The FTSE Finish Line - Friday, May 23

Image Source: Pexels

Britain's main stock indexes initially climbed on Friday, driven by gains in metal mining stocks, as positive economic data and declining bond yields boosted investor confidence. However, early gains were reversed as market sentiment shifted with the opening of New York trading. Wall Street's primary indexes fell after U.S. President Donald Trump proposed a 50% tariff on the European Union. Additionally, Apple shares declined following his warning that the company would face tariffs if iPhones were not manufactured in the United States. Earlier this week, stocks faced downward pressure due to worries about increasing debt in the U.S. and a larger-than-anticipated government budget deficit in the UK, which negatively affected investor confidence. On Friday, the benchmark 10-year gilt yield fell, following a similar trend in the U.S. after both yields had surged earlier in the week when the Republican-controlled U.S. House of Representatives approved a comprehensive tax and spending bill.

Dry and sunny weather boosted UK retail sales in April, with volumes rising 1.3% m/m on the core ex-fuel measure, surpassing the 0.1% consensus. This equates to a 5.3% y/y increase. While some of the upside reflects downward revisions to March data, the ONS noted strong performance in food stores, driven by favorable weather. Despite above-inflation household bill increases, modest retail price inflation (0.5% y/y ex-fuel) likely supported volumes. However, the strong figures may overstate underlying trends, as temporary factors like weather played a key role.

Single Stock Stories & Broker Updates:

-

Shares of Intermediate Capital Group rose 1.3% to 2,008p, making it one of the top gainers on the FTSE 100, which is up 0.3%. Morgan Stanley raised the price target for ICGIN from 2,250p to 2,540p, indicating a 28.2% upside. The brokerage notes appealing long-term growth at an undemanding valuation. Of 14 analysts, 12 have a "buy" or higher rating, with a median price target of 2,485.9p. ICGIN is down about 3% year-to-date.

-

Shares of easyJet rose 3.7% to 570p, making it the top gainer on FTSE 100, which increased by 0.3%. Morgan Stanley raised its price target (PT) on the stock to 745p from 680p, and Barclays increased its PT to 730p from 700p, while Bernstein raised its PT to 575p from 480p. Morgan Stanley noted that the initial share reaction to half-year results was an overreaction and expects pricing to re-accelerate as capacity tightens. Of the 22 analysts covering the stock, 16 rated it "buy" or higher, while 6 rated it "hold"; the median PT is 690.7p. EZJ is up approximately 1% year-to-date.

-

British miniature wargames maker Games Workshop is down 4.2% at 15,200p. Peel Hunt downgraded the stock to "add" from "buy," raising the price target to 16,500p. They expect tariffs to cost about £10 million, with a reduced impact over time. The company anticipates a core operating profit increase of 18.3% for the year ending June 2025, driven by strong demand for "Warhammer 40K." The average rating from 3 analysts is "strong buy" with a median price target of 16,500p. GAW stock has risen 14.7% YTD.

-

AJ Bell shares rise 10.1% to 503.5p, hitting a high since December. The stock is the top gainer on the FTSE mid-cap index, which is up 0.2%. The company reports a 12% Y/Y increase in half-yearly profit before tax to £68.8 million and adds 50,000 customers, with assets under administration at £96.2 billion. CEO Michael Summersgill reports strong momentum continuing into April, with stock up 11.1% this year.

Technical & Trade View

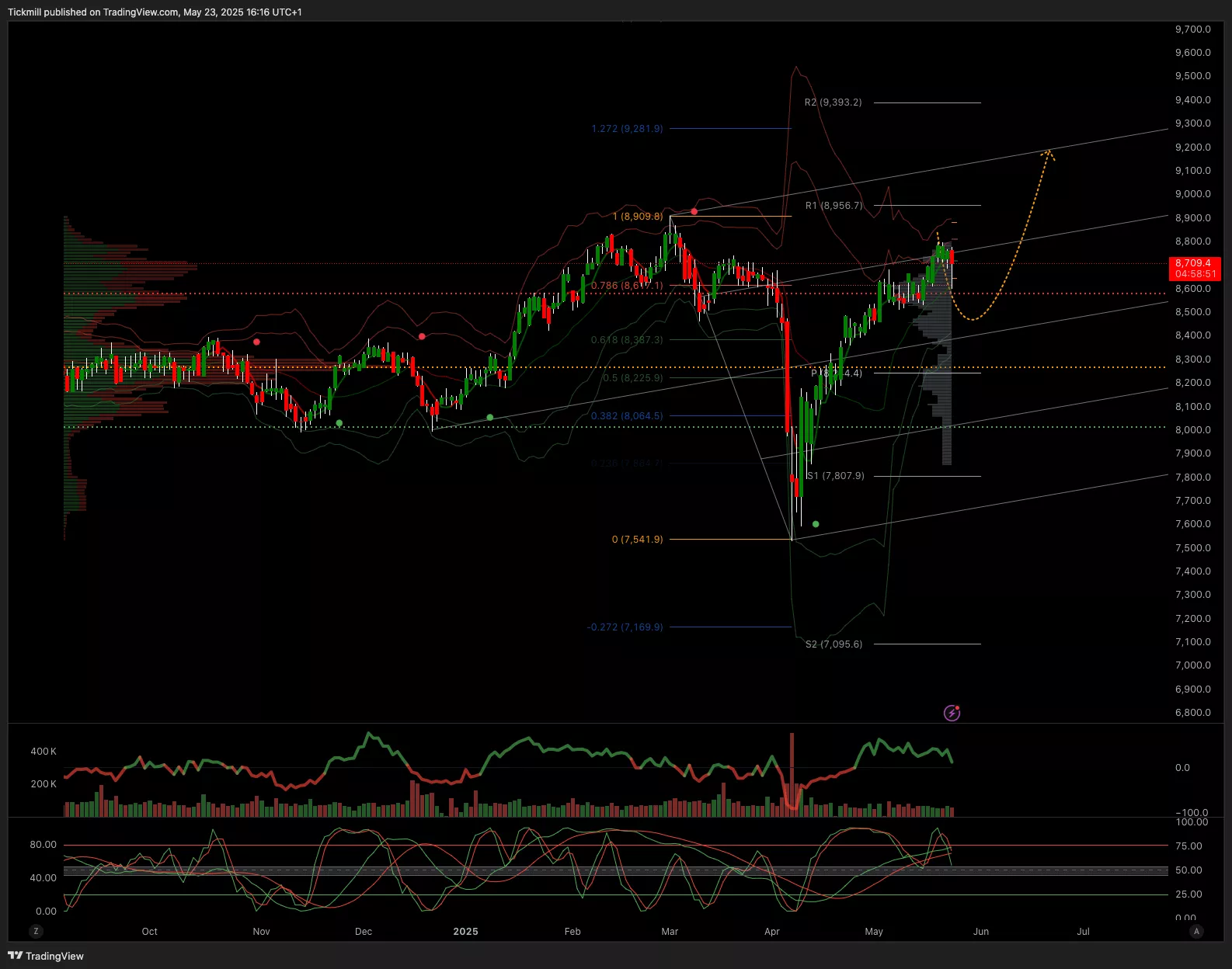

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8500

- Below 8500 opens 8250

- Primary objective 8900

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, May 23

Daily Market Outlook - Thursday, May 22

The FTSE Finish Line - Wednesday, May 21