Daily Market Outlook - Wednesday, May 21

Image Source: Pixabay

Oil prices reached their highest point in a week, while the dollar lost value following CNN's report of new US intelligence indicating that Israel may be planning a potential strike on Iranian nuclear sites. Brent crude increased by 1.7%. CNN noted that it was unclear whether Israeli officials had finalised their decision to proceed with the strikes, citing unnamed sources. Safe-haven currencies like the Swiss franc and the yen gained slightly. The yields on Japanese super-long government bonds fell after surging on Tuesday, whereas the 30-year US Treasury yield remained around the 5% level. Geopolitical uncertainties could pose challenges for the markets, which had recently stabilised following a month of chaos caused by the tariff measures introduced by US President Donald Trump. Investors are looking for signs that the recent stock market gains can be maintained, even as the Federal Reserve seeks a clearer understanding of the economy before adjusting interest rates downwards. Oil prices have been volatile since last week due to mixed reports about the state of Iran-US nuclear negotiations, which could lead to an increase in oil supply in a market projected to be oversupplied later this year. An Israeli attack would obstruct any advancements in those talks and contribute to instability in the Middle East, a region responsible for roughly one-third of the world's crude oil supply. The heightened tensions prompted risk-averse investors to sell dollars and buy yen. Most Asian currencies appreciated while a measure of the US dollar fell for the third consecutive day.

The ONS reported UK April CPI inflation at 3.5% y/y, 0.2ppts above market consensus and 0.1ppt higher than the BoE May MPR projection, driven by a 0.7ppt rise from March due to OFGEM's energy price reset. Core CPI hit 3.8% y/y, exceeding expectations by 0.2ppts, while services inflation rose to 5.4% y/y, 0.4ppts above the BoE’s forecast, signalling persistent inflation as noted by BoE Chief Economist Pill. However, factors like tax changes and a 27.5% m/m Easter-related airfare surge (the second-highest April airfare inflation on record) contributed to the volatility. Adjusting for such quirks, core services inflation looks less severe. While the MPC is unlikely to alter its course, the data aligns more with Pill’s hawkish stance than Taylor’s dovish perspective.

Yesterday’s weak 20yr auction aligns with long-end Japanese Government Bonds (JGBs) underperforming in outright yield since ‘Liberation Day.’ Notably, the 10s30s JGB curve has steepened by ~60bps since reciprocal tariffs were announced, ~45bps more than other G7 slopes. Unlike its G7 peers, Japan’s Ministry of Finance continues issuing a significant share of long-duration bonds despite overall issuance dropping ~15% since 2021. The weighted average maturity of JGBs has risen to ~8.5 years, the highest in six years. However, the key factor is the Bank of Japan’s (BoJ) tapering of bond purchases. In Q2, BoJ cut monthly purchases of 10-25yr JGBs from ¥450bn to ¥405bn, weakening market support in that sector. Yet, this doesn’t explain the 30yr JGB weakness, as BoJ’s Q2 purchases for this sector remained unchanged. The focus now shifts to the BoJ’s Q3 bond purchase plans, to be announced at the June 16-17 policy meeting. If market weakness persists, expectations for adjustments to the QT program may rise. Watch for the 40yr JGB auction results next Wednesday.

Today's macro slate features: ECB Financial Stability Review, comments from ECB's Lane, and insights from Fed's Barkin.

Overnight Headlines

- Oil Surges On Report That Israel Is Preparing To Strike Iran

- Gold Steady, Supported By Lingering US Fiscal-Deficit Concerns

- IMF Urges US To Curb Deficit As Trump Tax Cut Plan Stirs Debt Fears

- Fed Expect Tariffs To Boost Prices; White House Downplays Risk

- UK Chancellor To Meet Bessent As Questions Linger Over UK-US Deal

- UK CPI Expected To Reveal Inflation April Rise Above BoE’s Goal

- Canada: G7 Finance Ministers To Focus On Restoring Stability, Growth

- Trump Says $175B ‘Golden Dome’ Will Be Completed During His Term

- Tariff Wars Ignore The Win-Win From Comparative Advantage In Trade

- US Will Impose New Sanctions On Russia If No Progress On Peace Deal

- Morgan Stanley Strategists Say Buy America Except The Dollar

- Nvidia Chief Jensen Huang Says US Chip Curbs On China ‘A Failure’

