Daily Market Outlook - Tuesday, May 20

Image Source: Pixabay

The MSCI Asia Pacific Index climbed after the S&P 500 made significant strides toward a bull market on Monday. Hong Kong stocks advanced by 1.3%, with Contemporary Amperex Technology surging up to 18% on its debut. Treasuries stabilised following Monday's volatility, driven by Moody’s downgrade of US debt. Meanwhile, gold prices dropped 0.5% due to waning demand for safe-haven assets. Global stocks have rallied recently, fuelled by optimism over easing trade tensions since President Donald Trump imposed record-high tariffs on April 2. In Asia, investors are closely monitoring the outcomes of US trade discussions with India and Japan, following an earlier agreement with China to reduce tariffs, which boosted expectations. India is negotiating a three-phase trade deal with the US and aims to finalise a preliminary agreement before July, when Trump’s counter-tariffs are set to take effect, according to informed sources. In Japan, lead trade negotiator Ryosei Akazawa is preparing for a third round of talks with the US as early as this week. Additionally, Japan’s finance minister announced plans for a bilateral meeting with US Treasury Secretary Scott Bessent this week to address various issues, including currency matters, which contributed to the yen's appreciation. Elsewhere, Vietnam and the US began their second round of bilateral tariff discussions in Washington DC on Monday, with talks scheduled to continue through Thursday.

Moody’s recent downgrade of the US credit rating to Aa1 from Aaa, announced last Friday, follows similar actions by Fitch and S&P two and fourteen years ago, respectively. Despite the delay, the downgrade remains significant, as credit ratings influence approximately 60% of relative asset swap pricing for major developed market sovereign bonds. Moody’s decision is partly attributed to concerns over the growing imbalance between government spending and revenue projections. Currently, President Trump’s proposed “one big, beautiful bill” could potentially add up to $5 trillion to federal debt, while the administration’s anticipated $1 trillion in “efficiency” savings appears to be falling short of expectations this year. Additionally, the president’s tariff policy has shifted from being a potential revenue source to a tool for political negotiations. Compounding these issues, the cost of debt is now significantly higher compared to the early post-global financial crisis period. For instance, the average Treasury yield has quadrupled since S&P downgraded the US credit rating in 2011, rising from approximately 1% to 4% today. While this situation would be alarming for most sovereigns, the natural global demand for US dollars and Treasuries is unlikely to diminish. However, the chart indicates that the 10-year Treasury note currently trades with a 15-20 basis point higher yield relative to the swap spread than suggested by the fitted line. This implies that its rating might be two notches higher than warranted—closer to AA- or Aa3. In today’s environment, many would argue the latter conclusion is more accurate.

Today's macro slate includes: Eurozone current account and consumer confidence, and Canada CPI. Central Bank Speakers: BoE's Pill, ECB's Cipollone, Wunsch & Knot, Fed's Bostic, Barkin, Collins & Musalem.

Overnight Headlines

- RBA Slashes Official Cash Rate Target By 25bps To 3.85%, As Expected

- Jefferson Says Fed Policy In A ‘Very Good Place,’ Can Be Patient

- US Eyes Region-Based Tariffs For Many Nations As Deadline Nears

- Trump Crane Tariffs Would Cost US Ports $6.7B, Group Says

- Trump Says Russia And Ukraine To Start 'Immediate' Talks On Ceasefire

- UK Negotiates New Post-Brexit Reset Deal

- Plans For 12 New Towns In England To Cost Up To £48B, Report Says

- Pfizer Licenses 3SBio Cancer Drug For Record $1.2B

- Toyota Industries Shares Up On Report It Will Accept Buyout Bid

- Taiwan Plans Wealth Fund To Counter China With Global Expansion

- China Cuts LPR For The First Time In 7 Months In Growth Push

- Japan’s Kato Plans Bessent Meet To Discuss Topics Including FX

- Australia's Opposition Coalition Splits After Election Loss

- Stablecoin Bill Advances In US Senate In Big Win For Crypto

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1195-1.1200 (3BLN), 1.120-25 (443M), 1.1240-50 (2.9BLN)

- 1.1275 (250M), 1.1300 (1.4BLN), 1.1360 (443M)

- USD/CHF: 0.8300 (311M), 0.8325 (585M), 0.8340 (200M)

- EUR/GBP: 0.8450-55 (450M) . GBP/USD: 1.3350 (250M)

- AUD/USD: 0.6350 (367M). NZD/USD: 0.5915 (522M)

- USD/CAD: 1.3900-15 (1BLN)

- USD/JPY: 145.00 (1.1BLN), 145.50 (1.1BLN), 146.00-10 (828M)

CFTC Data As Of 16/5/25

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 18,160 contracts, bringing the total to 77,629. They also cut their net short position in CBOT US Ultrabond Treasury futures by 3,553 contracts, now at 261,222. However, they increased their net short position in CBOT US 2-year Treasury futures by 1,439 contracts, which now stands at 1,222,232. The net short position for CBOT US 5-year Treasury futures decreased by 116,453 contracts to 2,180,043, while the net short for CBOT US 10-year Treasury futures was reduced by 62,817 contracts to 890,351.

