Daily Market Outlook - Tuesday, May 27

Image Source: Pixabay

Coming out of the long weekend in the US and UK, international trade and fiscal policy remain the key macroeconomic themes influencing financial markets. On trade, the main development is that President Trump has agreed to delay the implementation of 50% tariffs on the EU from June 1 to July 9, providing additional time for negotiated agreements. In response, the EU has committed to ‘fast track’ trade discussions. This news supported gains in US equity futures yesterday but left the Dollar under pressure. Meanwhile, the Yen initially strengthened following hawkish remarks by Ueda, who signalled a willingness to “adjust the degree of monetary easing as necessary” while highlighting risks of rising underlying inflation driven by food prices. However, the Yen’s gains were reversed as Japan’s Ministry of Finance (MoF) engaged market participants in consultations about bond issuance splits, hinting at potential reductions in long-dated issuance due to challenges digesting recent supply. This dynamic also contributed to falling yields in both Japanese Government Bonds (JGBs) and US Treasuries. A parallel fiscal theme emerged in the UK, with a Financial Times article titled “UK turns to shorter-term borrowing as fiscal pressure mounts.” Those familiar with the gilt market view this as confirmation of an ongoing shift, but the prominence of the piece, including quotes from the Debt Management Office (DMO), suggests the shorter-dated issuance strategy will extend into 2025-26. The UK’s persistent fiscal challenges—widely discussed in the weekend press—have fuelled expectations of further tax hikes in the Autumn Budget.

The political actions of the US administration, ranging from defence policies to trade tariffs, have generally resulted in long-end bonds underperforming in outright yields, on the curve, and relative to swaps since taking office. Key factors driving this trend include the likelihood of rising fiscal deficits, the risk of an economic downturn, and persistent inflation. Germany appears particularly vulnerable to these dynamics, having introduced a substantial fiscal package of up to EUR 100 billion annually, while its export-driven economy has already felt the strain. For example, since "Liberation Day," the European Commission downgraded Germany's growth forecast for this year to 0% from a previous estimate of +0.7%. Focusing on Germany's significant fiscal announcement on March 4, we use this date as a reference point to analyze the relative performance of 30-year sovereign bonds against 5-year bonds and their equivalent swap tenors. The analysis reveals that long-end US bonds have been the most adversely affected, positioned at the furthest top-right in terms of performance. This reflects how policy uncertainty and debt concerns have raised doubts about their safe-haven status. By contrast, German bonds have benefitted from flight-to-safety flows but have still experienced downward pressure on the curve, partly due to their aggressive fiscal measures. Meanwhile, Italian long-end bonds have been less negatively impacted, given their relatively modest fiscal adjustments. Overall, despite heightened fiscal and economic risks, long-end euro area bonds have generally experienced less credit impact from geopolitical uncertainties compared to other developed markets.

Overnight Headlines

- BoJ’s Ueda Signals More Rate Hikes Ahead, Boosting Yen

- Lagarde Sees Opportunities To Raise Euro’s Global Profile

- EU Nations Push For Swift US Trade Deal After Tariff Reprieve

- UK Turns To Shorter-Term Borrowing As Fiscal Pressure Mounts

- Trump Pushes Back EU Tariff Deadline To July 9

- RBNZ Set For Sixth Rate Cut, Signals Easing Bias Ahead

- Germany Approves Use Of NATO Weapons Deep Inside Russia

- NATO’s Rutte Expects Bloc Will Agree On 5% Defence Target

- Japan Plans $6.3B US Tariff Relief Fund Amid Economic Strain

- Japan Loses World’s Top Creditor Status For First Time In 34 Years

- China Raises Cross-Border Yuan Usage Requirement For Big Banks

- Trump Media Group Plans To Raise $3B To Invest In Crypto

- Trump Weighs Sanctions On Russia As Relationship With Putin Sours

- Israel Orders Southern Gaza Evacuation Ahead Of Major Offensive

- Gold Slips, Holds Near Highs, Tariff Delay Tempers Haven Demand

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1200-10 (1.33BLN), 1.1245-50 (490M), 1.1290-00 (1.01BLN)

- 1.1340-50 (341M), 1.1360-70 (693M), 1.1375-80 (1.4BLN)

- 1.1400 (3.3BLN, 1.1440-50 (470M), 1.1500 (677M)

