Treasury Select Committee hearing with MPC members on the May Monetary Policy Report to be scheduled soon.

Goldman Sachs early pension update: U.S. pensions are projected to SELL $19 billion worth of U.S. equities by month-end. This $19 billion sale ranks in the 89th percentile of all buy and sell estimates in absolute dollar terms over the past three years and in the 85th percentile dating back to January 2000.

Overnight Headlines

- G7 FinChiefs Downplay Tariff Clashes, Seek Global Rebalance

- Senior US-China Officials Reaffirm Open Lines Of Communication

- US Considers Withdrawing Thousands Of Troops From South Korea

- Trump’s Tax And Spending Cuts Bill Passes Republican-Led House

- ECB’s Lagarde: ‘International Trade Will Never Be The Same Again’

- Trump Pushes EU To Cut Tariffs Or Face Extra Duties

- Investors Shift Away From US Bonds On Fears Over Trump’s Policies

- Macron Positions France As Asia’s Alternative Amid US-China Rivalry

- BoJ’s Ueda Refrains From Action Despite Surge In Super-Long Yields

- Japan Inflation Rises To 3.6% Y/Y As Energy Subsidy Effect Fades

- Apple 2026 AI Glasses; To Expand $1.5B Foxconn India Supply Chain

- Anthropic Claims New AI Model Can Code ‘For Hours At A Time’

- Google Faces DoJ Probe Over Character.AI Deal

- GM Moves To ‘Seize EV Battery Leadership’ For The US

- China Vies For Lead In The Race To Self-Driving Vehicles

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1225-30 (900M), 1.1275 (1.5BLN), 1.1295-1.1300 (2.4BLN)

- 1.1320-30 (1.6BLN), 1.1345-50 (1.4BLN), 1.1360 (395M), 1.1400 (1.2BLN)

- CHF: 0.8240-50(654M),0.8300 (285M). EUR/CHF: 0.9325-35(302M),0.9400 (435M)

- GBP/USD: 1.3400 (298M), 1.3500 (227M), 1.3600 (380M)

- EUR/GBP: 0.8385-90 (285M), 0.8525 (304M)

- AUD/USD: 0.6390-0.6400 (666M), 0.6410-15 (760M), 0.6425 (346M)

- 0.6435-40 (1BLN), 0.6475 (600M), 0.6500 (486M), 0.6530 (1BLN)

- NZD/USD: 0.5860 (603M), 0.58956 (320M). AUD/NZD: 1.0900 (510M)

- USD/CAD: 1.3870-80 (1.3BLN), 1.3900 (464M)

- USD/JPY: 142.50 (875M), 142.75-80 (808M), 143.00 (1.7BLN), 143.50 (864M)

- 144.00 (2.4BLN), 144.35 (672M), 144.50 (1.1BLN)

- EUR/JPY: 161.00 (620M), 161.50 (250M), 163.30 (430M), 164.00 (380M)

- AUD/JPY: 92.00 (350M)

CFTC Data As Of 16/5/25

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 18,160 contracts, bringing the total to 77,629. They also cut their net short position in CBOT US Ultrabond Treasury futures by 3,553 contracts, now at 261,222. However, they increased their net short position in CBOT US 2-year Treasury futures by 1,439 contracts, which now stands at 1,222,232. The net short position for CBOT US 5-year Treasury futures decreased by 116,453 contracts to 2,180,043, while the net short for CBOT US 10-year Treasury futures was reduced by 62,817 contracts to 890,351.

- In the equity sector, fund speculators boosted their net short position in the S&P 500 CME by 31,350 contracts to 287,281, whereas equity fund managers raised their net long position in the same index by 44,461 contracts to 857,623.

- The net long position for the Japanese yen is at 172,268 contracts, for the Euro it stands at 84,774 contracts, and for the British pound, it is 27,216 contracts. The Swiss franc has a net short position of -23,069 contracts, while Bitcoin's net short position is -827 contracts.

Technical & Trade Views

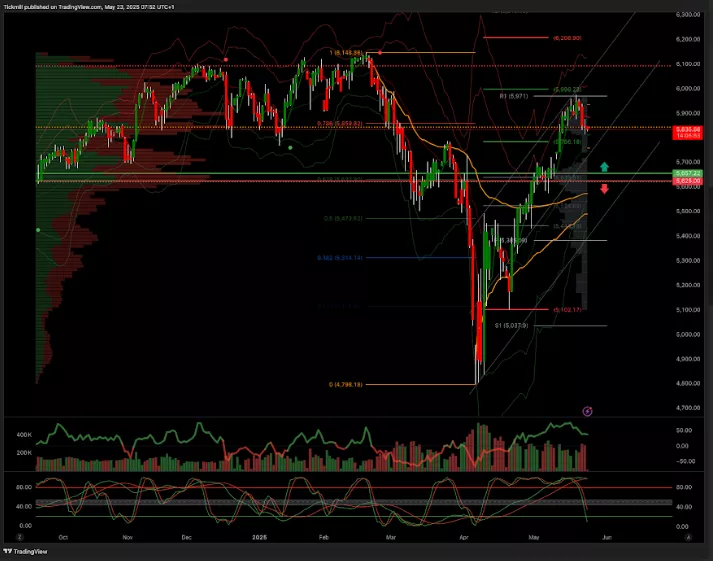

SP500 Pivot 5750

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 100k target 96.7k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, May 22

The FTSE Finish Line - Wednesday, May 21

Daily Market Outlook - Wednesday, May 21