Daily Market Outlook - Thursday, May 22

Image Source: Pixabay

Asian stocks declined while Treasuries stabilised following a sell-off driven by worries over a proposed tax-cut bill that could increase the US deficit. The regional MSCI stock index fell modestly, pulling back from a seven-month high. US equity-index futures showed volatility after the S&P 500 index experienced its largest drop in a month. Asian currencies gained strength, and the dollar index decreased for the fourth straight session. The yield on the 30-year US Treasury bond remained above the critical 5% threshold. Gold prices rose as investors expressed concerns over the tax-cut proposal and sought safe-haven assets. Bitcoin increased by 2.8% to reach a new record. Opposition to President Donald Trump's tax plans and the escalating deficit is becoming evident in the bond market, with Treasuries dropping across the board on Wednesday and causing declines in other US assets. JPMorgan's chief Dimon indicated on Thursday that he cannot dismiss the possibility of the US entering stagflation, as the nation faces significant risks from geopolitics, budget deficits, and inflationary pressures. Bond market concerns revolve around the idea that the tax bill could add trillions of dollars to already excessive budget deficits at a time when investor interest in US assets is diminishing globally. House Republican leaders unveiled a revised version of Trump's extensive tax and spending legislation, which includes a higher deduction limit for state and local taxes and other amendments aimed at garnering support from divided GOP factions. Traders have increasingly bet that long-term bond yields will rise due to the concerns surrounding the US's growing debt and deficits, particularly after Moody’s Ratings downgraded the nation's credit score from the highest triple-A level on Friday. The prevailing message is clear: unless the US improves its financial situation, the perceived risks associated with lending to the government will continue to rise.

Increased fiscal scrutiny is influencing bond yields in the US, UK, and Japan. As bond yields rise, governments are prioritising fiscal discipline. This week highlighted tepid investor interest in 20-year debt. Following weak demand at a Japanese auction on Tuesday, the US Treasury's $16 billion new 20-year bond auction saw yields rise by 1.2 basis points to 5.047%. In Japan, the Prime Minister's comparison of the fiscal situation to Greece exacerbates concerns. The 30-year US Treasury yield briefly reached 5.11%, nearing the October 2023 high of 5.18%. If this resistance is breached, the next target is the 2007 peak of 5.44%. Political manoeuvring around Trump's budget bill, especially after Moody's downgrade, is heightening worries about fiscal sustainability. The House may vote on a revised version of the bill today. UK gilts are also affected, with the 30-year yield at 5.52%, surpassing the January peak. Recent public finance data revealed borrowing of £20.2 billion in the first month of the new financial year. While we await the OBR's monthly profiles to evaluate this figure against expectations, the April deficit represents 17.2% of the annual borrowing target, a higher proportion than in the past two years. The UK's fiscal outlook will continue to be a significant driver for gilts as we approach the Autumn Budget, prompting us to begin our coverage of the government's challenging policy decisions ahead.

Today's macro slate includes: S&P Global Flash May PMIs, German IFO Index, ECB Minutes, US Initial Jobless Claims, Home Sales Data, and Regional Fed Surveys. Central Bank Speakers: BoE’s Pill, Breeden, and Dhingra; ECB’s Nagel, Elderson, and Guindos; Fed’s Williams.