- USD/JPY: 141.75-80 (310M), 142.00 (351M), 142.50 (205M)

- 143.00 (311M), 143.25-30 (655M), 143.40-50 (257M)

- 144.00 (310M), 144.15 (281M)

- USD/CHF: 0.8180 (200M), 0.8200 (530M), 0.8325 (410M)

- GBP/USD: 1.3500 (430M), 1.3545-50 (602M)

- EUR/GBP: 0.8450-55 (397M), 0.8500 (334M)

- AUD/USD: 0.6310-15 (513M), 0.6355 (403M), 0.6500-10 (2.1BLN)

- 0.6535 (364M), 0.6550 (611M)

- NZD/USD: 0.5900 (281M). AUD/NZD: 1.0725 (357M), 1.0800 (204M)

- 1.0875 (936M), 1.0900 (345M). USD/ZAR: 1.1790-00 (330M)

- USD/CAD: 1.3780 (210M), 1.3830-35 (431M), 1.3900 (861M)

CFTC Data As Of 20/5/25

- Speculators have increased their net short position in CBOT US 5-year Treasury futures by 95,898 contracts, bringing the total to 2,275,941. They have reduced their net short position in CBOT US 10-year Treasury futures by 38,920 contracts to 851,431. Additionally, speculators raised their net short position in CBOT US 2-year Treasury futures by 45,099 contracts to 1,267,331. Meanwhile, they cut their net short position in CBOT US Ultrabond Treasury futures by 15,087 contracts to 246,135 and trimmed their net short position in CBOT US Treasury bonds futures by 5,596 contracts to 72,033.

- Equity fund speculators have increased their net short position in S&P 500 CME futures by 9,949 contracts to 297,229, while equity fund managers have elevated their net long position in S&P 500 CME futures by 14,799 contracts to 872,421.

- The net long position for the Japanese yen stands at 167,330 contracts, the euro at 74,453 contracts, the British pound at 23,993 contracts, and the Swiss franc holds a net short position of -23,767 contracts. Lastly, the net short position for Bitcoin is recorded at -1,952 contracts..

Technical & Trade Views

SP500 Pivot 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

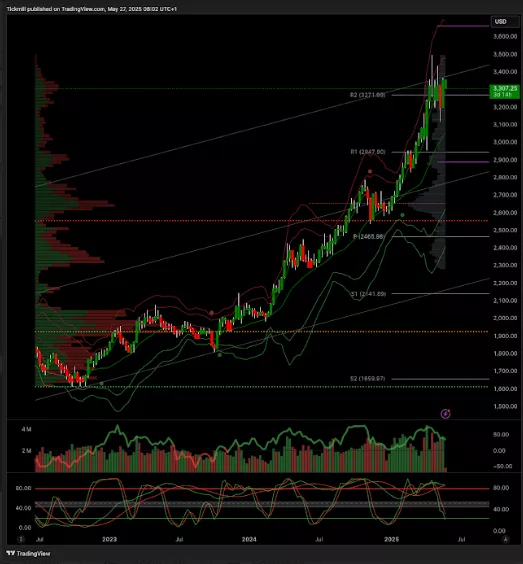

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

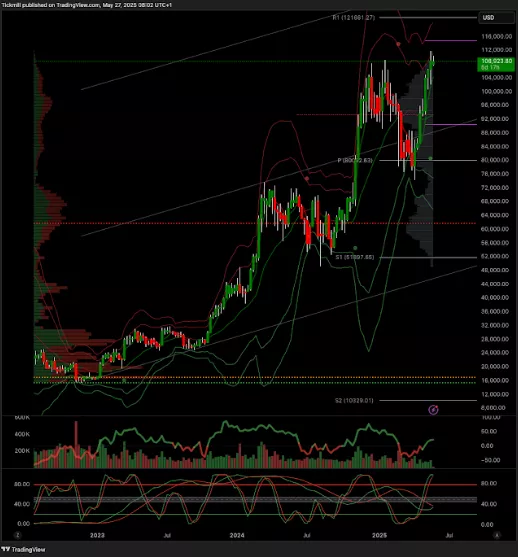

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 100k target 96.7k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, May 23

Daily Market Outlook - Friday, May 23

Daily Market Outlook - Thursday, May 22