- China LPRs May Fall Further Amid Economic Uncertainties

- Japan's Tariff Negotiator To Visit US For 3rd Time On Friday

- Japan Auto Exports Fall 5.8% In April On Trump Tariffs

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1250 (2BLN), 1.1265-70 (1.7BLN), 1.13000-5 (1.8BLN)

- 1.1320 (522M), 1.1335 (595M), 1.1390-1.1400 (3.1BLN)

- USD/CHF: 0.8200 (425M), 0.8250 (1.1BLN), 0.8280 (370M), 0.8300 (545M)

- EUR/CHF: 0.9300 (237M), 0.9325 (155M)

- GBP/USD: 1.3400 (537M), 1.3420 (387M), 1.3500 (432M)

- EUR/GBP: 0.8400-10 (498M), 0.8475-85 (690M)

- AUD/USD: 0.6380 (321M), 0.6400 (303M),0.6420-25 (257M), 0.6450 (222M)

- NZD/USD: 0.5875 (350M), 0.5940 (180M)

- USD/JPY: 142.00 (878M), 142.75 (400M), 143.00 (490M), 143.25 (300M)

- 143.95-144.00 (680M), 144.50 (940M)

- EUR/JPY: 164.50 (415M), 165.20 (300M)

- AUD/JPY: 91.20 (300M), 91.70 (200M)

CFTC Data As Of 16/5/25

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 18,160 contracts, bringing the total to 77,629. They also cut their net short position in CBOT US Ultrabond Treasury futures by 3,553 contracts, now at 261,222. However, they increased their net short position in CBOT US 2-year Treasury futures by 1,439 contracts, which now stands at 1,222,232. The net short position for CBOT US 5-year Treasury futures decreased by 116,453 contracts to 2,180,043, while the net short for CBOT US 10-year Treasury futures was reduced by 62,817 contracts to 890,351.

- In the equity sector, fund speculators boosted their net short position in the S&P 500 CME by 31,350 contracts to 287,281, whereas equity fund managers raised their net long position in the same index by 44,461 contracts to 857,623.

- The net long position for the Japanese yen is at 172,268 contracts, for the Euro it stands at 84,774 contracts, and for the British pound, it is 27,216 contracts. The Swiss franc has a net short position of -23,069 contracts, while Bitcoin's net short position is -827 contracts.

Technical & Trade Views

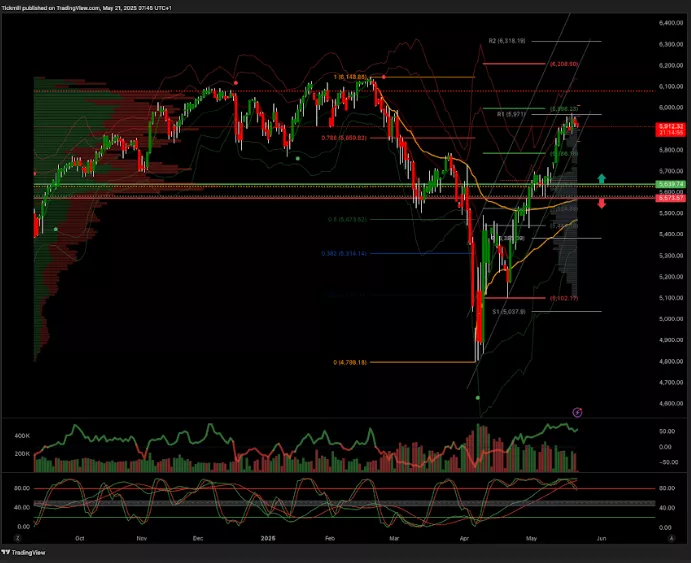

SP500 Pivot 5750

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 97k target 109k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, May 20

Daily Market Outlook - Tuesday, May 20

The FTSE Finish Line - Monday, May 19