- In the equity sector, fund speculators boosted their net short position in the S&P 500 CME by 31,350 contracts to 287,281, whereas equity fund managers raised their net long position in the same index by 44,461 contracts to 857,623.

- The net long position for the Japanese yen is at 172,268 contracts, for the Euro it stands at 84,774 contracts, and for the British pound, it is 27,216 contracts. The Swiss franc has a net short position of -23,069 contracts, while Bitcoin's net short position is -827 contracts.

Technical & Trade Views

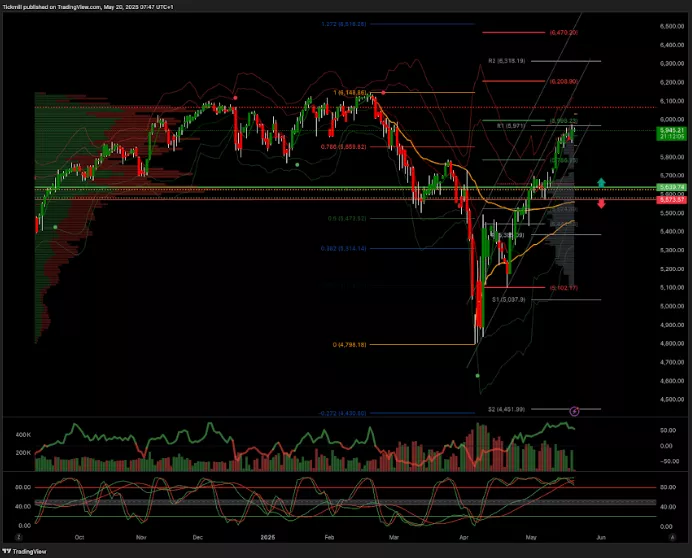

SP500 Pivot 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

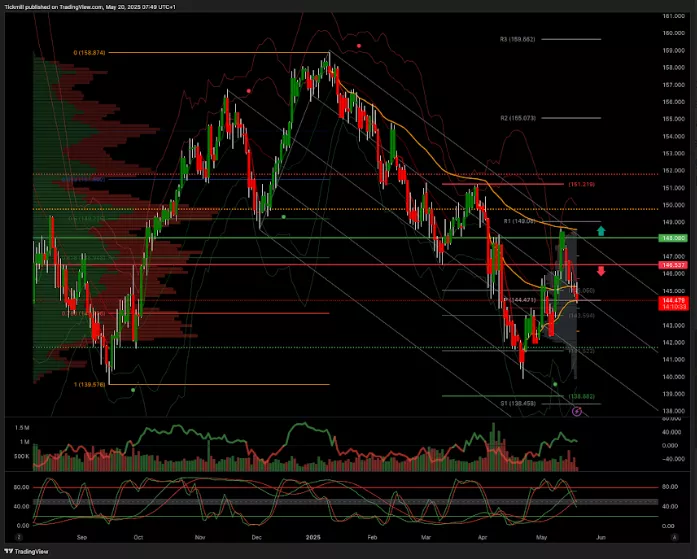

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

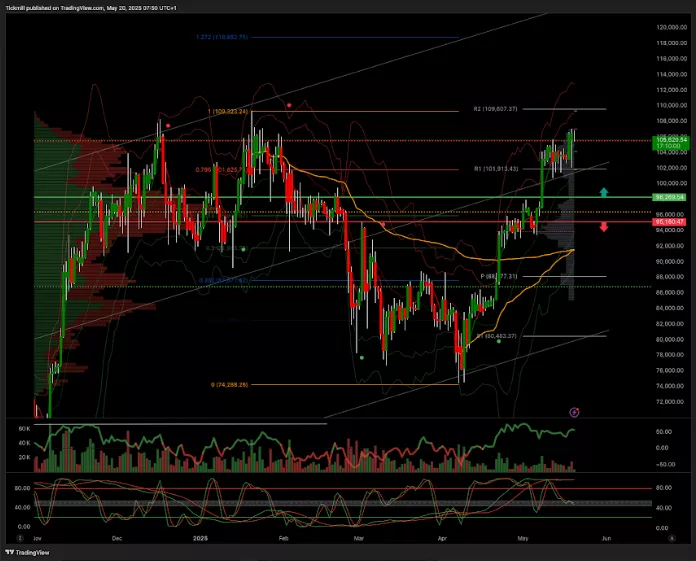

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, May 19

S&P 500 Weekly Action Areas & Price Targets - Monday, May 19

Daily Market Outlook For Monday, May 19