Overnight Headlines

- ECB’s Escriva: Strong Euro Unexpectedly Weighing On Inflation

- BTC Hits Record High, Open Interest Surges To Pre-ATH Setup

- US Bessent, Japan FM Kato Did Not Discuss FX Levels At G-7 Meeting

- GOP Spending Bill Drives Yields Higher, Adds To Market Volatility

- G7 Finance Ministers Downplay Tariff Disputes, Seek Policy Unity

- Target Misses Estimates, Signals Strain On US Consumers

- UnitedHealth Secretly Paid Nursing Homes To Cut Hospital Transfers

- US Accepts $400M Qatari Jet As Future Air Force One

- Oil Prices Retreat As US-Iran Nuclear Talks Set To Resume

- OpenAI To Buy Jony Ive’s io Products For $6.5B

- Honeywell Nears £1.8B Deal For Johnson Matthey Catalyst Unit

- Snowflake Guides Strong Outlook With AI Tool Focus

- Netanyahu Claims Israel Likely Killed Hamas Chief In Gaza Strike

- SEC Sues Crypto Firm Unicoin, Execs For Fraud

- AT&T Buys Lumen’s Consumer Fiber Business For $5.75B

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1175 (2.1BLN), 1.1200 (445M), 1.1225-35 (572M), 1.1300 (624M)

- 1.1315 (1BLN), 1.1340 (317M), 1.1365-75 (721M), 1.1390-1.1400 (1BLN)

- USD/CHF: 0.8465 (200M), 0.8525 (598M)

- GBP/USD: 1.3340-50 (485M), 1.3390-95 (804M), 1.3500 (347M)

- EUR/GBP: 0.8410 (872M)

- USD/CAD: 1.3700 (660M), 1.3955-60 (468M), 1.4050 (1.4BLN)

- USD/JPY: 142.50 (226M), 142.90-143.00 (370M), 143.50 (601M)

CFTC Data As Of 16/5/25

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 18,160 contracts, bringing the total to 77,629. They also cut their net short position in CBOT US Ultrabond Treasury futures by 3,553 contracts, now at 261,222. However, they increased their net short position in CBOT US 2-year Treasury futures by 1,439 contracts, which now stands at 1,222,232. The net short position for CBOT US 5-year Treasury futures decreased by 116,453 contracts to 2,180,043, while the net short for CBOT US 10-year Treasury futures was reduced by 62,817 contracts to 890,351.

- In the equity sector, fund speculators boosted their net short position in the S&P 500 CME by 31,350 contracts to 287,281, whereas equity fund managers raised their net long position in the same index by 44,461 contracts to 857,623.

- The net long position for the Japanese yen is at 172,268 contracts, for the Euro it stands at 84,774 contracts, and for the British pound, it is 27,216 contracts. The Swiss franc has a net short position of -23,069 contracts, while Bitcoin's net short position is -827 contracts.

Technical & Trade Views

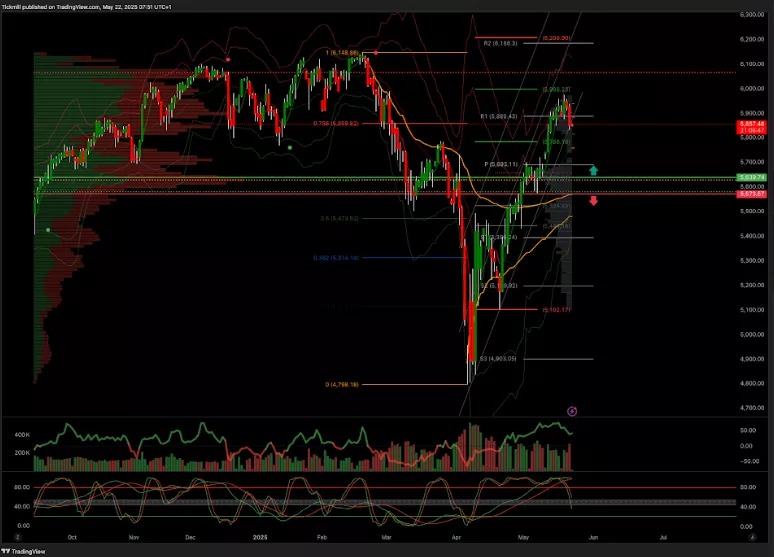

SP500 Pivot 5750

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 100k target 96.7k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, May 21

Daily Market Outlook - Wednesday, May 21

The FTSE Finish Line - Tuesday, May 20